With the Federal Reserve lowering interest rates for the first time in over four years, investors are advised to rethink their strategies. Experts suggest shifting from cash holdings to equities and fixed income, while also considering potential challenges like the federal deficit.

on Wednesday marked the first time in more than four years it moved to lower the benchmark interest rate. According to VanEck CEO Jan van Eck, investors should start thinking about how the changing macro environment will affect their investments in the year ahead.

"Fixed income is this area that is just seeing a tremendous amount of flows right now because of the rate environment, and that likely will continue," he said."About six and a half trillion dollars in money market funds, much of that will flow into either longer-duration fixed income, or some in other areas of equities."

With rates finally beginning to fall, van Eck points to the federal deficit as the next potential challenge for markets. He sees reason to stick with some popular portfolio hedges amid broader repositioning. "Can the government continue to stimulate the economy and spend so much more than they're taking in in tax receipts? Our answer is that's going to cause a lot of uncertainty.Why a 38-year-old earning a 6-figure salary doesn't have a college fund for her son: ‘I expect him to get his own money'

Interest Rates Investment Strategies Portfolio Repositioning Fixed Income Federal Deficit

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Investors should diversify portfolios to hedge against risk into election: UBSInvestors should diversify portfolios to hedge against risk into election: UBS

Investors should diversify portfolios to hedge against risk into election: UBSInvestors should diversify portfolios to hedge against risk into election: UBS

Read more »

Investors should diversify portfolios to hedge against risk into election: UBSInvestors should diversify portfolios to hedge against risk into election: UBS

Investors should diversify portfolios to hedge against risk into election: UBSInvestors should diversify portfolios to hedge against risk into election: UBS

Read more »

Microsoft-Backed 2020 Election Censors Reposition Themselves as ‘AI Deepfake’ Authorities Source of breaking news and analysis, insightful commentary and original reporting, curated and written specifically for the new generation of independent and conservative thinkers.

Microsoft-Backed 2020 Election Censors Reposition Themselves as ‘AI Deepfake’ Authorities Source of breaking news and analysis, insightful commentary and original reporting, curated and written specifically for the new generation of independent and conservative thinkers.

Read more »

2024 Election Censors Reposition as 'AI Deepfake' Authorities With Microsoft BackingThis article exposes how groups involved in 2020 election censorship are now rebranding themselves as experts on AI deepfakes, leveraging support from tech giant Microsoft to push for new regulations. The piece highlights the involvement of extreme Democrat partisans and their history of promoting political censorship in these anti-disinformation projects.

2024 Election Censors Reposition as 'AI Deepfake' Authorities With Microsoft BackingThis article exposes how groups involved in 2020 election censorship are now rebranding themselves as experts on AI deepfakes, leveraging support from tech giant Microsoft to push for new regulations. The piece highlights the involvement of extreme Democrat partisans and their history of promoting political censorship in these anti-disinformation projects.

Read more »

Positioning credit portfolios for the US electionPositioning credit portfolios for the US election

Positioning credit portfolios for the US electionPositioning credit portfolios for the US election

Read more »

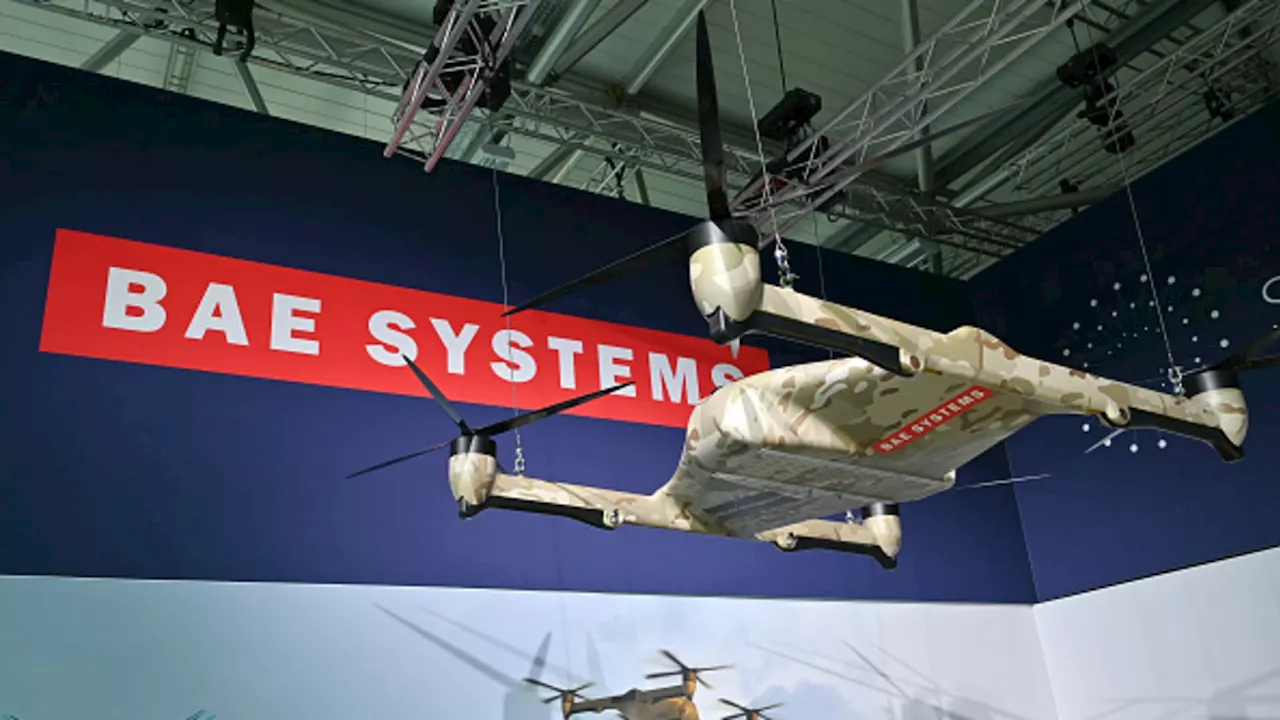

Defense stocks in an ESG portfolio? A profound — and controversial — shift seems to be underwayThe idea of including defense stocks in sustainably-minded portfolios remains controversial.

Defense stocks in an ESG portfolio? A profound — and controversial — shift seems to be underwayThe idea of including defense stocks in sustainably-minded portfolios remains controversial.

Read more »