Mississippi Governor Tate Reeves prioritizes eliminating the state income tax, but remains silent on the issues facing the Public Employees Retirement System, despite its significant financial challenges.

Hours before the 2025 session of the Mississippi Legislature kicked off last week, Gov. Tate Reeves went to social media to proclaim the No. 1 goal “for this Republican” is to eliminate the state income tax. The governor does not have a vote in the Legislature and cannot even introduce legislation. He must seek out a legislative ally to file bills he supports.

But the governor has perhaps the biggest political bully pulpit in the state, giving an effective governor the immense opportunity to sway public opinion. And the governor has the power of the veto, which it takes an imposing two-thirds majority in both legislative chambers to override. Obviously, one of the governor’s most important duties is working with the Legislature to develop policies for the betterment of the state. In the opinion of Jonathan Tate Reeves, now in his 21st year as a statewide elected official and in his fifth year as governor, the most important issue facing 3 million Mississippians is eliminating the income tax. Reeves has proposed phasing out the income tax every year he has been governor. His latest proposal is to phase out the tax, which accounts for about 30% of the state general fund, by 2029. Other Republicans in the state, including House Speaker Jason White, also say the elimination of the income tax is their top priority or near the top of their “to do list.” But White speaks of eliminating the tax in eight to 10 years. Lt. Gov. Delbert Hosemann wants to cut the tax, but says if legislation is enacted to fully eliminate the tax, it will be after his tenure as lieutenant governor ends in January 2028. Many politicians cite other pressing needs facing the state, not the least of which is ensuring the long-term viability of the state’s massive retirement program for public employees. Some say if the Public Employees Retirement System is not fiscally sound in the long term, the financial impact on the state could be devastating. Yet the governor has rarely commented about the issues facing PERS, which provides or will provide retirement benefits for more than 350,000 people who worked or have worked in the public sector — including for state agencies, local governmental entities and public schools, kindergarten through the university level. In other words, more than 10% of the state’s population is in the PERS system. Experts say the system has a deficit of $25 billion. It should be stressed that the deficit could be considered a bit misleading because PERS has assets to meet its obligations for years — for long after Reeves leaves office. But many believe that if steps are not taken now to shore up the system, the state will eventually face financial obligations like it has never experienced. It is very unlikely Reeves will have to deal with that likelihood since he will long be gone from state government service. The PERS governing board and legislators began work to shore up the system before the 2024 session began. That work is continuing this year. While Reeves talks about eliminating the income tax all the time, he seldom if ever weighs in on what he believes should be done to deal with PERS. After the 2024 session, Reeves allowed a bill that made significant changes to PERS to become law without his signature. It was not clear whether he supported or opposed the legislation that was viewed by many as an opening salvo in dealing with issues surrounding PERS. The governor’s silence is particularly interesting considering he was a member of the governing board of PERS when he served as state treasurer. Reeves’ experience as treasure and his short career in the private sector in finance should give him a unique perspective on the financial issues the retirement system faces. Every politician has different priorities. Reeves has not been shy about letting Mississippians know his top priority. It is easy to find his thoughts on the income tax in his social media posts. But on PERS, it is crickets when it comes to what the governor thinks

TATE REEVES INCOME TAX PERS RETIREMENT SYSTEM MISSISSIPPI

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Governor Tate Reeves signs Executive Order on AIMississippi isn’t looking at artificial intelligence as a negative. Instead, the Governor is hoping the right use of it will allow the state to bring in more tech jobs.

Governor Tate Reeves signs Executive Order on AIMississippi isn’t looking at artificial intelligence as a negative. Instead, the Governor is hoping the right use of it will allow the state to bring in more tech jobs.

Read more »

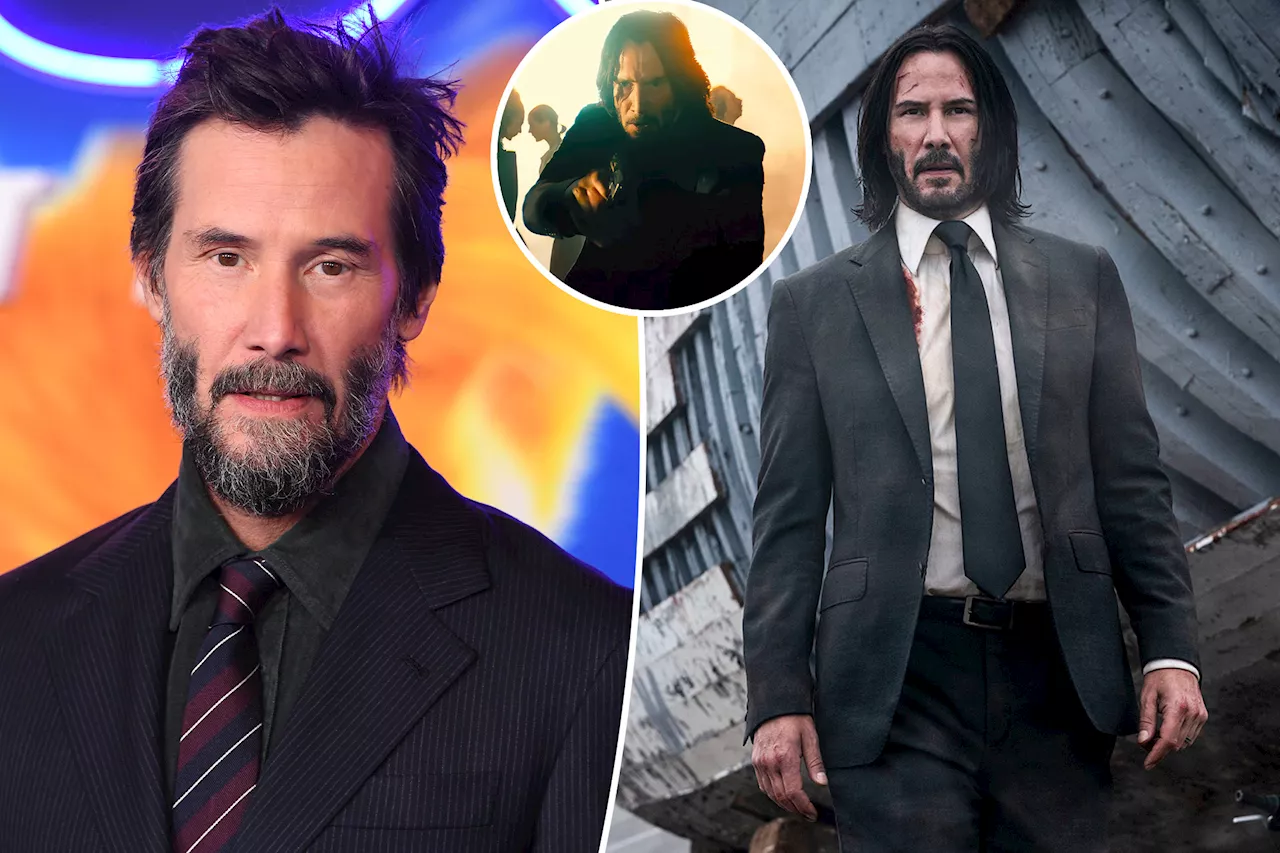

Keanu Reeves Hints at Potential 'John Wick' RetirementKeanu Reeves expresses uncertainty about returning for another 'John Wick' film, citing physical and emotional exhaustion from the franchise. Producer Erica Lee Iwanyk reveals Reeves desired a definitive ending in the fourth film but leaves a small possibility for a future installment.

Keanu Reeves Hints at Potential 'John Wick' RetirementKeanu Reeves expresses uncertainty about returning for another 'John Wick' film, citing physical and emotional exhaustion from the franchise. Producer Erica Lee Iwanyk reveals Reeves desired a definitive ending in the fourth film but leaves a small possibility for a future installment.

Read more »

Keanu Reeves to Star in Ruben Östlund's 'Entertainment System is Down'Keanu Reeves will begin filming 'Entertainment System is Down' next month, directed by Oscar-nominated director Ruben Östlund. The film features a star-studded cast including Woody Harrelson, Kirsten Dunst, Joel Edgerton, Samantha Morton, Daniel Brühl, Nicholas Braun, and Vincent Lindon. It explores the comedic boredom of passengers on a long flight whose entertainment system fails.

Keanu Reeves to Star in Ruben Östlund's 'Entertainment System is Down'Keanu Reeves will begin filming 'Entertainment System is Down' next month, directed by Oscar-nominated director Ruben Östlund. The film features a star-studded cast including Woody Harrelson, Kirsten Dunst, Joel Edgerton, Samantha Morton, Daniel Brühl, Nicholas Braun, and Vincent Lindon. It explores the comedic boredom of passengers on a long flight whose entertainment system fails.

Read more »

The one move that could add years to your nest eggUtah retirement experts weigh in on a retirement tax-saving recommendation from the Wall Street Journal.

The one move that could add years to your nest eggUtah retirement experts weigh in on a retirement tax-saving recommendation from the Wall Street Journal.

Read more »

Podcast: Ray Higgins on PERS Needs Both Extra Cash and Benefit Changes for Future EmployeesMississippi Today's Bobby Harrison interviews Ray Higgins, executive director of the Mississippi Public Employees Retirement System (PERS), discussing proposed pension benefit changes for future employees and the system's future.

Podcast: Ray Higgins on PERS Needs Both Extra Cash and Benefit Changes for Future EmployeesMississippi Today's Bobby Harrison interviews Ray Higgins, executive director of the Mississippi Public Employees Retirement System (PERS), discussing proposed pension benefit changes for future employees and the system's future.

Read more »

San Diego Pension System Pays Out Controversial BonusesThe San Diego pension system is facing criticism for paying out a controversial retirement bonus despite the system's debt of over $3.5 billion.

San Diego Pension System Pays Out Controversial BonusesThe San Diego pension system is facing criticism for paying out a controversial retirement bonus despite the system's debt of over $3.5 billion.

Read more »