EUR/USD drove up 0.4% on Tuesday, breaching back above 1.1100 for the first time since last December, chalking in a fresh high for 2024.

EUR/USD climbed four-tenths of one percent on Tuesday. Markets are broadly pivoting into a risk-on stance, pressuring the US Dollar. Investors will be craning their necks for signs of Fed rate cuts. The pair has closed firmly in the green for three straight trading days, and is on pace to climb a full percent since Monday’s opening bids.

EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY , EUR/GBP and EUR/AUD . What is the ECB and how does it impact the Euro? The European Central Bank in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

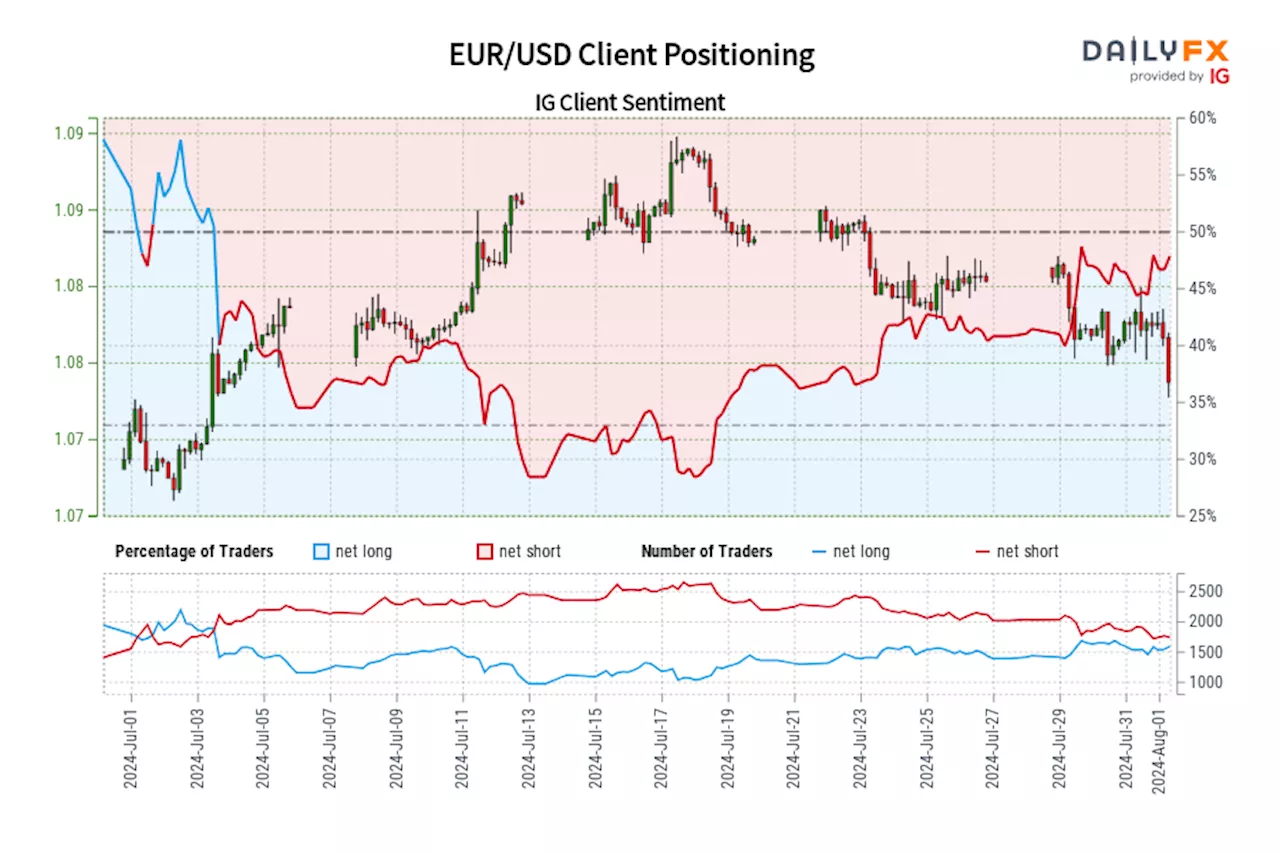

EUR/USD IG Client Sentiment: Our data shows traders are now net-long EUR/USD for the first time since Jul 03, 2024 when EUR/USD traded near 1.08.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bearish contrarian trading bias.

EUR/USD IG Client Sentiment: Our data shows traders are now net-long EUR/USD for the first time since Jul 03, 2024 when EUR/USD traded near 1.08.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bearish contrarian trading bias.

Read more »

EUR/USD edges higher above 1.0900, US PPI data loomsThe EUR/USD pair trades in positive territory around 1.0940 during the Asian session on Tuesday.

EUR/USD edges higher above 1.0900, US PPI data loomsThe EUR/USD pair trades in positive territory around 1.0940 during the Asian session on Tuesday.

Read more »

EUR/USD Forecast: Euro stabilizes above key technical levelEUR/USD closed in negative territory on Tuesday but managed to stabilize above 1.0900.

EUR/USD Forecast: Euro stabilizes above key technical levelEUR/USD closed in negative territory on Tuesday but managed to stabilize above 1.0900.

Read more »

EUR/USD stays below 1.0900 ahead of Eurozone Consumer ConfidenceEUR/USD retraces its recent gains, trading around 1.0870 during the European session on Tuesday.

EUR/USD stays below 1.0900 ahead of Eurozone Consumer ConfidenceEUR/USD retraces its recent gains, trading around 1.0870 during the European session on Tuesday.

Read more »

EUR/USD Price Analysis: Inches higher to near 1.0900; next barrier at four-month highsEUR/USD advances for the second consecutive day, trading around 1.0900 during Tuesday's Asian session.

EUR/USD Price Analysis: Inches higher to near 1.0900; next barrier at four-month highsEUR/USD advances for the second consecutive day, trading around 1.0900 during Tuesday's Asian session.

Read more »

Gold, Silver Price Action Setups Ahead of FOMC Minutes, Jackson HolePrecious metals and risk assets have witnessed remarkable recoveries since the contained sell-off at the start of August. See how gold, silver and the S&P 500 shape up

Gold, Silver Price Action Setups Ahead of FOMC Minutes, Jackson HolePrecious metals and risk assets have witnessed remarkable recoveries since the contained sell-off at the start of August. See how gold, silver and the S&P 500 shape up

Read more »