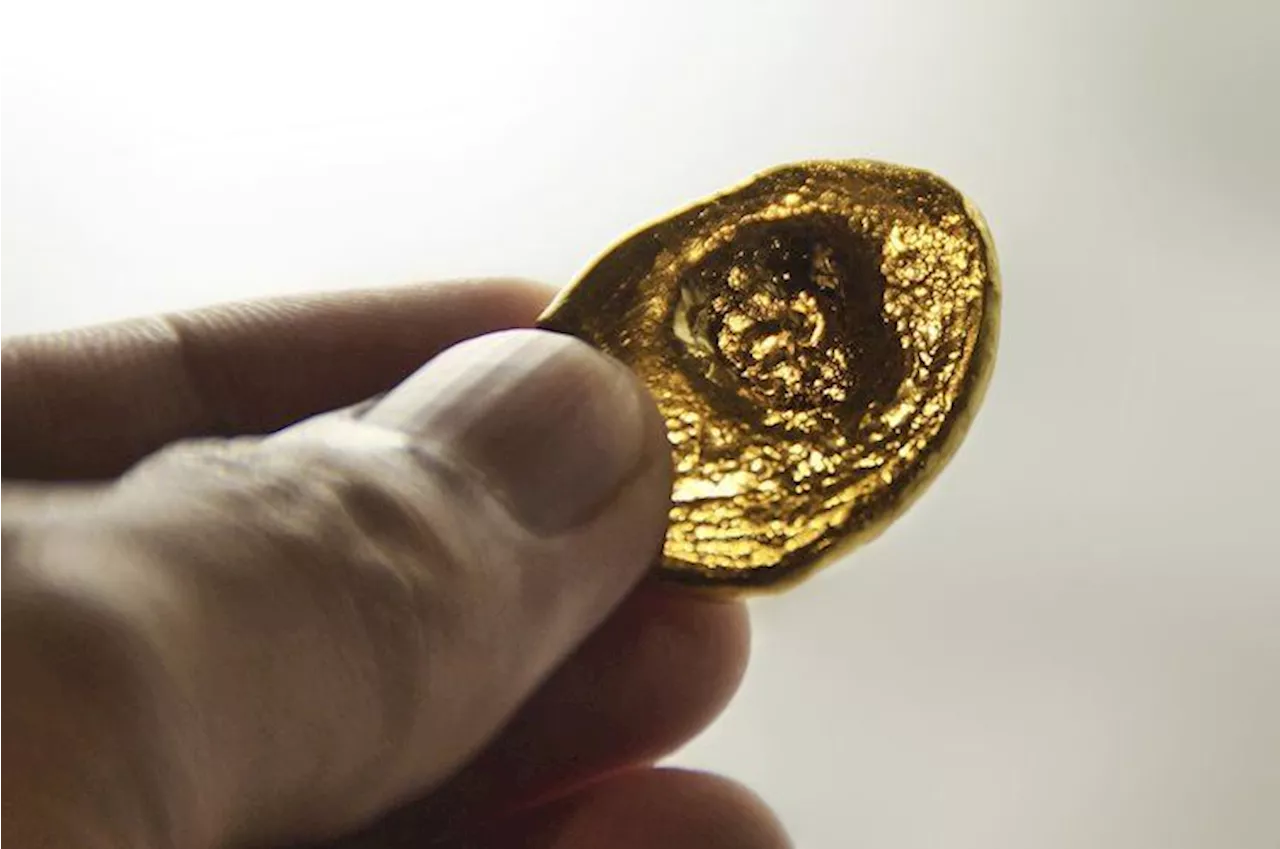

This article analyzes the recent fluctuations in gold prices, highlighting its impressive rally and subsequent consolidation. It delves into key milestones, market dynamics, and factors influencing these trends, including geopolitical escalations and economic stimulus packages.

has experienced significant fluctuations, marked by an impressive rally and subsequent pullback. As the price of gold reached new heights, investors have been keenly observing the dynamics at play. This article delves into the recent movements in gold price s, analyzing key milestones, market consolidations, and the factors influencing these trends.

Nevertheless, this pullback has not led to a sell signal in the weekly stochastic so far. Rather, the oscillator sits firmly in the saddle with both lines above 80, bullishly embedded, and has continued to secure the higher-order uptrend. Hence, should the pullback extend, this will likely be played out primarily over time rather than price once again.

In sum, the daily chart is neutral. While the stochastic oscillator still indicates more need for correction, Friday’s recovery has forced a stalemate. If the potential flag formation persists, the rally could resume soon. Alternatively, the 50-day line would be preferable as the target of the pullback. The daily chart calls for patience.As of the closing price of USD 2,622 on Tuesday, October 8th, commercial traders held a cumulative short position of 303,976contracts.

Macro Update – The International Financial Casino Will Force Central Banks to Take Unprecedented Liquidity Measures Maturity transformation: Banks grant long-term loans while holding short-term deposits. This discrepancy requires constant refinancing and increases the need for liquidity. In this system, central banks function as “lenders of last resort” to mitigate systemic risks. They can provide additional liquidity in times of crisis, which, however, leads to a further expansion of the money supply in the long term and thus logically favors inflation.Since 2002, for example, the balance sheet total of the European Central Bank has increased significantly and amounted to approximately EUR 6.473 trillion at the end of August 2024, more than ten times the value of 2002.

Gold Price Rally Consolidation Geopolitical Escalations Economic Stimulus

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Gold price soars to record high as US Consumer Confidence deterioratesGold prices hit a new all-time high (ATH) during Tuesday's North American session due to a deterioration in Consumer Confidence in the United States (US), according to data provided by the Conference Board.

Gold price soars to record high as US Consumer Confidence deterioratesGold prices hit a new all-time high (ATH) during Tuesday's North American session due to a deterioration in Consumer Confidence in the United States (US), according to data provided by the Conference Board.

Read more »

Gold price soars to record high amid firm US yieldsGold hit a new all-time high of $2,685 on Thursday as the Greenback began to recover from earlier losses sustained in the Asian and European sessions.

Gold price soars to record high amid firm US yieldsGold hit a new all-time high of $2,685 on Thursday as the Greenback began to recover from earlier losses sustained in the Asian and European sessions.

Read more »

Shiba Inu (SHIB) Burn Rate Shoots up 647% as Price Rallies 13%Shiba Inu price soars, burn rate takes new twist

Shiba Inu (SHIB) Burn Rate Shoots up 647% as Price Rallies 13%Shiba Inu price soars, burn rate takes new twist

Read more »

Gold's price is still climbing: 3 gold options to consider nowSome gold investments may be more advantageous than others in today's unusual gold market climate.

Gold's price is still climbing: 3 gold options to consider nowSome gold investments may be more advantageous than others in today's unusual gold market climate.

Read more »

Gold price consolidates below record high as traders await US PCE Price IndexGold price (XAU/USD) extended its record-breaking run for the fifth straight day on Thursday amid the emergence of fresh US Dollar (USD) selling.

Gold price consolidates below record high as traders await US PCE Price IndexGold price (XAU/USD) extended its record-breaking run for the fifth straight day on Thursday amid the emergence of fresh US Dollar (USD) selling.

Read more »

Gold price sets new record as Fed rate cut decision loomsNo 1 source of global mining news and opinion

Gold price sets new record as Fed rate cut decision loomsNo 1 source of global mining news and opinion

Read more »