Berkshire Hathaway has been steadily backing off its longtime stake in the Charlotte, NC-based lender.

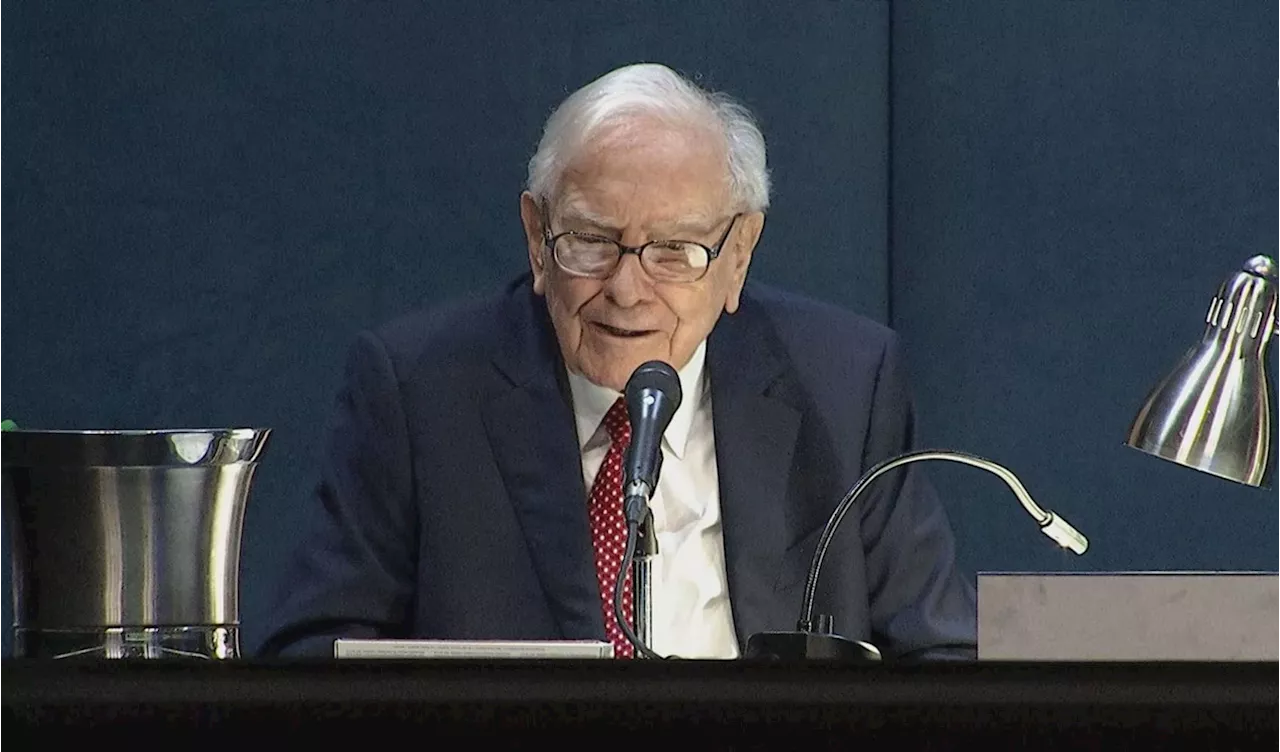

Billionaire investor Warren Buffett ’s Berkshire Hathaway sold nearly $1 billion worth of Bank of America shares as his firm continues to cut its stake in the second-largest US lender.

The conglomerate sold about 24.7 million Bank of America shares, worth $981.9 million, between last Friday and Tuesday, according to a regulatory filing Tuesday.Meanwhile, Berkshire Hathaway’s market cap surpassed $1 trillion on Wednesday, reflecting investor confidence in the conglomerate that Buffett built over nearly six decades into what many consider a proxy for the American economy.

Berkshire’s stock sell-off is a sharp pivot from last year, when the 93-year-old known as the “Oracle” and the “Sage of Omaha” praised Bank of America and its CEO Brian Moynihan, who took the helm in 2010.But The firm started investing in the major US bank in 2011, when it bought $5 billion of preferred stock.Buffett’s involvement with the bank coincided with struggles following the 2008 financial crisis, and his investment helped to calm investor concerns and drive the share price up.Despite the firm’s latest sale, it is still Bank of America’s largest shareholder. Buffett’s firm owns 903.8 million shares worth $35.85 billion, based on Tuesday’s closing price.

Ex-Levi's exec delivers scathing takedown after 'woke' takeover of Harley-Davidson puts 'elite jerks' in chargeElizabeth Chambers moves her kids for the 5th time in 5 years as Armie Hammer is forced to sell his carBella Hadid ‘happily’ lived with boyfriend Adan Banuelos in his 5th-wheel trailer at start of romance: 'It was badass'

Bank Of America Berkshire Hathaway Warren Buffett

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Warren Buffett's Berkshire Hathaway sells Bank of America for a ninth-straight dayOver the past nine trading sessions, Berkshire has cut its BofA stake by 71.2 million shares with just over $3 billion of sales.

Warren Buffett's Berkshire Hathaway sells Bank of America for a ninth-straight dayOver the past nine trading sessions, Berkshire has cut its BofA stake by 71.2 million shares with just over $3 billion of sales.

Read more »

Warren Buffett's Berkshire Hathaway sold nearly half its stake in AppleBerkshire Hathaway disclosed a $84.2 billion bet in Apple at the end of the second quarter, indicating that Warren Buffett offloaded 49.4% of the tech bet.

Warren Buffett's Berkshire Hathaway sold nearly half its stake in AppleBerkshire Hathaway disclosed a $84.2 billion bet in Apple at the end of the second quarter, indicating that Warren Buffett offloaded 49.4% of the tech bet.

Read more »

Warren Buffett surprises by slashing Berkshire Hathaway's longtime Apple stake in second quarterInvestor Warren Buffett slashed Berkshire Hathaway's massive Apple stake that he once called a pillar of the company that he intended to hold indefinitely. However, a drop in the paper value of its remaining investments drug down its second-quarter earnings. Its many operating businesses improved, led by Geico.

Warren Buffett surprises by slashing Berkshire Hathaway's longtime Apple stake in second quarterInvestor Warren Buffett slashed Berkshire Hathaway's massive Apple stake that he once called a pillar of the company that he intended to hold indefinitely. However, a drop in the paper value of its remaining investments drug down its second-quarter earnings. Its many operating businesses improved, led by Geico.

Read more »

Warren Buffett surprises by slashing Berkshire Hathaway's longtime Apple stake in second quarterInvestor Warren Buffett slashed Berkshire Hathaway's massive Apple stake that he once called a pillar of the company that he intended to hold indefinitely.

Warren Buffett surprises by slashing Berkshire Hathaway's longtime Apple stake in second quarterInvestor Warren Buffett slashed Berkshire Hathaway's massive Apple stake that he once called a pillar of the company that he intended to hold indefinitely.

Read more »

Warren Buffett surprises by slashing Berkshire Hathaway's longtime Apple stake in second quarterInvestor Warren Buffett slashed Berkshire Hathaway's massive Apple stake that he once called a pillar of the company that he intended to hold indefinitely.

Warren Buffett surprises by slashing Berkshire Hathaway's longtime Apple stake in second quarterInvestor Warren Buffett slashed Berkshire Hathaway's massive Apple stake that he once called a pillar of the company that he intended to hold indefinitely.

Read more »

Warren Buffett surprises by slashing Berkshire Hathaway’s longtime Apple stake in second quarterOMAHA, Neb. (AP) — Investor Warren Buffett 's company recorded a $47 billion gain on stock sales during the second quarter as he slashed Berkshire

Warren Buffett surprises by slashing Berkshire Hathaway’s longtime Apple stake in second quarterOMAHA, Neb. (AP) — Investor Warren Buffett 's company recorded a $47 billion gain on stock sales during the second quarter as he slashed Berkshire

Read more »