Much like 2023, the 2000 economy was seen as too hot, fueled in part by “dot-com” businesses first monetizing the internet.

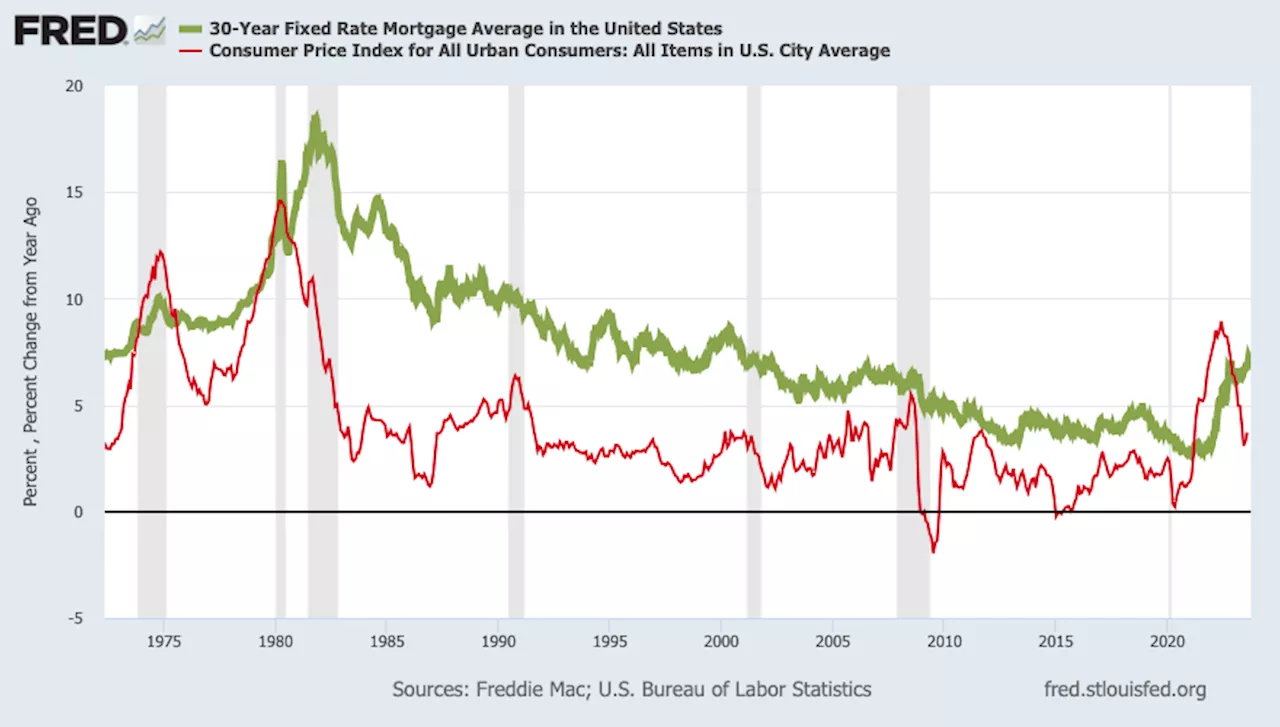

Mortgage rates have surged to their highest level since 2000 – with hints they’ll go higher – as the Federal Reserve plays housing’s “Grinch” to cool the economy.My trusty spreadsheet looked at the rates on the average 30-year fixed mortgage from a survey by Freddie Mac. To help explain home loan swings, I compared rates with the Consumer Price Index’s inflation rate.The average 30-year mortgage rate was 7.49% for the week, up from 7.31% a week ago and the eighth consecutive week above 7%.

Remember it’s the Fed’s job to keep inflation moderate. So in Grinch-like fashion, the central bank uses its rate-nudging powers to chill the economic party when the cost of living seems out of control. It’s also worth noting the inflation that put mortgage rates at 8% in 2000 was a seemingly meek 3.5%. But that was roughly double 1998 and folks had memories of 1970s double-digit inflation in their heads.A mild recession hit the nation in 2001 as joblessness rose to a four-year high. GDP growth, which was 3% in 2000, fell to almost zero the next year.

It’s a key relationship because lenders, and the investors who buy mortgages, want to get paid an interest rate well above the inflation rate. This premium rate varies over time. It’s a mortgage pricing variable that the Fed doesn’t control.Then consider August 2023, the latest month with full inflation stats. The 7.1% average mortgage rate came with 3.7% inflation – only a 3.4-point gap.From 1972 through 2000, mortgage rates averaged 9.9% as inflation ran 5.2% – that’s a 4.7-point gap.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Mortgage rates reach highest since November 2000Mortgage rates reach highest since November 2000 - MBA

Mortgage rates reach highest since November 2000Mortgage rates reach highest since November 2000 - MBA

Read more »

8% mortgage rates are perilously close — that's a psychological milestone for the housing market‘We haven’t seen an 8% mortgage rate in over 20 years,’ says Cris deRitis, deputy chief economist at Moody’s Analytics.

8% mortgage rates are perilously close — that's a psychological milestone for the housing market‘We haven’t seen an 8% mortgage rate in over 20 years,’ says Cris deRitis, deputy chief economist at Moody’s Analytics.

Read more »

8% mortgage rates are perilously close — and it's a psychological milestone for the housing market‘We haven’t seen an 8% mortgage rate in over 20 years,’ says Cris deRitis, deputy chief economist at Moody’s Analytics.

8% mortgage rates are perilously close — and it's a psychological milestone for the housing market‘We haven’t seen an 8% mortgage rate in over 20 years,’ says Cris deRitis, deputy chief economist at Moody’s Analytics.

Read more »

Mortgage rates race toward 8% as demand plummets to three-decade lowHome-purchase applications tumbled last week to the lowest level in nearly three decades as high interest rates and limited availability weighed on demand.

Mortgage rates race toward 8% as demand plummets to three-decade lowHome-purchase applications tumbled last week to the lowest level in nearly three decades as high interest rates and limited availability weighed on demand.

Read more »

8% Mortgage Rates Are on the Horizon—and May Stick AroundThe rates could drive home sales to the lowest level in more than a decade as buyers and sellers pull back.

8% Mortgage Rates Are on the Horizon—and May Stick AroundThe rates could drive home sales to the lowest level in more than a decade as buyers and sellers pull back.

Read more »

Mortgage rates race toward 8% as demand plummets to three-decade lowA key measure of home-purchase applications tumbled last week to a nearly three-decade low as consumer demand cooled sharply amid a recent surge in...

Mortgage rates race toward 8% as demand plummets to three-decade lowA key measure of home-purchase applications tumbled last week to a nearly three-decade low as consumer demand cooled sharply amid a recent surge in...

Read more »