The Federal Reserve is on a path to shrink the size of its massive stock of cash and bonds for several more years, and will likely also face several more years of negative net income as well, a report from the New York Fed said Tuesday.

for 2022, the bank said that Fed holdings, which now stand at $8.7 trillion, will likely fall to around $6 trillion by the middle of 2025 before holding steady for around a year. Holdings are then expected to grow to maintain balance with the growth of the economy and tick back up to $7.2 trillion by 2030.

Aggressive purchases of Treasury and mortgage bonds kicking off at the onset of the coronavirus pandemic in March 2020 more than doubled the size of the SOMA, which peaked last summer at just shy of $9 trillion. The Fed is now allowing just shy of $100 billion per month in bonds it owns to expire and not be replaced.

"The projections for negative net income suggest that remittances to the U.S. Treasury will be suspended for some time, and that the deferred asset recorded on the Federal Reserve’s balance sheet reflecting the accumulated net loss will continue to grow," the report said. , which has taken in $2 trillion per day or more from money market funds and other firms for many months, should contract over time, in part due to money managers gaining greater certainty over the economic outlook.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Gold Price Forecast: XAU/USD eases amid risk aversion, United States inflation, Federal Reserve Minutes eyedGold price (XAU/USD) extends the previous pullback from 13-month high even as Easter Monday holiday restricts the market moves. In doing so, the preci

Gold Price Forecast: XAU/USD eases amid risk aversion, United States inflation, Federal Reserve Minutes eyedGold price (XAU/USD) extends the previous pullback from 13-month high even as Easter Monday holiday restricts the market moves. In doing so, the preci

Read more »

Gold Price Forecast: XAU/USD rebound appears elusive amid hawkish Federal Reserve betsGold price (XAU/USD) snaps three-day losing streak as it prints mild gains around $1,995 while bouncing off one-week low during Tuesday’s Asian sessio

Gold Price Forecast: XAU/USD rebound appears elusive amid hawkish Federal Reserve betsGold price (XAU/USD) snaps three-day losing streak as it prints mild gains around $1,995 while bouncing off one-week low during Tuesday’s Asian sessio

Read more »

Fed's Williams: If inflation comes down, we will have to lower ratesFederal Reserve (Fed) Bank of New York President John Williams said on Tuesday that they need to stay in 'data-dependent mode,' as reported by Reuters

Fed's Williams: If inflation comes down, we will have to lower ratesFederal Reserve (Fed) Bank of New York President John Williams said on Tuesday that they need to stay in 'data-dependent mode,' as reported by Reuters

Read more »

Chicago Fed's Goolsbee preaches caution on interest rate hikes amid bank sector concernsThe new head of the Chicago Federal Reserve said the Fed needs "to be cautious" about further increases in interest rates in light of recent bank...

Chicago Fed's Goolsbee preaches caution on interest rate hikes amid bank sector concernsThe new head of the Chicago Federal Reserve said the Fed needs "to be cautious" about further increases in interest rates in light of recent bank...

Read more »

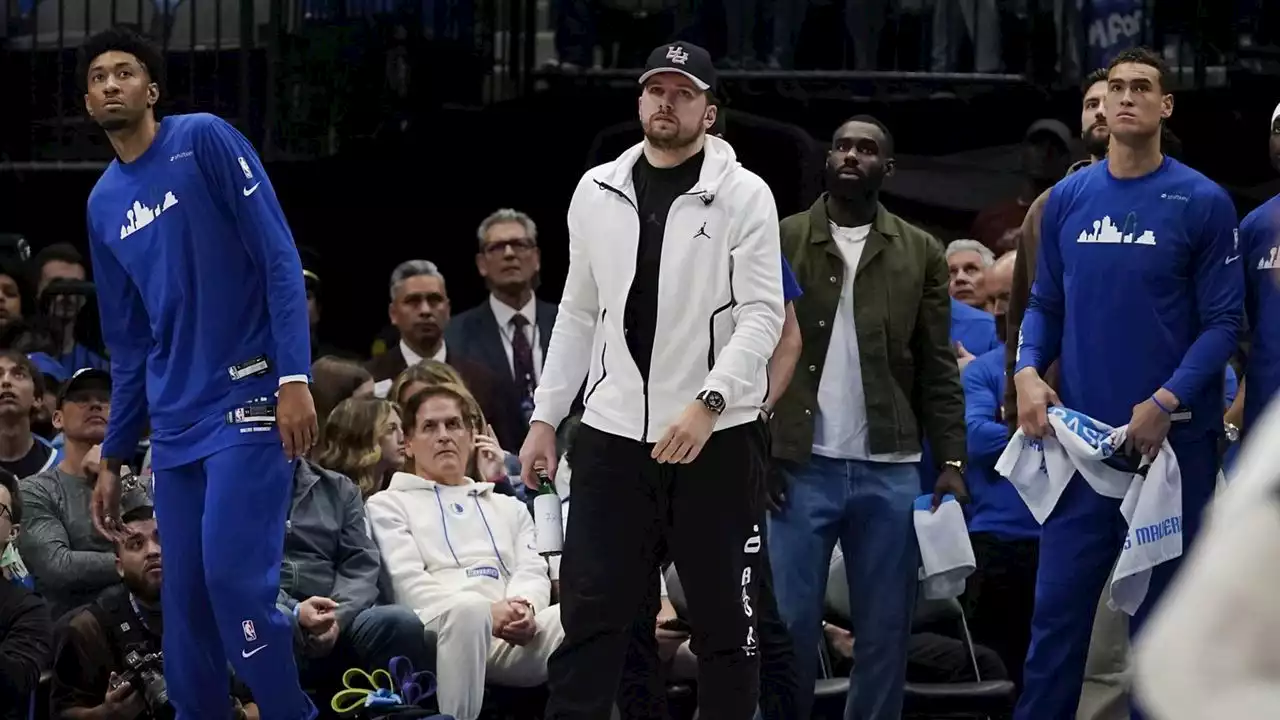

Uncertainty next for Mavs after reserve-filled loss to SpursSandro Mamukelashvili scored 23 points, and the San Antonio Spurs sent Dallas into an offseason of uncertainty with a 138-117 victory over the Mavericks in a meaningless, reserve-filled finale.

Uncertainty next for Mavs after reserve-filled loss to SpursSandro Mamukelashvili scored 23 points, and the San Antonio Spurs sent Dallas into an offseason of uncertainty with a 138-117 victory over the Mavericks in a meaningless, reserve-filled finale.

Read more »

Uncertainty next for Mavs after reserve-filled loss to SpursLuka Doncic, Kyrie Irving and four other regulars were out for Dallas, which is being investigated by the NBA for similar roster decisions two days earlier against Chicago.

Uncertainty next for Mavs after reserve-filled loss to SpursLuka Doncic, Kyrie Irving and four other regulars were out for Dallas, which is being investigated by the NBA for similar roster decisions two days earlier against Chicago.

Read more »