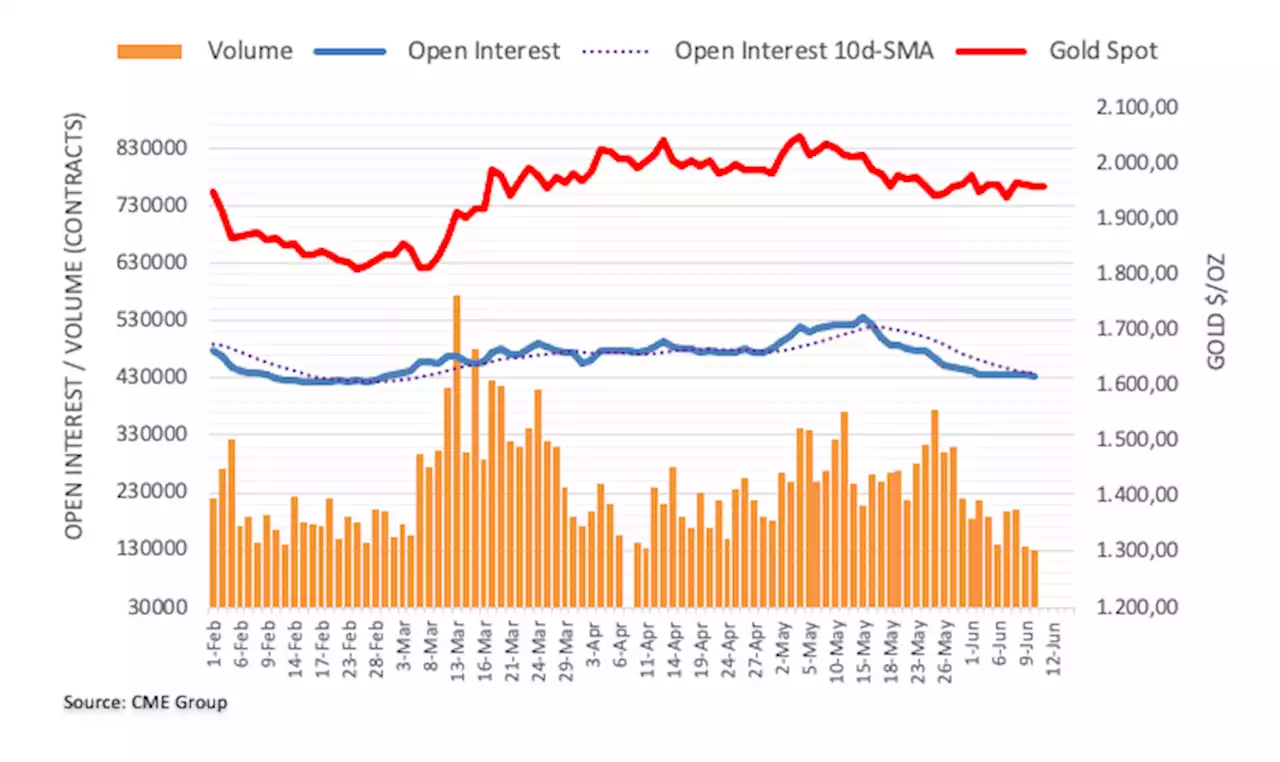

Gold Futures: A deeper pullback appears unlikely Gold Commodities Metals OpenInterest Futures

futures markets noted traders trimmed their open interest positions for the second straight day on Monday, this time by around 2.5K contracts. Volume followed suit and went down for the second consecutive session, now by around 6.6K contracts.prices started the week on a negative foot amidst shrinking open interest and volume. Against that, further retracements appear not favoured for the time being, giving way instead to some near-term rebound.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Gold Futures: Further losses not favouredOpen interest in gold futures markets shrank by just 702 contracts on Friday according to preliminary readings from CME Group. Volume followed suit an

Gold Futures: Further losses not favouredOpen interest in gold futures markets shrank by just 702 contracts on Friday according to preliminary readings from CME Group. Volume followed suit an

Read more »

Natural Gas: A near-term rebound looks probableCME Group’s flash data for natural gas futures markets noted traders reduced their open interest positions by just 830 contracts on Friday, adding to

Natural Gas: A near-term rebound looks probableCME Group’s flash data for natural gas futures markets noted traders reduced their open interest positions by just 830 contracts on Friday, adding to

Read more »

Crude Oil Futures: A sustained drop is out of favourConsidering advanced prints from CME Group for crude oil futures markets, open interest went down for the third session in a row on Friday, this time

Crude Oil Futures: A sustained drop is out of favourConsidering advanced prints from CME Group for crude oil futures markets, open interest went down for the third session in a row on Friday, this time

Read more »

Open Interest in Binance's BNB Token Futures Jumps to 5-Month HighOpen interest or the number of active $BNB futures contracts have jumped to 1.57 million BNB or $360 million. Reports godbole17.

Open Interest in Binance's BNB Token Futures Jumps to 5-Month HighOpen interest or the number of active $BNB futures contracts have jumped to 1.57 million BNB or $360 million. Reports godbole17.

Read more »

U.S. stock futures flirt with fresh highs ahead of inflation data, Fed decisionStock futures looked to extend their recent rally Monday -- though the positivity was tinged with caution ahead of a week stuffed with potential tripwires.

U.S. stock futures flirt with fresh highs ahead of inflation data, Fed decisionStock futures looked to extend their recent rally Monday -- though the positivity was tinged with caution ahead of a week stuffed with potential tripwires.

Read more »

Stock futures are flat ahead of key May inflation reportThe S&P 500 and Nasdaq Composite closed on Monday at their highest levels since last April.

Stock futures are flat ahead of key May inflation reportThe S&P 500 and Nasdaq Composite closed on Monday at their highest levels since last April.

Read more »