From Breakingviews - TikTok’s best U.S. charm offensive involves an IPO

TikTok escaped an effective U.S. ban when President Joe Biden in 2021 revoked executive orders by his predecessor Donald Trump prohibiting new downloads of the app. The company is now trying to work with the Committee on Foreign Investment in the United States to ease concerns about Chinese access to American customers’ data. TikTok has proposed constructing a division with a separate board, which includes a former U.S.

One partial solution would be for TikTok to list its shares on a U.S. stock exchange. That would force the company to be more transparent about its operations and financial performance, while offering American investors the ability to take a direct stake in the company. An initial public offering would not solve the question of Chinese government influence over TikTok’s parent, and could cause other headaches: Ride-hailing app Didi Global had to cancel its U.S. stock market listing after China’s internet watchdog launched a security probe. TikTok may also want to wait for tech valuations to recover. But if an IPO helps TikTok to keep operating in the United States, it’s worth a try.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

This HR Specialist Is Sharing How NOT To Get Fired For Making TikToks At Work'In some cases, you might not even know that you've done something wrong until it's too late.'

This HR Specialist Is Sharing How NOT To Get Fired For Making TikToks At Work'In some cases, you might not even know that you've done something wrong until it's too late.'

Read more »

Breakingviews - UK’s giga fail is economic not environmentalBritishvolt has filed for administration, after struggling to raise funds. The collapse of a key battery manufacturer probably doesn’t compromise the government’s plan for the country to switch to electric vehicles. But it leaves a big question mark hanging over the domestic auto industry’s future.

Breakingviews - UK’s giga fail is economic not environmentalBritishvolt has filed for administration, after struggling to raise funds. The collapse of a key battery manufacturer probably doesn’t compromise the government’s plan for the country to switch to electric vehicles. But it leaves a big question mark hanging over the domestic auto industry’s future.

Read more »

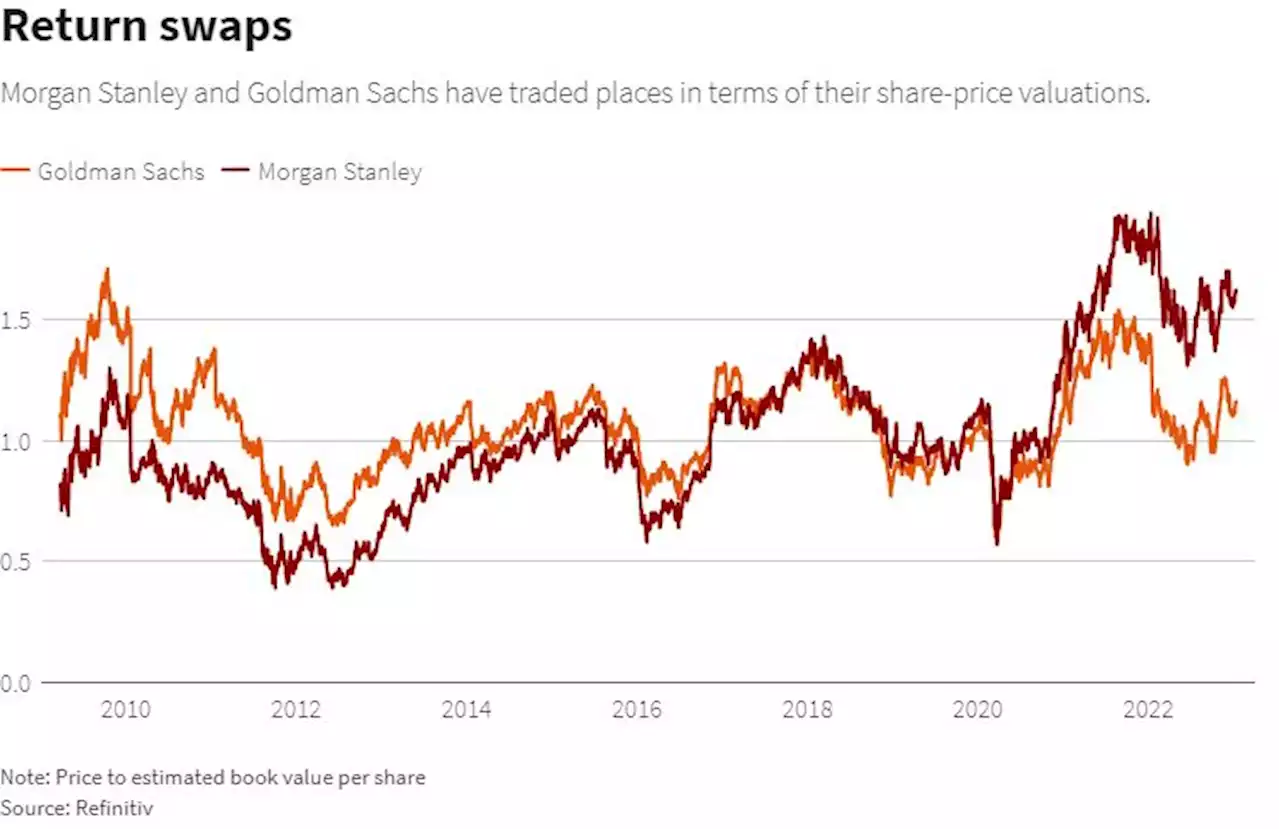

Breakingviews - Goldman slams into unwelcome sort of volatilityThe similarities between Goldman Sachs and Morgan Stanley are drawing attention to what makes them different. It’s a problem for Goldman Chief Executive David Solomon: johnsfoley

Breakingviews - Goldman slams into unwelcome sort of volatilityThe similarities between Goldman Sachs and Morgan Stanley are drawing attention to what makes them different. It’s a problem for Goldman Chief Executive David Solomon: johnsfoley

Read more »

Breakingviews - China’s demographic decline can be boon, not doomFor decades foreign companies and investors flocked to the People’s Republic seeking cheap labour, new markets and, for some, weaker protections for workers and the environment. As the country looks set to lose the title of World’s Most Populous Nation to India, some capitalists are wondering whether the next China is to be found there, or Indonesia, or Mexico. Yet China’s demographic doom is not certain.

Breakingviews - China’s demographic decline can be boon, not doomFor decades foreign companies and investors flocked to the People’s Republic seeking cheap labour, new markets and, for some, weaker protections for workers and the environment. As the country looks set to lose the title of World’s Most Populous Nation to India, some capitalists are wondering whether the next China is to be found there, or Indonesia, or Mexico. Yet China’s demographic doom is not certain.

Read more »

Breakingviews - Alibaba’s pushy shareholder mistimes his momentRyan Cohen has been pressing Alibaba , for improvements since last August, per the Wall Street Journal. As the owner of an undisclosed stake, he wants the company to boast its share buybacks. There are similarities with cash-rich Apple where he owns roughly $800 million of stock. Alibaba is sitting on $48 billion of net cash as of September, up 4% since March.

Breakingviews - Alibaba’s pushy shareholder mistimes his momentRyan Cohen has been pressing Alibaba , for improvements since last August, per the Wall Street Journal. As the owner of an undisclosed stake, he wants the company to boast its share buybacks. There are similarities with cash-rich Apple where he owns roughly $800 million of stock. Alibaba is sitting on $48 billion of net cash as of September, up 4% since March.

Read more »

Breakingviews - Bank of Japan has learnt danger of half-measuresGovernor Haruhiko Kuroda’s battle with market forces has entered a new phase. The Bank of Japan (BOJ) made no adjustments to its yield-curve control (YCC) policy that keeps interest rates ultra-low on Wednesday. That is stinging traders who bet the central bank would be forced to widen a 10-year government bond’s trading band again, having expanded it to 0.50% from 0.25% in December under market pressure. However, that tweak’s failure to reduce the need of central bank intervention has left the BOJ with little appetite for more compromises.

Breakingviews - Bank of Japan has learnt danger of half-measuresGovernor Haruhiko Kuroda’s battle with market forces has entered a new phase. The Bank of Japan (BOJ) made no adjustments to its yield-curve control (YCC) policy that keeps interest rates ultra-low on Wednesday. That is stinging traders who bet the central bank would be forced to widen a 10-year government bond’s trading band again, having expanded it to 0.50% from 0.25% in December under market pressure. However, that tweak’s failure to reduce the need of central bank intervention has left the BOJ with little appetite for more compromises.

Read more »