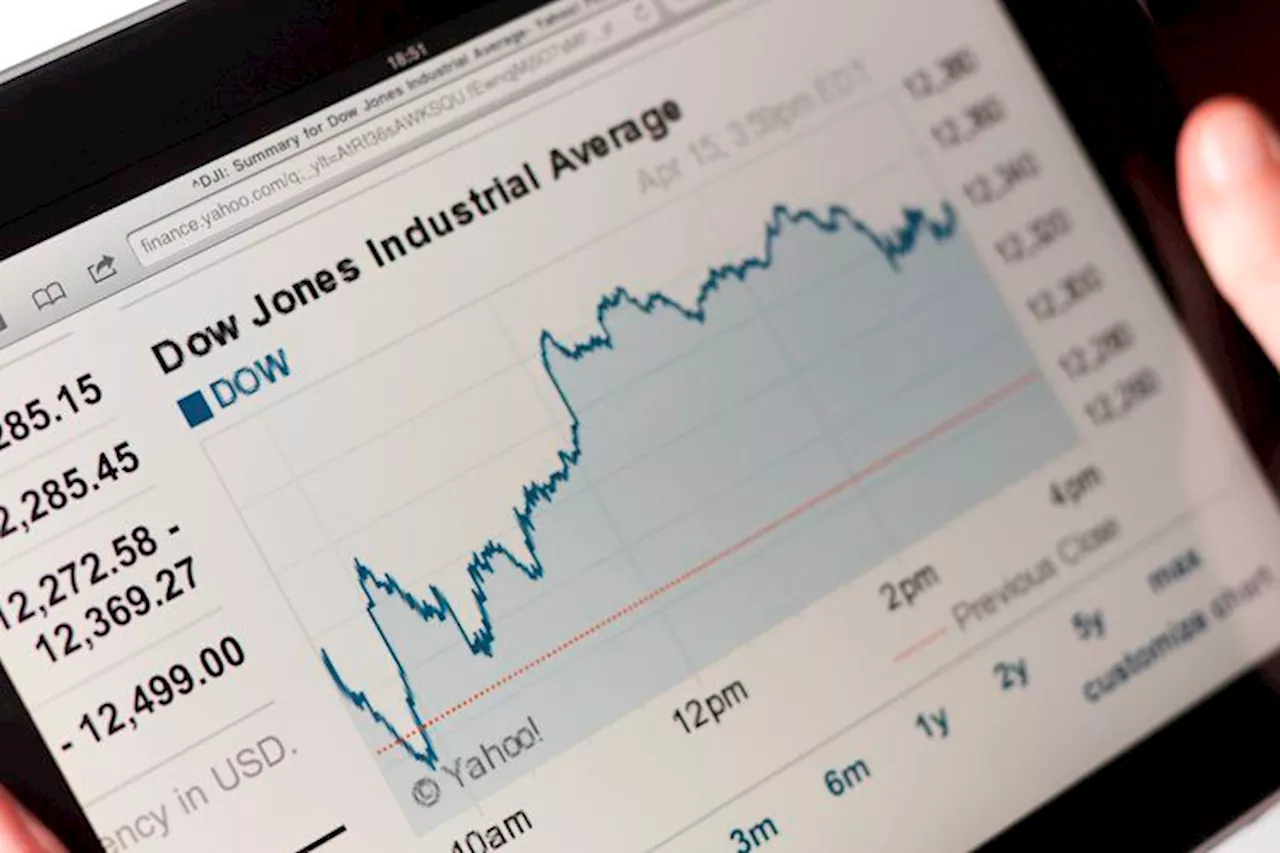

The Dow Jones index has dropped for 9 consecutive days, raising concerns about the stock market. The author discusses possible reasons for the decline, including the murder of United Health Group's CEO and potential policy missteps by the Federal Reserve and the Trump administration. The author also highlights rising inflation concerns and speculates on the effectiveness of Trumpian growth policies in addressing 'Bidenflation'.

Trumpian growth is the supply-side cure to ' Bidenflation ' and that's the subject of the riff. Nobody really knows what drives stocks up – or down – in the short run. That's why I have long been a believer in a buy and hold index fund strategy, i.e. passive investing. Many disagree, and I respect that, but that is still my view. All that said, it is noteworthy that the Dow Jones index has dropped 9 straight days – for the first time since 1978.

Over half of the Dow decline is the function of a 20% drop in United Health Group, following the heinous murder of their insurance CEO Brian Thompson. But aside from the United Health tragedy, roughly two-thirds of the Dow components have fallen during this 9-day selloff – including NVIDIA, which has dropped 11%. Nobody should push the panic button on the stock market. The S&P 500 has been roughly flat during this Dow selloff period, but the Dow drop does give me an opportunity to raise a couple of economic policy issues – that may or may not have anything to do with the selloff. TECH LEADERS BEZOS, ZUCKERBERG, COOK, AND PICHAI LOOK FOR FACE TIME WITH TRUMP Nonetheless... I think the Federal Reserve will be making another mistake – when they drop their target interest rate tomorrow, as is widely expected, and I also worry that the Trump administration and the Republican Congress will delay its tax cut plans. Again, this may or may not have a thing to do with the Dow correction, but, regarding the Fed, an interesting Breitbart News story speculates that some on President Trump's economic team are warning that inflation risks may be underestimated, Jay Powell should be careful with these rate cuts and 'Bidenflation' is not dead. Essentially, the data shows that in the last 6 months or so, various inflation measures have not only stopped falling, but have actually ticked up. CRB commodity prices are up 16% over the past year. Gold and silver prices are up nearly 30% over the past yea

FINANCE POLITICS Stock Market Dow Jones Bidenflation Trumpian Growth Federal Reserve Inflation

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Dow Jones, Nasdaq, S&P 500 weekly preview: December FOMC, slew of economic dataDow Jones, Nasdaq, S&P 500 weekly preview: December FOMC, slew of economic data

Dow Jones, Nasdaq, S&P 500 weekly preview: December FOMC, slew of economic dataDow Jones, Nasdaq, S&P 500 weekly preview: December FOMC, slew of economic data

Read more »

Dow Jones, Nasdaq, S&P 500 weekly preview: December FOMC, slew of economic dataDow Jones, Nasdaq, S&P 500 weekly preview: December FOMC, slew of economic data

Dow Jones, Nasdaq, S&P 500 weekly preview: December FOMC, slew of economic dataDow Jones, Nasdaq, S&P 500 weekly preview: December FOMC, slew of economic data

Read more »

Dow Jones tepid as investors await FedThe Dow Jones Industrial Average (DJIA) continues to churn on the low end of recent chart action, with the major equity index bogged down near 43,800.

Dow Jones tepid as investors await FedThe Dow Jones Industrial Average (DJIA) continues to churn on the low end of recent chart action, with the major equity index bogged down near 43,800.

Read more »

Dow Jones extends losses, sheds another 100 pointsThe Dow Jones Industrial Average (DJIA) softened during a sedate Friday session.

Dow Jones extends losses, sheds another 100 pointsThe Dow Jones Industrial Average (DJIA) softened during a sedate Friday session.

Read more »

Dow Jones Industrial Average treads water after US CPI meets expectationsThe Dow Jones Industrial Average (DJIA) spun in a tight circle on Wednesday, keeping close tabs on the 44,200 level after US Consumer Price Index (CPI) inflation broadly met market expectations.

Dow Jones Industrial Average treads water after US CPI meets expectationsThe Dow Jones Industrial Average (DJIA) spun in a tight circle on Wednesday, keeping close tabs on the 44,200 level after US Consumer Price Index (CPI) inflation broadly met market expectations.

Read more »

Dow Jones adrift after PPI uptickThe Dow Jones Industrial Average (DJIA) held steady on Thursday, drifting into the 44,000 major price handle as investors balked at the latest US Producer Price Index (PPI) inflation figures.

Dow Jones adrift after PPI uptickThe Dow Jones Industrial Average (DJIA) held steady on Thursday, drifting into the 44,000 major price handle as investors balked at the latest US Producer Price Index (PPI) inflation figures.

Read more »