A union representing federal workers filed two lawsuits against the acting director of the Consumer Financial Protection Bureau (CFPB), alleging that his recent directives are unlawful and that he has allowed unauthorized access to employee information. The National Treasury Employees Union claims that Acting Director Russell Vought's orders to halt new rules, investigations, and funding requests threaten the agency's mission and violate privacy rights. The lawsuits also point to the involvement of the Department of Government Efficiency (DOGE) and Elon Musk's comments about the CFPB as potential catalysts for the situation.

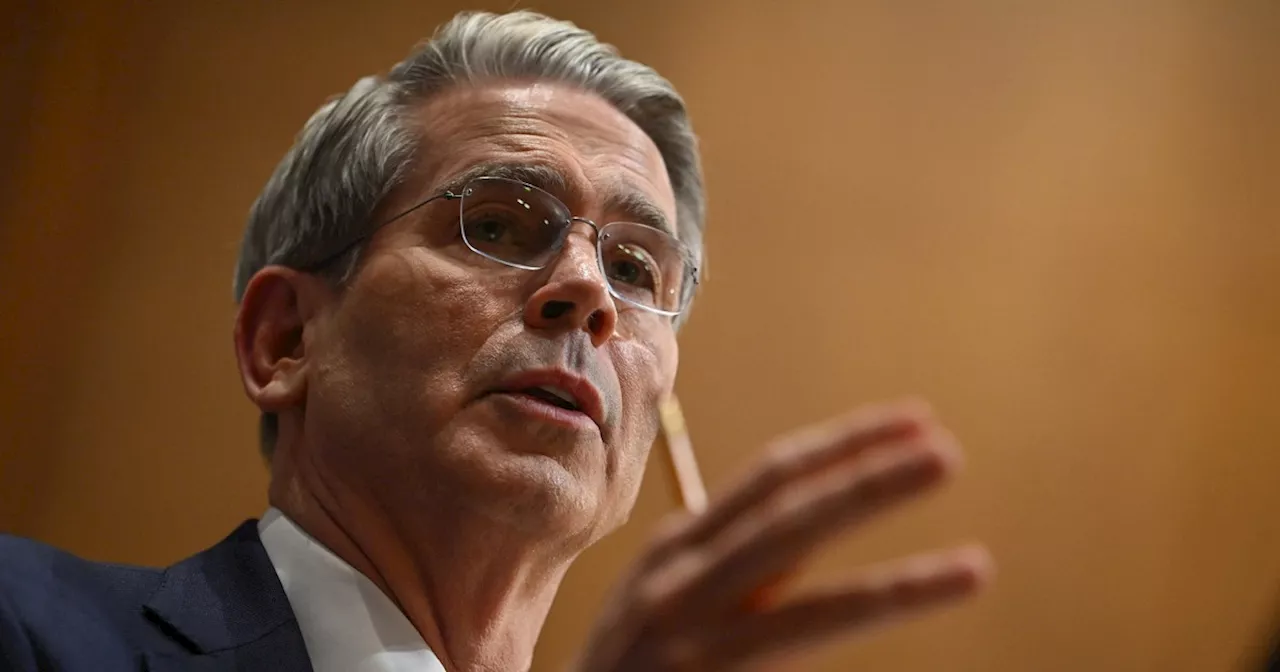

A union representing federal workers filed a pair of lawsuits against Consumer Financial Protection Bureau acting Director Russell Vought , asking a court to declare recent actions by him unlawful and to block the Department of Government Efficiency from gaining access to employee information. The filings by the National Treasury Employees Union come after Vought told staff at the CFPB not to issue any new rules and to stop any new investigations, among other directives.

Vought, who is the head of the Office of Management and Budget, was named acting director of the agency on Friday. "As Acting Director, I am committed to implementing the President's policies, consistent with the law, and acting as a faithful steward of the Bureau's resources," Vought said in an email to colleagues obtained by RealClearPolitics.

CONSUMER FINANCIAL PROTECTION BUREAU UNION LAWSUIT RUSSELL VOUGHT DEPARTMENT OF GOVERNMENT EFFICIENCY ELON MUSK

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Union Sues CFPB Acting Director Over Halt of Bureau ActivitiesThe National Treasury Employees Union has filed two lawsuits against CFPB Acting Director Russell Vought after he issued directives pausing much of the bureau's operations. The lawsuits aim to block the Department of Government Efficiency from accessing employee information and to overturn Vought's orders halting supervision, examinations, stakeholder engagement, and pending investigations.

Union Sues CFPB Acting Director Over Halt of Bureau ActivitiesThe National Treasury Employees Union has filed two lawsuits against CFPB Acting Director Russell Vought after he issued directives pausing much of the bureau's operations. The lawsuits aim to block the Department of Government Efficiency from accessing employee information and to overturn Vought's orders halting supervision, examinations, stakeholder engagement, and pending investigations.

Read more »

Trump Appoints Bessent as Acting CFPB Director, Replacing ChopraPresident Trump has chosen Scott Bessent, the newly confirmed Treasury Secretary, as the acting director of the CFPB. This comes after the dismissal of Rohit Chopra, the previous director appointed by former President Biden. Bessent's appointment is expected to be temporary until a permanent replacement is found.

Trump Appoints Bessent as Acting CFPB Director, Replacing ChopraPresident Trump has chosen Scott Bessent, the newly confirmed Treasury Secretary, as the acting director of the CFPB. This comes after the dismissal of Rohit Chopra, the previous director appointed by former President Biden. Bessent's appointment is expected to be temporary until a permanent replacement is found.

Read more »

Trump Appoints Acting CFPB Director, Halts Agency OperationsPresident Trump appoints Treasury Secretary Scott Bessent as the acting director of the CFPB, immediately halting agency operations. Bessent orders all work on regulations, guidance, investigations, and public communications to cease.

Trump Appoints Acting CFPB Director, Halts Agency OperationsPresident Trump appoints Treasury Secretary Scott Bessent as the acting director of the CFPB, immediately halting agency operations. Bessent orders all work on regulations, guidance, investigations, and public communications to cease.

Read more »

Scott Bessent Named Acting Director of CFPBTreasury Secretary Scott Bessent will serve as the acting director of the Consumer Financial Protection Bureau (CFPB). President Trump appointed Bessent to the role following the resignation of former Director Rohit Chopra. Republicans have long criticized the CFPB's regulatory approach to the financial services industry.

Scott Bessent Named Acting Director of CFPBTreasury Secretary Scott Bessent will serve as the acting director of the Consumer Financial Protection Bureau (CFPB). President Trump appointed Bessent to the role following the resignation of former Director Rohit Chopra. Republicans have long criticized the CFPB's regulatory approach to the financial services industry.

Read more »

Trump Appoints Bessent as Acting CFPB DirectorPresident Trump has appointed Treasury Secretary Scott Bessent as the acting director of the Consumer Financial Protection Bureau (CFPB), following the resignation of Rohit Chopra. This move comes amidst broader efforts to reduce the size of the federal government, as highlighted by Elon Musk's proposed shutdown of the U.S. Agency for International Development (USAID). The appointment has been praised by Republican lawmakers and the American Bankers Association, who have criticized the CFPB's past actions.

Trump Appoints Bessent as Acting CFPB DirectorPresident Trump has appointed Treasury Secretary Scott Bessent as the acting director of the Consumer Financial Protection Bureau (CFPB), following the resignation of Rohit Chopra. This move comes amidst broader efforts to reduce the size of the federal government, as highlighted by Elon Musk's proposed shutdown of the U.S. Agency for International Development (USAID). The appointment has been praised by Republican lawmakers and the American Bankers Association, who have criticized the CFPB's past actions.

Read more »

Trump Appoints Hedge Fund Manager as Acting CFPB Director, Halts Bureau OperationsPresident Trump has appointed Scott Bessent, a wealthy hedge fund manager, as the acting director of the Consumer Financial Protection Bureau (CFPB). Bessent's appointment has raised concerns among consumer advocates, who argue that it signals a shift towards a more business-friendly approach to financial regulation. In an internal email, CFPB staff were instructed to immediately cease most operations, including issuing or approving new rules and guidance, suspending the implementation of existing rules, and halting enforcement actions. The directive has been met with criticism, with some lawmakers accusing the administration of weakening consumer protections.

Trump Appoints Hedge Fund Manager as Acting CFPB Director, Halts Bureau OperationsPresident Trump has appointed Scott Bessent, a wealthy hedge fund manager, as the acting director of the Consumer Financial Protection Bureau (CFPB). Bessent's appointment has raised concerns among consumer advocates, who argue that it signals a shift towards a more business-friendly approach to financial regulation. In an internal email, CFPB staff were instructed to immediately cease most operations, including issuing or approving new rules and guidance, suspending the implementation of existing rules, and halting enforcement actions. The directive has been met with criticism, with some lawmakers accusing the administration of weakening consumer protections.

Read more »