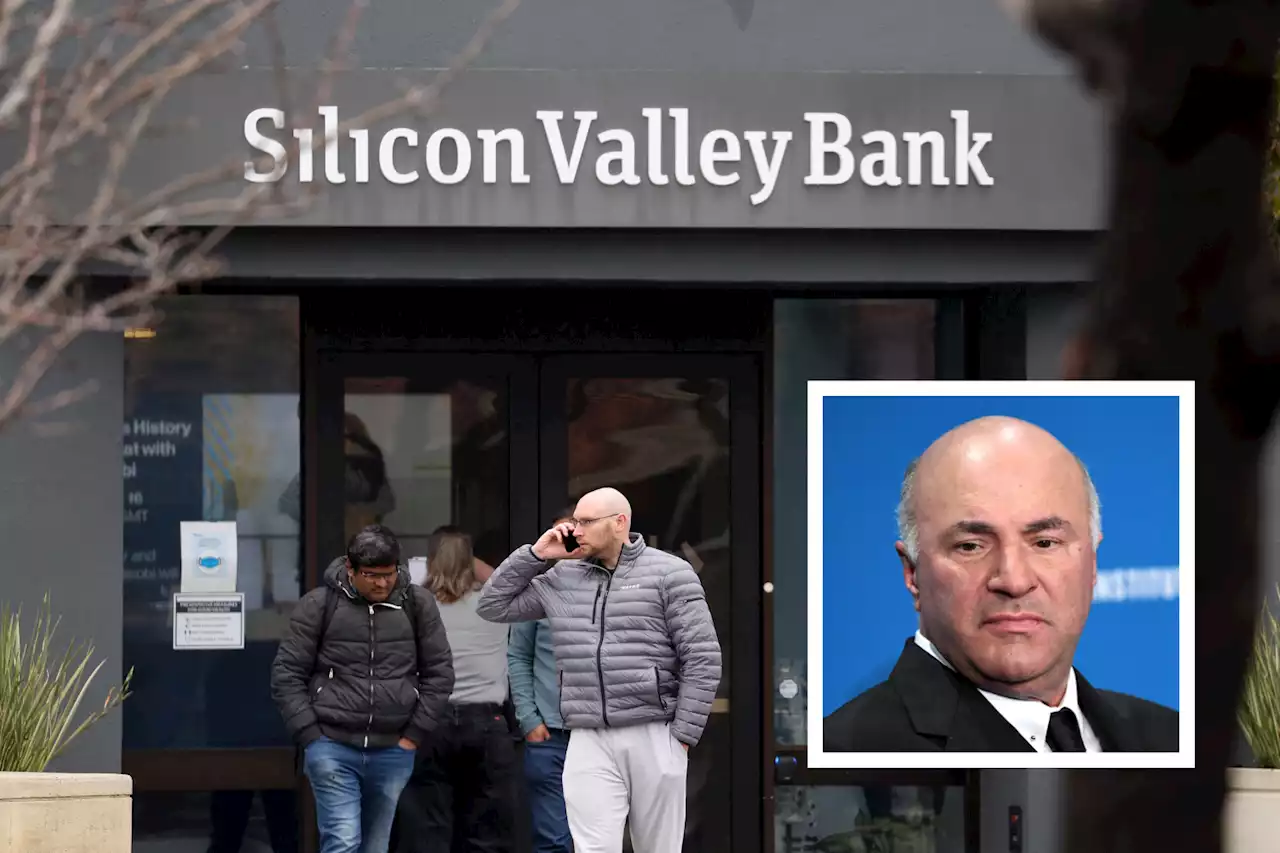

Kevin O'Leary, also known as 'Mr. Wonderful' by Shark Tank viewers, took to Twitter to share one key takeaway from the Silicon Valley Bank collapse.

Following the collapse, viewed as the largest failure since the 2008 financial crisis, questions about the bank's future have emerged, with finance experts debating about whether the federal government should bail out the bank amid concerns the fallout could further devastate the U.S. economy.

"The combination of a negligent board of directors @SVB with idiot management is the potent cocktail that led to a disastrous outcome. Why should taxpayers bail them out?"O'Leary

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

JPMorgan, PNC among suitors for SVB Financial in deal excluding SVB Bank - AxiosJPMorgan Chase & Co and PNC Financial Service Group Inc are among those in talks about acquiring SVB Financial Group in a deal that would exclude its commercial banking unit Silicon Valley Bank that is currently under U.S. control, Axios reported on Monday citing sources.

JPMorgan, PNC among suitors for SVB Financial in deal excluding SVB Bank - AxiosJPMorgan Chase & Co and PNC Financial Service Group Inc are among those in talks about acquiring SVB Financial Group in a deal that would exclude its commercial banking unit Silicon Valley Bank that is currently under U.S. control, Axios reported on Monday citing sources.

Read more »

SVB collapse: The Treasury must make whole SVB investorsThe Treasury Department is right to ensure that investors at Silicon Valley Bank have access to their deposits.

SVB collapse: The Treasury must make whole SVB investorsThe Treasury Department is right to ensure that investors at Silicon Valley Bank have access to their deposits.

Read more »

Kevin Cramer insists banks 'don't need any more regulation' following SVB collapseSen. Kevin Cramer (R-ND) rebuffed calls for increased banking regulations in the wake of Silicon Valley Bank's collapse.

Kevin Cramer insists banks 'don't need any more regulation' following SVB collapseSen. Kevin Cramer (R-ND) rebuffed calls for increased banking regulations in the wake of Silicon Valley Bank's collapse.

Read more »

FDIC's Takeover of SVB Sparks Bank Runs, BoA & Wells Fargo FearsSVB's collapse has sparked bank runs at branches across the country, and now ... additional fears are percolating that even more big banks could be next in having the FDIC step in and take over.

FDIC's Takeover of SVB Sparks Bank Runs, BoA & Wells Fargo FearsSVB's collapse has sparked bank runs at branches across the country, and now ... additional fears are percolating that even more big banks could be next in having the FDIC step in and take over.

Read more »

All the Companies Facing Major Troubles After SVB’s CollapseWhile Roku is struggling to recover after SVB’s big crash on Friday, Etsy has sent messages to sellers telling them their payouts will be delayed.

All the Companies Facing Major Troubles After SVB’s CollapseWhile Roku is struggling to recover after SVB’s big crash on Friday, Etsy has sent messages to sellers telling them their payouts will be delayed.

Read more »

UK finance minister and Bank of England work to contain SVB falloutBritain's finance ministry and the Bank of England are working together to minimise the disruption that could stem from a collapse of the UK arm of Silicon Valley Bank , which has been seized by U.S. regulators, the ministry said on Saturday.

UK finance minister and Bank of England work to contain SVB falloutBritain's finance ministry and the Bank of England are working together to minimise the disruption that could stem from a collapse of the UK arm of Silicon Valley Bank , which has been seized by U.S. regulators, the ministry said on Saturday.

Read more »