The NZD/USD pair is stuck in a tight range near 0.6150 in Monday’s Asian session.

NZD/USD consolidates around 0.6150 with a focus on US Manufacturing PMI . China’s upbeat Manufacturing PMI data improves global economic outlook. The Fed is less-likely to start reducing interest rates from the September meeting. The Kiwi asset trades inside Friday’s trading range, suggesting indecisiveness among market participants ahead of a busy United States data-packed week.

Doubts over the Fed beginning to reduce interest rates from their current levels in September deepened after the US Personal Consumption Expenditure Price Index report for August showed that price pressures were stubbornly elevated. The core PCE inflation, which strips off volatile food and energy items and is the Fed’s preferred inflation gauge, grew steadily by 2.8%. However, on a month-on-month basis, the underlying inflation data rose at a slower pace of 0.

Fed PMI Inflation Riskappetite

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

NZD/USD gains traction above 0.6100 ahead of US PMI dataThe NZD/USD pair gains momentum around 0.6108 during the Asian trading hours on Thursday.

NZD/USD gains traction above 0.6100 ahead of US PMI dataThe NZD/USD pair gains momentum around 0.6108 during the Asian trading hours on Thursday.

Read more »

NZD/USD moves below 0.6000 after the release of Business NZ PMINZD/USD has halted its two days of gains, trading around 0.6020 during the Asian session on Friday.

NZD/USD moves below 0.6000 after the release of Business NZ PMINZD/USD has halted its two days of gains, trading around 0.6020 during the Asian session on Friday.

Read more »

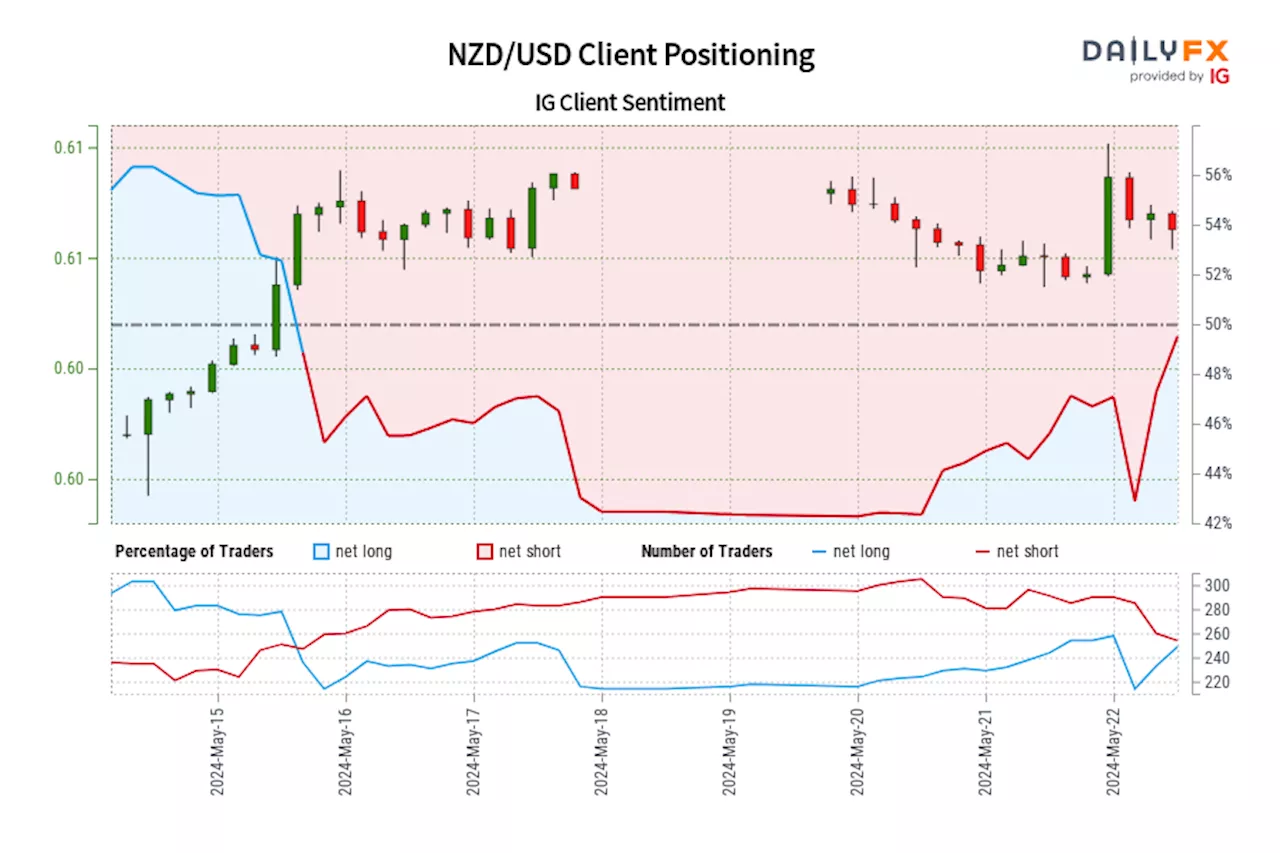

NZD/USD IG Client Sentiment: Our data shows traders are now net-long NZD/USD for the first time since May 15, 2024 13:00 GMT when NZD/USD traded near 0.61.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger NZD/USD-bearish contrarian trading bias.

NZD/USD IG Client Sentiment: Our data shows traders are now net-long NZD/USD for the first time since May 15, 2024 13:00 GMT when NZD/USD traded near 0.61.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger NZD/USD-bearish contrarian trading bias.

Read more »

NZD/USD IG Client Sentiment: Our data shows traders are now net-short NZD/USD for the first time since Mar 12, 2024 when NZD/USD traded near 0.61.Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger NZD/USD-bullish contrarian trading bias.

NZD/USD IG Client Sentiment: Our data shows traders are now net-short NZD/USD for the first time since Mar 12, 2024 when NZD/USD traded near 0.61.Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger NZD/USD-bullish contrarian trading bias.

Read more »

China manufacturing activity grows more than expected in May- Caixin PMIChina manufacturing activity grows more than expected in May- Caixin PMI

China manufacturing activity grows more than expected in May- Caixin PMIChina manufacturing activity grows more than expected in May- Caixin PMI

Read more »

China's Caixin Manufacturing PMI rises to 51.7 in May vs. 51.5 expectedChina's Caixin S&P Global Manufacturing Purchasing Managers' Index (PMI) rose from 51.4 in April to 51.7 in May, according to the latest data released on Monday.

China's Caixin Manufacturing PMI rises to 51.7 in May vs. 51.5 expectedChina's Caixin S&P Global Manufacturing Purchasing Managers' Index (PMI) rose from 51.4 in April to 51.7 in May, according to the latest data released on Monday.

Read more »