Bill Ackman woke up in February 2020 with an innate sense that the stock market would be throttled by the COVID-19 pandemic. Author lizrhoffman details the billionaire’s realization that the coronavirus would be a “black swan” event.

But even in late February, something strange had happened. The sellers of these financial insurance policies weren’t distinguishing between riskier borrowers and safer ones, charging barely any more for swaps on lower-rated debt. “The market is completely mispricing this,” Ackman told his team on that Sunday conference call. “Start buying.”use the word, Ackman was calling the financial market what it had clearly become: a bubble, and one that was at risk of popping.

The S&P 500 gained 400 percent between March 2009 and March 2020 in an historic bull market. Debt got cheap and plentiful. The oddity that Ackman had noticed—a lack of discernment among bond investors who charged barely more interest to riskier borrowers than safer ones—grew more pronounced. Near-zero interest rates set by the Federal Reserve forced investors to invest in anything that might return a little profit, pushing them further and further into riskier territory.

The billionaire was as folksy as ever in his reply. In an email dictated to his longtime secretary—the octogenarian doesn’t use email—he said that he hoped to see Ackman at this year’s meeting, set for May 2, and invited the investor and Oxman to a private brunch. “Unfortunately we can’t include Raika,” he said of Ackman’s infant daughter, “though if she owns Berkshire, I hope she continues to vote for me and Charlie” as members of the board of directors.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

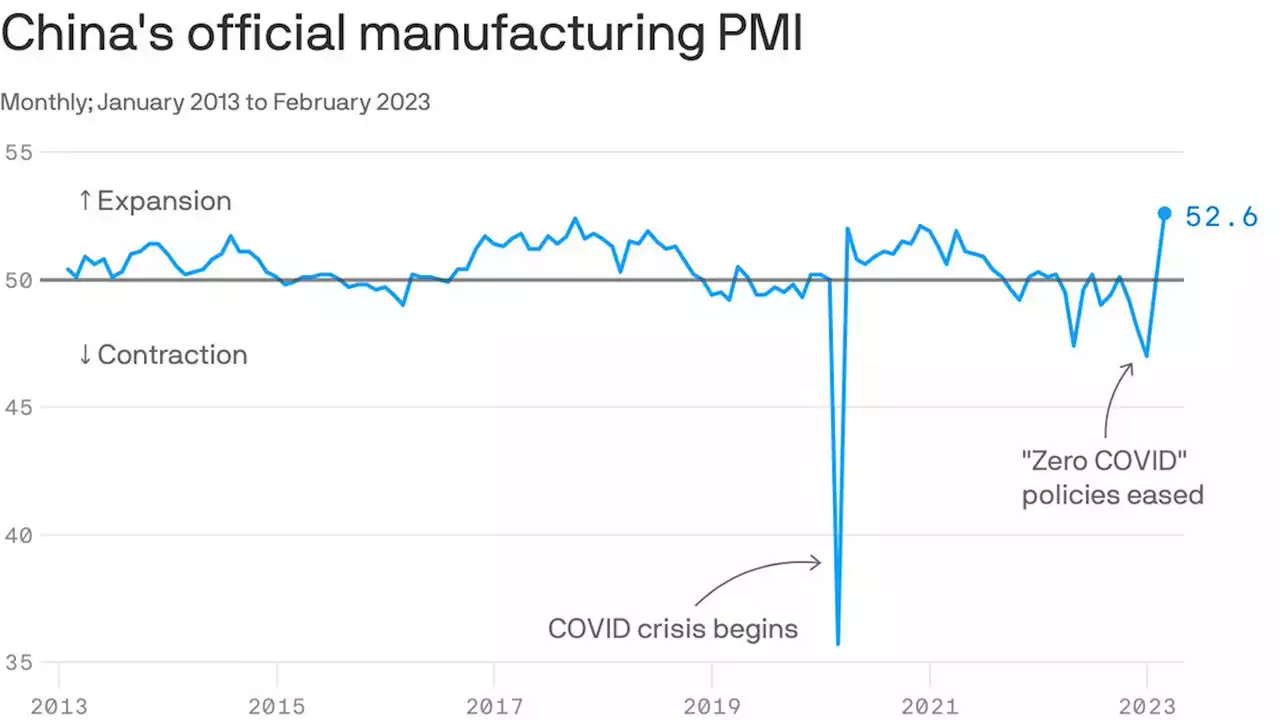

China's industrial engine revs upChina's manufacturing sector has accelerated sharply since the end of the government's harsh 'zero-COVID' lockdowns in December.

China's industrial engine revs upChina's manufacturing sector has accelerated sharply since the end of the government's harsh 'zero-COVID' lockdowns in December.

Read more »

Senate unanimously passes bill to declassify intelligence on COVID-19 originsThe Senate unanimously passed Wednesday a bill that would force President Biden to declassify all intelligence related to the origins of COVID-19 and a possible lab leak.

Senate unanimously passes bill to declassify intelligence on COVID-19 originsThe Senate unanimously passed Wednesday a bill that would force President Biden to declassify all intelligence related to the origins of COVID-19 and a possible lab leak.

Read more »

March madness could be in store for markets after a somber FebruaryMarch madness? After a euphoric January was followed by a somber February, with bonds and equities selling off as strong data renewed rate-hike bets, more wild swings could be next for world markets.

March madness could be in store for markets after a somber FebruaryMarch madness? After a euphoric January was followed by a somber February, with bonds and equities selling off as strong data renewed rate-hike bets, more wild swings could be next for world markets.

Read more »