Looking at the 4-hour chart, the pair struggled to clear the 1.0870 and 1.0880 resistance levels.

Key highlights EUR/USD is struggling to rise above the 1.0880 resistance zone. A major bearish trend line is forming with resistance at 1.0875 on the 4-hour chart. EUR/USD technical analysis A high was formed near 1.0876 and the pair is now stuck near the 100 simple moving average and the 200 simple moving average . On the upside, the pair is facing hurdles near 1.0880. There is also a major bearish trend line forming with resistance at 1.0875 on the same chart.

A clear move above the 1.0880 resistance could send the pair further higher. In the stated case, EUR/USD could rise toward the 1.0950 level. Immediate support is near the 1.0820 level. The next major support is at 1.0785 or the 61.8% Fib retracement level of the upward move from the 1.0725 swing low to the 1.0876 high. If there is a downside break below the 1.0785 support, the pair could decline toward the 1.0750 support. Any more losses might send the pair toward the 1.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

EUR/USD Forecast: Bears looking to test the 1.0700 regionThe EUR/USD pair fell on Monday to 1.0730, its lowest since mid-February.

EUR/USD Forecast: Bears looking to test the 1.0700 regionThe EUR/USD pair fell on Monday to 1.0730, its lowest since mid-February.

Read more »

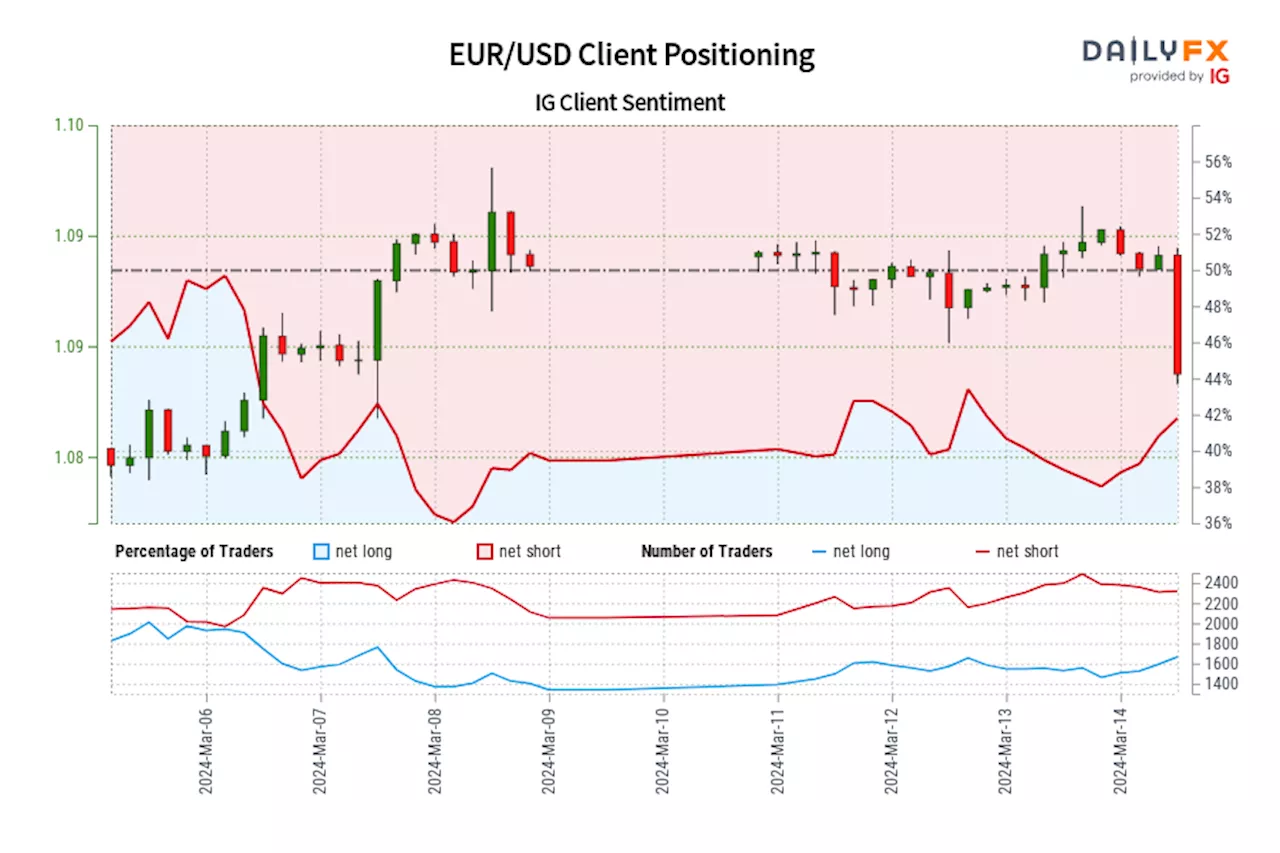

EUR/USD IG Client Sentiment: Our data shows traders are now net-long EUR/USD for the first time since Mar 06, 2024 03:00 GMT when EUR/USD traded near 1.09.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bearish contrarian trading bias.

EUR/USD IG Client Sentiment: Our data shows traders are now net-long EUR/USD for the first time since Mar 06, 2024 03:00 GMT when EUR/USD traded near 1.09.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bearish contrarian trading bias.

Read more »

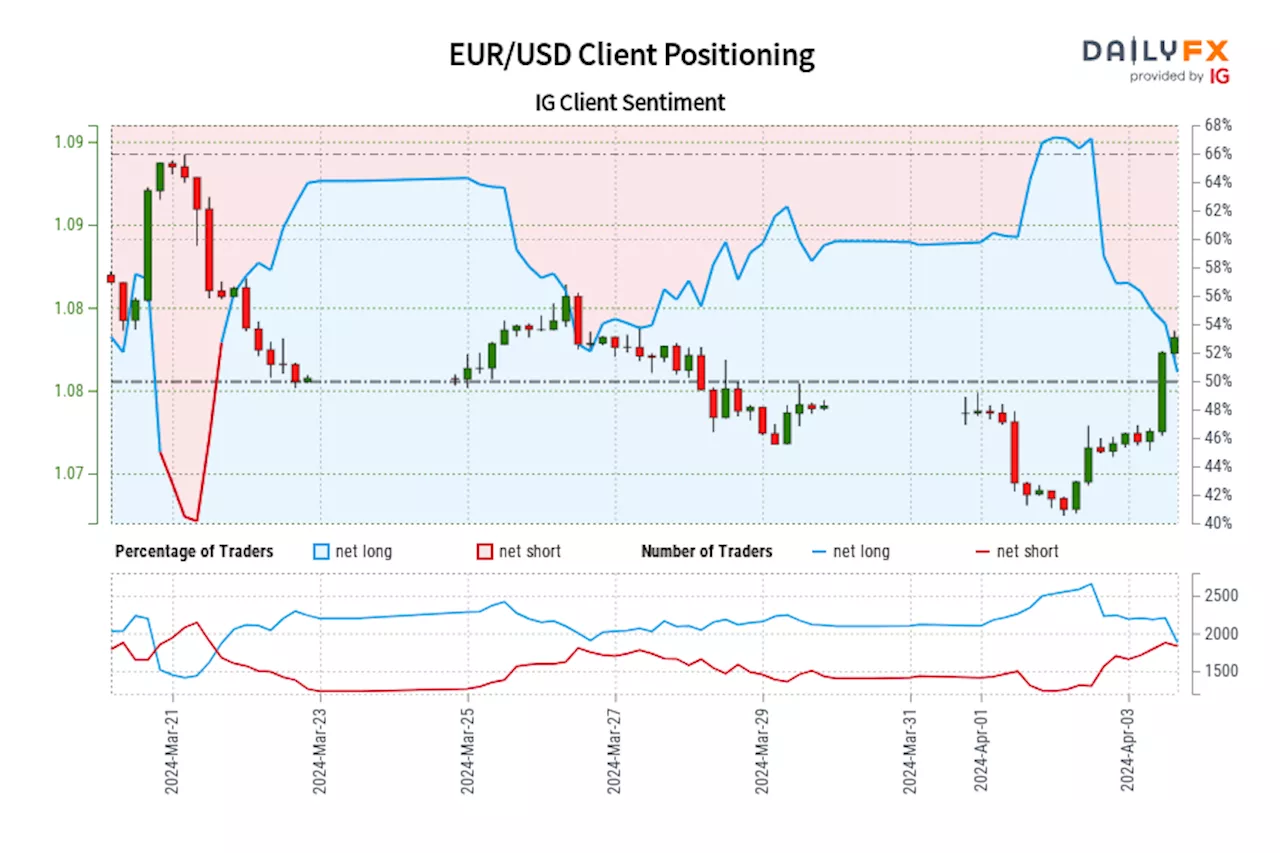

EUR/USD IG Client Sentiment: Our data shows traders are now net-short EUR/USD for the first time since Mar 21, 2024 when EUR/USD traded near 1.09.Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bullish contrarian trading bias.

EUR/USD IG Client Sentiment: Our data shows traders are now net-short EUR/USD for the first time since Mar 21, 2024 when EUR/USD traded near 1.09.Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bullish contrarian trading bias.

Read more »

Fed Sticks to Dovish Policy Roadmap; Setups on Gold, EUR/USD, Nasdaq 100The Fed held borrowing costs unchanged at its March meeting and continued to signal that it would implement three rate cuts this year despite upside inflation risks. This dovish outlook boosted gold prices and the Nasdaq 100.

Fed Sticks to Dovish Policy Roadmap; Setups on Gold, EUR/USD, Nasdaq 100The Fed held borrowing costs unchanged at its March meeting and continued to signal that it would implement three rate cuts this year despite upside inflation risks. This dovish outlook boosted gold prices and the Nasdaq 100.

Read more »

Market Sentiment Analysis & Outlook: Gold, Silver, Oil, S&P 500 and EUR/USDThis article provides an in-depth analysis of market sentiment and retail positioning on several assets, including gold, silver, crude oil, the S&P 500 and EUR/USD.

Market Sentiment Analysis & Outlook: Gold, Silver, Oil, S&P 500 and EUR/USDThis article provides an in-depth analysis of market sentiment and retail positioning on several assets, including gold, silver, crude oil, the S&P 500 and EUR/USD.

Read more »

US Dollar Rallies, EUR/USD Slumps, Gold Continues to Push Ever HigherThe US dollar is trading at a multi-month high after data showed that inflation in the US is creeping higher. Despite higher US Treasury yields, gold continues to eye a fresh record high.

US Dollar Rallies, EUR/USD Slumps, Gold Continues to Push Ever HigherThe US dollar is trading at a multi-month high after data showed that inflation in the US is creeping higher. Despite higher US Treasury yields, gold continues to eye a fresh record high.

Read more »