The EUR/USD pair trades softer below the 1.0900 mark during the early Asian session on Monday.

EUR/USD edges lower to 1.0885 amid the recovery of USD.

is expected to hold its key fed funds rate steady at a 5.25%–5.50% range on Wednesday. ECB’s de Cos said that the central bank could start cutting interest rates in June after a decrease in Eurozone inflation. The monetary policy meeting and press conference on Wednesday will be in the spotlight. The rebound of the US Dollar above 103.50 weighs on the major pair. Investors await the US Federal Open Market Committee's interest rate decision on Wednesday, with no change in rate expected. At press time, EUR/USD is trading at 1.0885, down 0.03% on the day. The University of Michigan showed on Friday that the Consumer Sentiment Index dropped to 76.

is widely expected to hold its key fed funds rate steady at a 22-year high of a 5.25%–5.50% range on Wednesday as Fed officials want to see more evidence of inflation data to ensure it returns to its 2% target before starting to cut the interest rates. That being said, the high-for-longer US rate narrative might lift the US Dollar and act as a headwind for the EUR/USD pair.

interest rate decision on Wednesday. Traders will take cues from the data and find trading opportunities around the EUR/USD pair. EUR/USD Overview Today last price 1.0884 Today Daily Change -0.0005 Today Daily Change % -0.05 Today daily open 1.0889 Trends Daily SMA20 1.0865 Daily SMA50 1.0852 Daily SMA100 1.0858 Daily SMA200 1.0838 Levels Previous Daily High 1.09 Previous Daily Low 1.0873 Previous Weekly High 1.0964 Previous Weekly Low 1.0873 Previous Monthly High 1.0898 Previous Monthly Low 1.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

US Dollar Subdued Ahead of Fed Minutes; Setups on EUR/USD, USD/JPY, USD/CADThis article focuses on the technical outlook for three popular U.S. dollar pairs: EUR/USD, USD/JPY, and USD/CAD. Throughout the piece, we scrutinize potential scenarios and examine key price levels worth watching in the coming days.

US Dollar Subdued Ahead of Fed Minutes; Setups on EUR/USD, USD/JPY, USD/CADThis article focuses on the technical outlook for three popular U.S. dollar pairs: EUR/USD, USD/JPY, and USD/CAD. Throughout the piece, we scrutinize potential scenarios and examine key price levels worth watching in the coming days.

Read more »

US Dollar Seeks Fed Signals in PPI, Retail Sales Data - EUR/USD, USD/JPY SetupsThe release of U.S. PPI and retail sales data on Thursday is poised to capture the market's focus and potentially ignite volatility, as both macroeconomic reports may influence the Fed’s monetary policy outlook.

US Dollar Seeks Fed Signals in PPI, Retail Sales Data - EUR/USD, USD/JPY SetupsThe release of U.S. PPI and retail sales data on Thursday is poised to capture the market's focus and potentially ignite volatility, as both macroeconomic reports may influence the Fed’s monetary policy outlook.

Read more »

US Dollar Soars on Inflation Risks as Fed Looms; EUR/USD, GBP/USD, USD/JPY SetupsThis article provides an in-depth analysis of the outlook for EUR/USD, USD/JPY and GBP/USD, exploring various technical and fundamental scenarios that could play out in the near term.

US Dollar Soars on Inflation Risks as Fed Looms; EUR/USD, GBP/USD, USD/JPY SetupsThis article provides an in-depth analysis of the outlook for EUR/USD, USD/JPY and GBP/USD, exploring various technical and fundamental scenarios that could play out in the near term.

Read more »

EUR/USD Levels Off at Support Ahead of Key Fed DecisionThis article looks at EUR/USD’s near-term outlook, examining potential technical scenarios ahead of the Fed decision next week.

EUR/USD Levels Off at Support Ahead of Key Fed DecisionThis article looks at EUR/USD’s near-term outlook, examining potential technical scenarios ahead of the Fed decision next week.

Read more »

– Fed and BoE will Drive EUR/USD and EUR/GBP Price SetupsEuro traders will be looking at the Federal Reserve and the Bank of England this week to help gauge EUR/USD and EUR/GBP future price levels

– Fed and BoE will Drive EUR/USD and EUR/GBP Price SetupsEuro traders will be looking at the Federal Reserve and the Bank of England this week to help gauge EUR/USD and EUR/GBP future price levels

Read more »

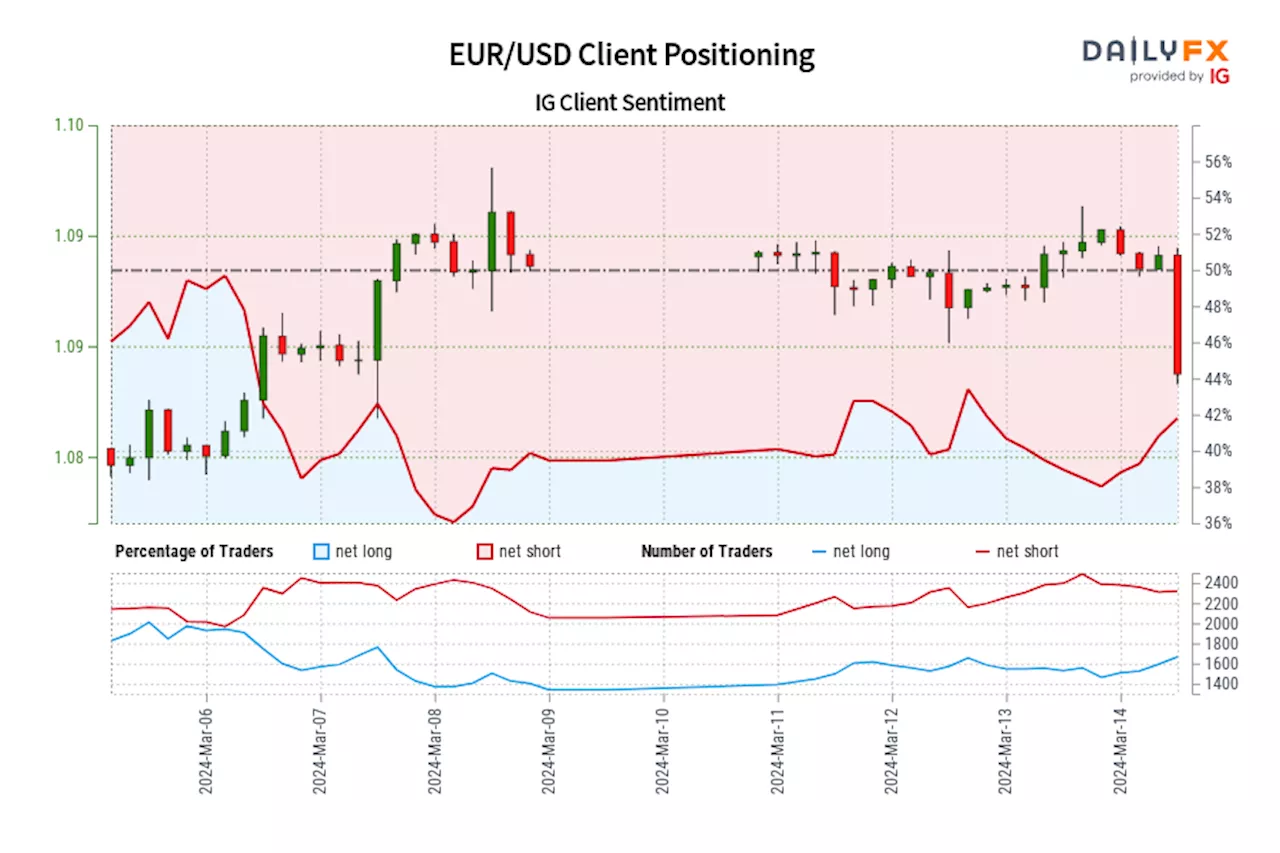

EUR/USD IG Client Sentiment: Our data shows traders are now net-long EUR/USD for the first time since Mar 06, 2024 03:00 GMT when EUR/USD traded near 1.09.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bearish contrarian trading bias.

EUR/USD IG Client Sentiment: Our data shows traders are now net-long EUR/USD for the first time since Mar 06, 2024 03:00 GMT when EUR/USD traded near 1.09.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bearish contrarian trading bias.

Read more »