Sarwant has over 29 years of work experience in leading major advisory and transformation engagements focusing on making organizations future ready. Sarwant is currently working with Markets and Markets as President and Chief Commercial office.

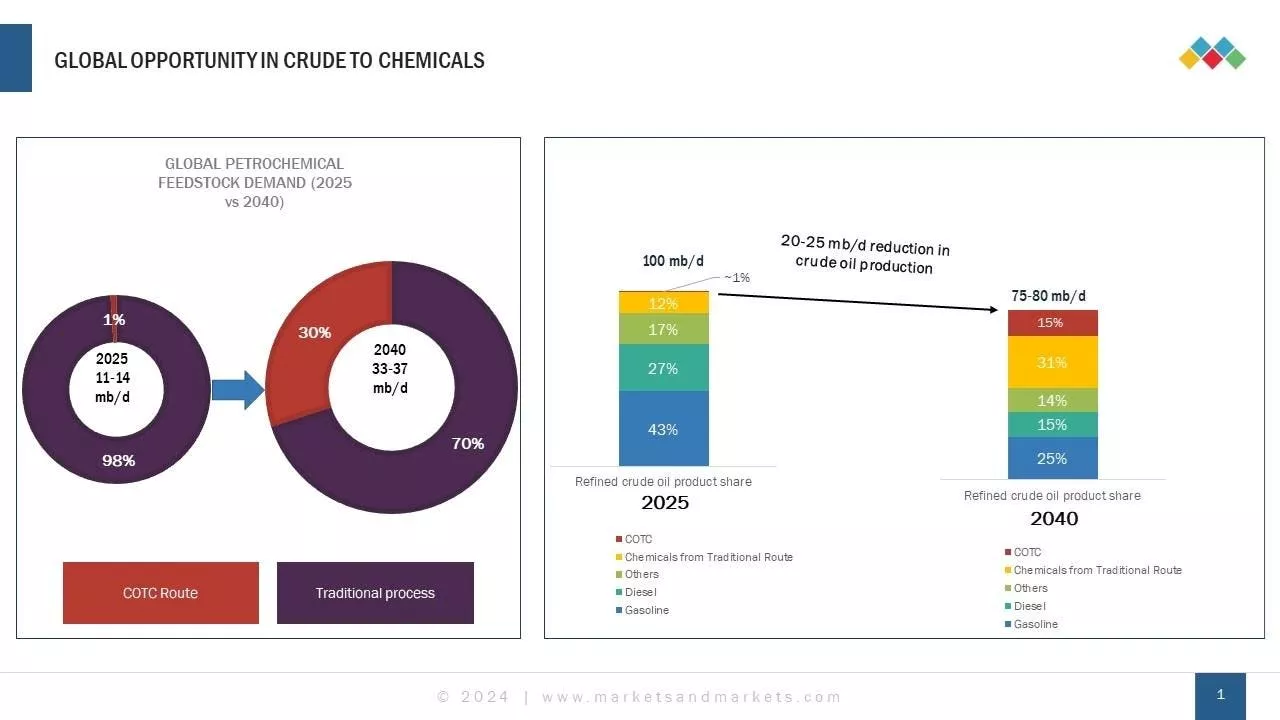

The emergence of ultra-low and zero emission vehicles is disrupting the oil & gas industry. The high growth of electric and alternate fuel vehicles will suppress the demand for diesel and gasoline in the long term; it could reduce the need for at least 5 million barrels of oil per day for transportation fuel by 2030. The high growth of electric vehicles is expected to result in the flattening of gasoline and diesel demand by 2030 and a gradual decline to 2040.

The concept of Crude-to-Chemicals technology brings benefits over the conventional refining process by overcoming the challenge of high energy consumption, high capital costs, carbon emissions, and feedstock limitations. Some areas define the welcoming change that Crude-to-chemical technology brings onto the table.Within the business domain, every operational framework seeks increased efficiency and financial gains.

Crude-to-chemicals provide immense opportunities for oil & gas companies. The crude-to-chemicals market has not yet reached widespread adoption; however, it has the potential to reach over USD 200 billion by 2040 as per adone by Markets and Markets. The anticipated high growth is backed by significant investments in facilities set-up and R&D for switching to this technology by major oil & gas companies such as Exxon Mobil, Shell, Aramco, and Sinopec.

On an average, a traditional refining process emits approximately 10-20 Kgs of CO2 per barrel of crude oil; let us consider a medium-sized refinery processing 100,000 barrels per day; this could result in annual CO2 emissions ranging from approximately 3 to 7 million metric tons. In contrast to traditional processes, crude-to-chemicals has the potential to reduce carbon emissions by up to 20-30%, thereby emitting approximately 2 to 4 million metric tons by the same refinery.

Companies in the oil & gas industry worldwide, including the major players, have committed over USD 300 billion of investments in the next 5-6 years in crude-to-chemicals technology to reconfigure their assets and produce more petrochemicals. Of the committed investments to date, ~65% is to be utilized for integrating facilities in Asia Pacific, and ~40% has been done in China only by companies such as Zhejiang Petroleum, Hengli Petrochemical, and Sinopec.

Shell Exxon Mobil BP Sinopec Zhejiang Petroleum Hengli Petrochemicals SABIC Oman Oil

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Unlocking the Power of Crypto Markets with CoinGecko APIExplore the power of CoinGecko's API with our guide on using real-time crypto data for trading, market analysis, and building applications.

Unlocking the Power of Crypto Markets with CoinGecko APIExplore the power of CoinGecko's API with our guide on using real-time crypto data for trading, market analysis, and building applications.

Read more »

USD/SGD holds firm as markets assess robust US data, markets delay cutsThe USD/SGD recovered from daily lows, and ahead of the Asian session is trading with slight gains.

USD/SGD holds firm as markets assess robust US data, markets delay cutsThe USD/SGD recovered from daily lows, and ahead of the Asian session is trading with slight gains.

Read more »

Markets Week Ahead: Markets Risk-On, BoE Decision, Gold, Nasdaq, BitcoinRisk markets regained all their early losses this week and continue to press higher. A benign FOMC and a weak US Jobs Report boosted markets going into the weekend.

Markets Week Ahead: Markets Risk-On, BoE Decision, Gold, Nasdaq, BitcoinRisk markets regained all their early losses this week and continue to press higher. A benign FOMC and a weak US Jobs Report boosted markets going into the weekend.

Read more »

Australia and Japan markets slip as Fed decision looms, most Asian markets closedMost markets in the region are closed for the Labor Day holiday, except Australia and Japan

Australia and Japan markets slip as Fed decision looms, most Asian markets closedMost markets in the region are closed for the Labor Day holiday, except Australia and Japan

Read more »

Australia and Japan markets set to slip as Fed decision looms, most Asian markets closedMost markets in the region are closed for the Labor Day holiday, except Australia and Japan

Australia and Japan markets set to slip as Fed decision looms, most Asian markets closedMost markets in the region are closed for the Labor Day holiday, except Australia and Japan

Read more »

Australia and Japan markets set to slip as Fed decision looms, most Asian markets closedMost markets in the region are closed for the Labor Day holiday, except Australia and Japan

Australia and Japan markets set to slip as Fed decision looms, most Asian markets closedMost markets in the region are closed for the Labor Day holiday, except Australia and Japan

Read more »