EUR/USD hovers in a tight range near the round-level figure of 1.0900 in Tuesday’s European session as the upside move stalls with a focus on Thursday's European Central Bank (ECB) monetary policy meeting.

EUR/USD consolidates near 1.0900 as investors shift focus to the US monthly Retail Sales and the ECB policy meeting. The ECB is expected to leave interest rates unchanged. Monthly US Retail Sales are estimated to have remained unchanged in June. EUR/USD hovers in a tight range near the round-level figure of 1.0900 in Tuesday’s European session as the upside move stalls with a focus on Thursday's European Central Bank monetary policy meeting.

The US Dollar Index , which tracks the Greenback’s value against six major currencies, manages to protect its immediate support of 104.00. In his speech on Monday, Powell acknowledged that the inflation data in the second quarter has added to confidence that inflation will return sustainably to the bank’s target of 2%. However, Powell cited the need of more good data to gain greater confidence before cutting interest rates.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

EUR/USD: Topside for EUR/USD is very limited – Societe GeneraleThis morning’s IFO data confirm what the PMIs told us – expectations are down, FX strategist Kit Juckes at Societe Generale notes.

EUR/USD: Topside for EUR/USD is very limited – Societe GeneraleThis morning’s IFO data confirm what the PMIs told us – expectations are down, FX strategist Kit Juckes at Societe Generale notes.

Read more »

EUR/USD Forecast: Euro loses bullish momentum as focus shifts to ECB ForumFollowing a bullish opening to the week, EUR/USD climbed to its highest level in over two weeks above 1.0770 on Monday.

EUR/USD Forecast: Euro loses bullish momentum as focus shifts to ECB ForumFollowing a bullish opening to the week, EUR/USD climbed to its highest level in over two weeks above 1.0770 on Monday.

Read more »

EUR/USD posts fresh three-week high above 1.0900 with focus on ECB meetingThe EUR/USD pair refreshes a three-week high slightly above the round-level figure of 1.0900 in Monday’s European session.

EUR/USD posts fresh three-week high above 1.0900 with focus on ECB meetingThe EUR/USD pair refreshes a three-week high slightly above the round-level figure of 1.0900 in Monday’s European session.

Read more »

EUR/USD Monday bidding blinks as ECB rate call looms over the horizonEUR/USD fell short of recent bullish momentum, pulling back sharply after a brief jump above 1.0900 to kick off the new trading week and keeping price action strung out along the top end of a descending price channel.

EUR/USD Monday bidding blinks as ECB rate call looms over the horizonEUR/USD fell short of recent bullish momentum, pulling back sharply after a brief jump above 1.0900 to kick off the new trading week and keeping price action strung out along the top end of a descending price channel.

Read more »

EUR/USD: 1.09 Breakout Still in the Cards - ECB Decision, CPI Could Seal the DealForex Analysis by Investing.com (Damian Nowiszewski) covering: EUR/USD, US Dollar Index Futures. Read Investing.com (Damian Nowiszewski)'s latest article on Investing.com

EUR/USD: 1.09 Breakout Still in the Cards - ECB Decision, CPI Could Seal the DealForex Analysis by Investing.com (Damian Nowiszewski) covering: EUR/USD, US Dollar Index Futures. Read Investing.com (Damian Nowiszewski)'s latest article on Investing.com

Read more »

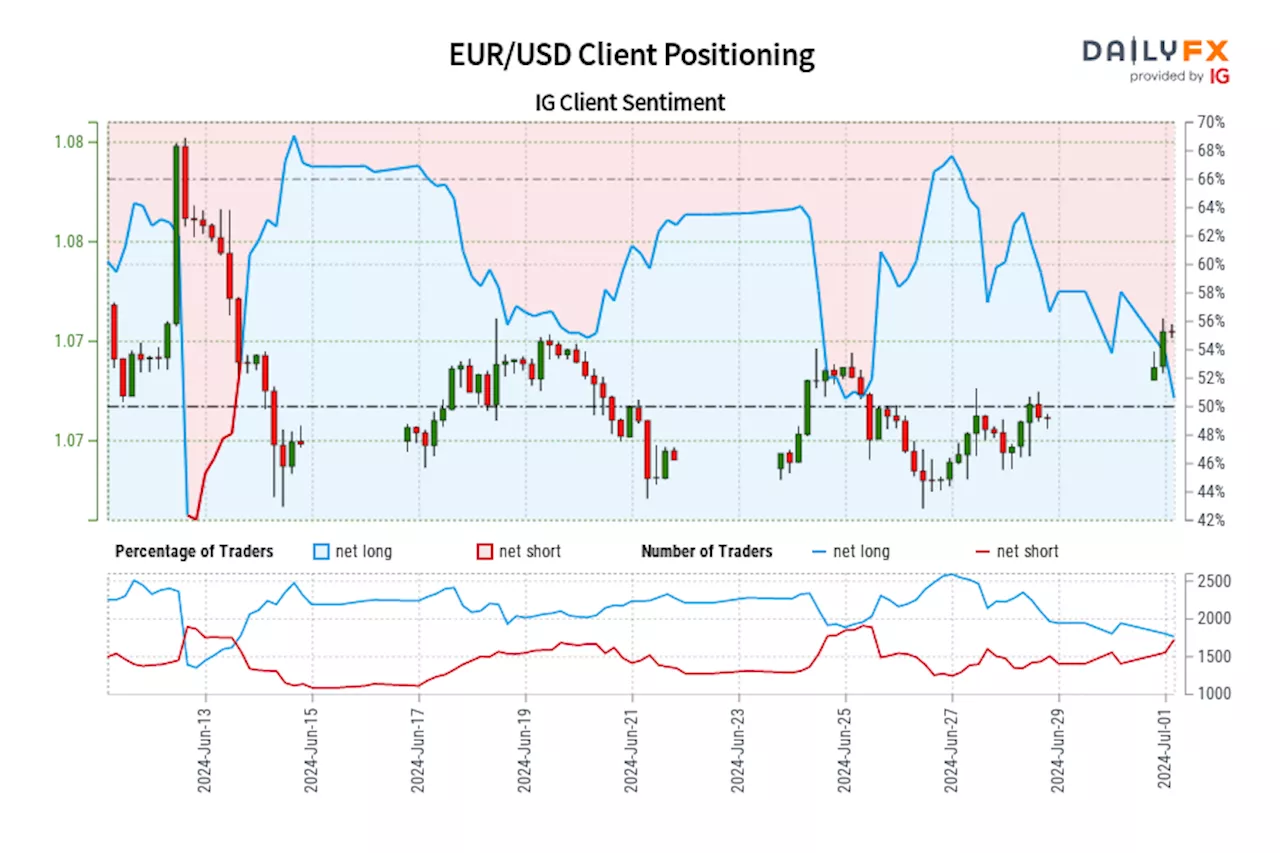

EUR/USD IG Client Sentiment: Our data shows traders are now net-short EUR/USD for the first time since Jun 13, 2024 when EUR/USD traded near 1.07.Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bullish contrarian trading bias.

EUR/USD IG Client Sentiment: Our data shows traders are now net-short EUR/USD for the first time since Jun 13, 2024 when EUR/USD traded near 1.07.Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bullish contrarian trading bias.

Read more »