EUR/JPY advances to over two-week high, around mid-157.00s amid notable JPY supply – by hareshmenghani EURJPY BOJ Inflation ECB Currencies

tion for the second successive day on Tuesday. The momentum lifts spot prices to over a two-week high, around mid-157.00s during the Asian session and is sponsored by the heavily offered tone surrounding the Japanese Yen .

Data released earlier today showed that real wages in Japan fell for a 15th straight month in June and nominal pay growth also slowed, reaffirming expectations that the Bank of Japan will stick to its dovish stance. This, in turn, is seen weighing on the JPY and providing a goodish lift to the EUR/JPY cross. It is worth recalling that the Bank of Japan has emphasised that sustainable pay hikes is a prerequisite to consider exiting easy policies and dismantling its massive monetary stimulus.

Moreover, the BoJ's Summary of Opinions released on Monday revealed that policymakers backed the case for the need to patiently continue with the current monetary easing towards achieving the price stability target. This comes after the Japanese central bank intervened to cool the speed of the rise in the benchmark 10-year Japanese government bond yield, which shot to a fresh nine-year peak last Thursday, and continues to undermine the JPY, though a softer risk tone could help limit losses.

The aforementioned mixed fundamental backdrop makes it prudent to wait for sustained strength and acceptance beyond the 158.00 mark, or the highest level since September 2008 touched last month, before positioning for any further gains. Traders now look to the release of the final German CPI print, which might influence the shared currency. Apart from this, the broader market risk sentiment might contribute to producing short-term trading opportunities around the EUR/JPY cross.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

EUR/JPY Price Analysis: Bulls continue to target 158.00EUR/JPY extends Friday’s small gains and surpasses the key 156.00 hurdle at the beginning of the week. So far, the continuation of the upside momentum

EUR/JPY Price Analysis: Bulls continue to target 158.00EUR/JPY extends Friday’s small gains and surpasses the key 156.00 hurdle at the beginning of the week. So far, the continuation of the upside momentum

Read more »

EUR/JPY Price Analysis: Bulls comfortably consolidate above the 20-day SMA despite weak European dataThe EUR/JPY rises for a second consecutive day, standing above the 156.50 zone. The EUR reported weak Industrial data, which led to a decrease in German bond yields. BoJ’s summary of opinions of July’s meeting hinted at a possible YCC liftoff. At the start of the week, the Euro weakened against most of its rivals on the back of weak industrial data but held gains against the JPY.

EUR/JPY Price Analysis: Bulls comfortably consolidate above the 20-day SMA despite weak European dataThe EUR/JPY rises for a second consecutive day, standing above the 156.50 zone. The EUR reported weak Industrial data, which led to a decrease in German bond yields. BoJ’s summary of opinions of July’s meeting hinted at a possible YCC liftoff. At the start of the week, the Euro weakened against most of its rivals on the back of weak industrial data but held gains against the JPY.

Read more »

Silver Price Analysis: XAG/USD remains depressed around mid-$23.00s, holds above 61.8% Fibo.Silver Price Analysis: XAG/USD remains depressed around mid-$23.00s, holds above 61.8% Fibo. – by hareshmenghani Silver Commodities Technical Analysis XAGUSD Silver

Silver Price Analysis: XAG/USD remains depressed around mid-$23.00s, holds above 61.8% Fibo.Silver Price Analysis: XAG/USD remains depressed around mid-$23.00s, holds above 61.8% Fibo. – by hareshmenghani Silver Commodities Technical Analysis XAGUSD Silver

Read more »

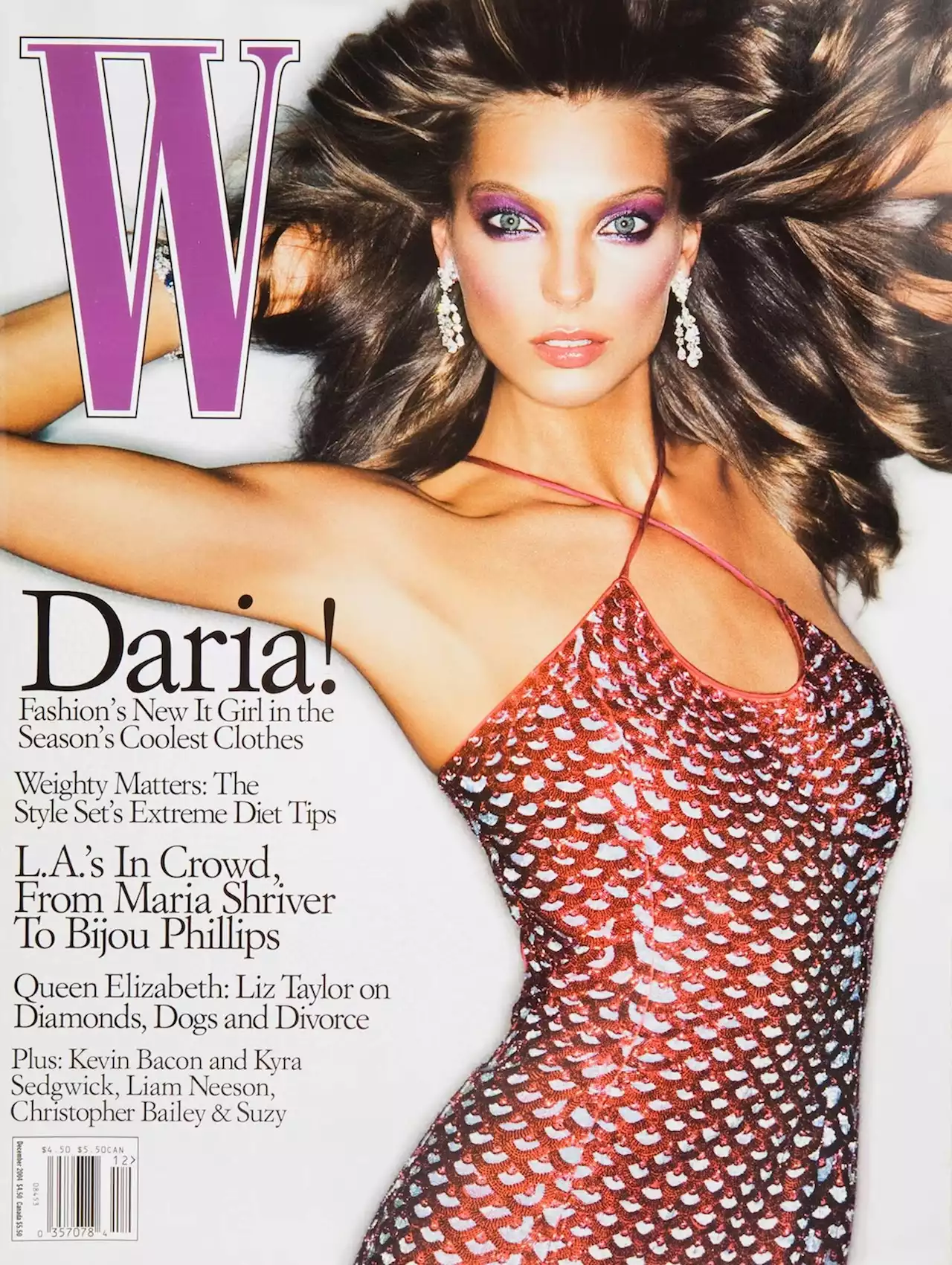

One of the '00s Biggest Supermodels Has Returned After 7 Years of RetirementDaria Werbowy, one of the iconic supermodels of the 2000s, has made a comeback after a 7-year retirement. She has already secured two major fall 2023 fashion items, causing excitement among fashion enthusiasts.

One of the '00s Biggest Supermodels Has Returned After 7 Years of RetirementDaria Werbowy, one of the iconic supermodels of the 2000s, has made a comeback after a 7-year retirement. She has already secured two major fall 2023 fashion items, causing excitement among fashion enthusiasts.

Read more »

USD/JPY now seen extending the range bound trade – UOBUSD/JPY is expected to keep the 140.00-143.30 range for the time being, according to Economist Lee Sue Ann and Markets Strategist Quek Ser Leang at UO

USD/JPY now seen extending the range bound trade – UOBUSD/JPY is expected to keep the 140.00-143.30 range for the time being, according to Economist Lee Sue Ann and Markets Strategist Quek Ser Leang at UO

Read more »

AUD/JPY Price Analysis: Remains on the defensive near 93.50, within a descending trend channelAUD/JPY Price Analysis: Remains on the defensive near 93.50, within a descending trend channel – by lilyfinancial AUDJPY Crosses Technical Analysis

AUD/JPY Price Analysis: Remains on the defensive near 93.50, within a descending trend channelAUD/JPY Price Analysis: Remains on the defensive near 93.50, within a descending trend channel – by lilyfinancial AUDJPY Crosses Technical Analysis

Read more »