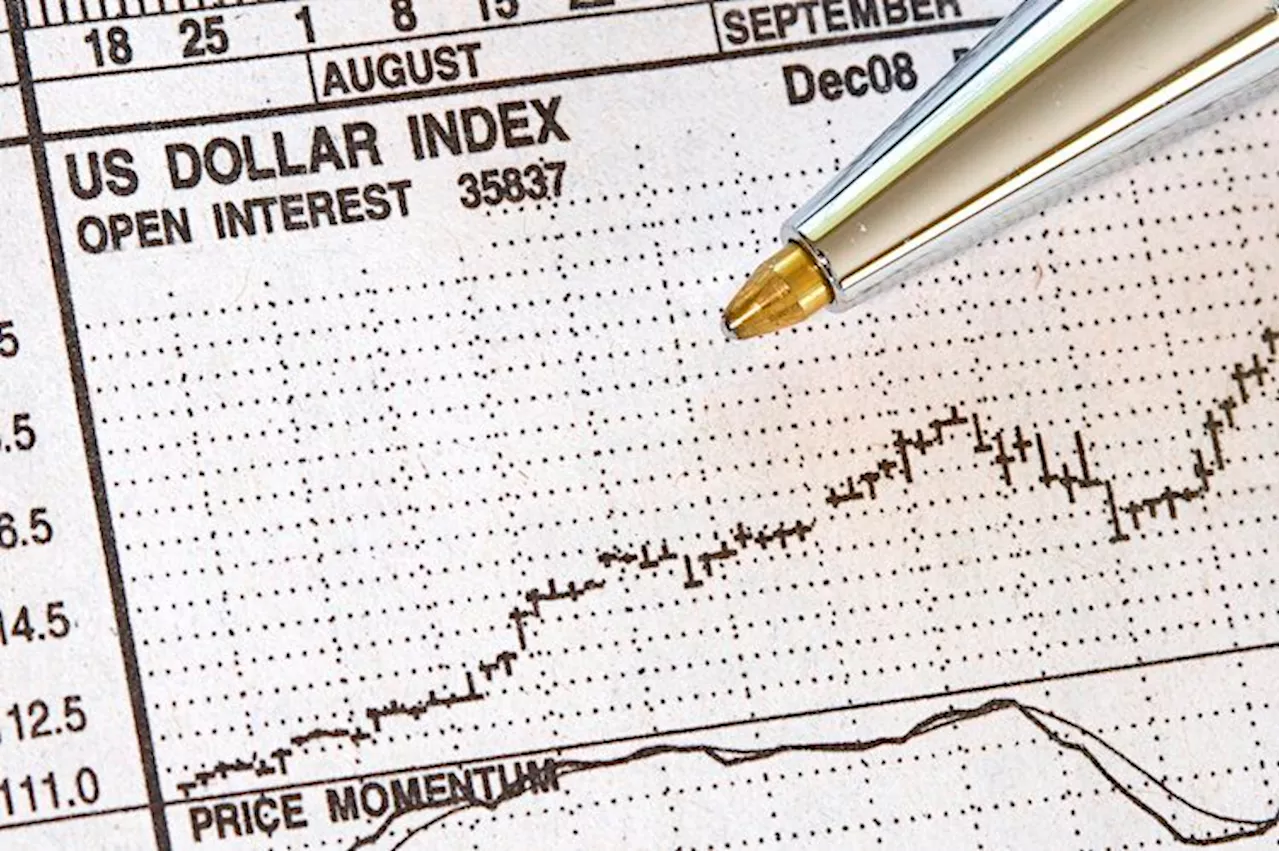

The US Dollar Index (DXY) is in a medium and long-term sideways trend within a multi-year range.

The US Dollar Index has touched down on a key support level at the 100 mark. This has historically provided a springboard for a recovery, however, it is too early to say whether history will repeat itself. The US Dollar Index is in a medium and long-term sideways trend within a multi-year range. Since late July it has been steadily unfolding a down leg within that range from the ceiling at around 105, to the range floor at the 100 level. 100 is important.

57, the July 2023 low. This is the lowest floor of the range – a decisive break below there would be a very bearish sign. The Relative Strength Index momentum indicator is oversold on both the daily chart and weekly chart . This suggests prices are overextended to the downside and there is a greater risk of a pull back occurring. However, RSI has not yet exited the oversold zone, a necessary prerequisite for a buy signal.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

US Dollar Index Price Forecast: Remains above 103.00 with expecting a trend reversalThe US Dollar Index (DXY) retraces its recent losses from the previous session, trading around 103.20 during the European hours on Monday.

US Dollar Index Price Forecast: Remains above 103.00 with expecting a trend reversalThe US Dollar Index (DXY) retraces its recent losses from the previous session, trading around 103.20 during the European hours on Monday.

Read more »

Dollar Index outlook: The dollar was sold across the board on fresh dovish signals from PowellThe US dollar fell across the board on Friday, following a highly anticipated speech of Fed Chair Powell in Jackson Hole symposium.

Dollar Index outlook: The dollar was sold across the board on fresh dovish signals from PowellThe US dollar fell across the board on Friday, following a highly anticipated speech of Fed Chair Powell in Jackson Hole symposium.

Read more »

GBP/USD Price Forecast: Rises on weak US Dollar, eyes 1.3100The GBP/USD advanced steadily for the fifth straight day and is eyeing the 1.3100 figure after data from the US Bureau of Labor Statistics (BLS) revealed that the US economy added 800K fewer Americans to the workforce.

GBP/USD Price Forecast: Rises on weak US Dollar, eyes 1.3100The GBP/USD advanced steadily for the fifth straight day and is eyeing the 1.3100 figure after data from the US Bureau of Labor Statistics (BLS) revealed that the US economy added 800K fewer Americans to the workforce.

Read more »

Australian Dollar Price Forecast: Aussie gets a boost due to hawkish RBA signsThe AUD/USD pair recorded an upturn at 0.6580 during Thursday's sessions, a notable rise by 0.80%.

Australian Dollar Price Forecast: Aussie gets a boost due to hawkish RBA signsThe AUD/USD pair recorded an upturn at 0.6580 during Thursday's sessions, a notable rise by 0.80%.

Read more »

US Dollar Price Forecast: USD holds steady after strong labor market dataThe US Dollar (USD), measured by the US Dollar Index (DXY), held steady at around 103.00 on Thursday after a two-day rebound.

US Dollar Price Forecast: USD holds steady after strong labor market dataThe US Dollar (USD), measured by the US Dollar Index (DXY), held steady at around 103.00 on Thursday after a two-day rebound.

Read more »

Australian Dollar Price Forecast: AUD strengthens following RBA's decisionThe AUD/USD pair is currently trading around 0.6555, up by 0.50% on Wednesday.

Australian Dollar Price Forecast: AUD strengthens following RBA's decisionThe AUD/USD pair is currently trading around 0.6555, up by 0.50% on Wednesday.

Read more »