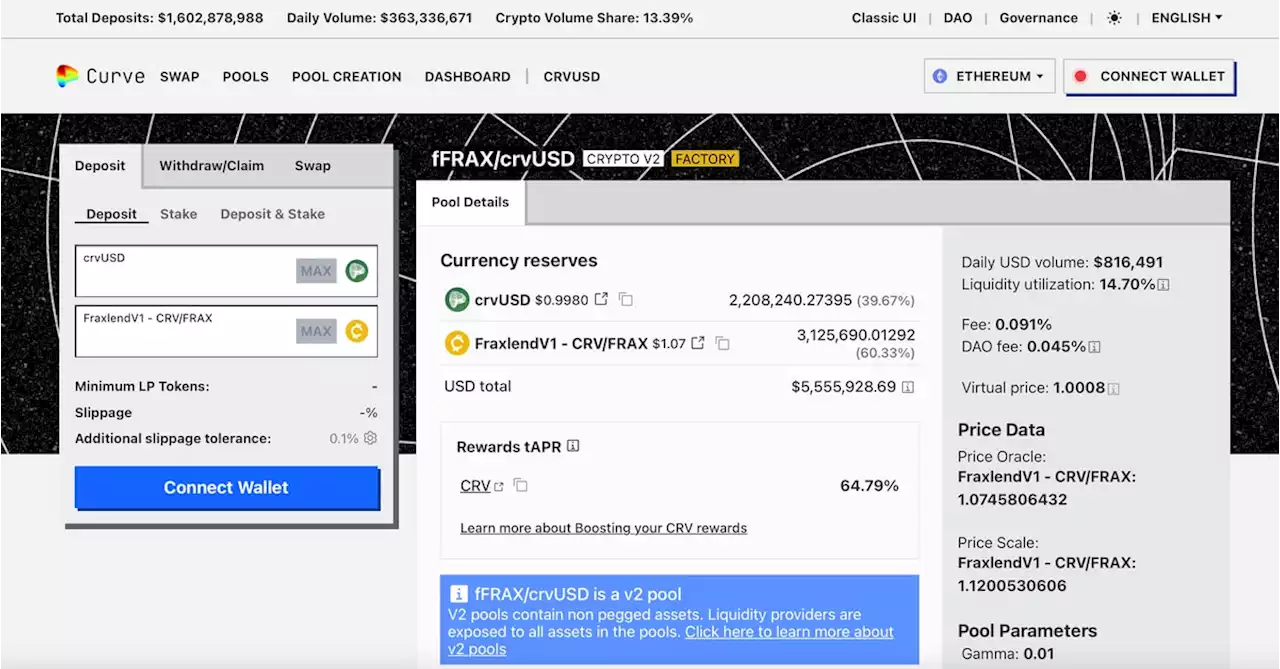

.CurveFinance founder Michael Erogov has deployed a new pool dedicated to bringing more liquidity to Fraxlend's CRV/FRAX market. reports godbole17.

the liquidation of the FRAX loan and Erogov's CRV-backed loan of 63.2 million tether from leading and borrowing marketplace Aave ever since late Sunday's Curve exploit sent CRV tanking.

In other words, the interest rate can become astronomical unless more liquidity flows into the pool, bringing the utilization rate lower,crypto research firm Delphi Digital. In that case, the astronomical interest rate alone could trigger the liquidation of Erogov's FRAX loan, putting additional pressure on the CRV token and increasing the risk of liquidation on the bigger Aave loan.

"He [Erogov] borrowed FRAX using CRV as collateral on Fraxlend. However, because people are withdrawing FRAX from the pool, fearing bad debt in the event of CRV liquidation, the APY has significantly increased," Ignas explained."He now needs more FRAX deposited to that CRV/FRAX lending pool. That's why the introduction of a new pool on Curve, equipped with CRV incentives."

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Curve Finance Exploit Puts $100M+ Worth of Crypto at Risk; CRV Token TumblesMore than $100M-worth of cryptocurrency could be at risk due to a bug impacting Curve, a stablecoin exchange at the center of Ethereum’s DeFi ecosystem.

Curve Finance Exploit Puts $100M+ Worth of Crypto at Risk; CRV Token TumblesMore than $100M-worth of cryptocurrency could be at risk due to a bug impacting Curve, a stablecoin exchange at the center of Ethereum’s DeFi ecosystem.

Read more »

Millions of Curve DAO tokens stolen minutes before a white hat rescue missionMillions of CRV tokens were taken minutes before a white hat mission to protect the funds was set to take place.

Millions of Curve DAO tokens stolen minutes before a white hat rescue missionMillions of CRV tokens were taken minutes before a white hat mission to protect the funds was set to take place.

Read more »

Curve Finance pools exploited in over $24M due to reentrancy vulnerabilitySeveral stable pools on Curve Finance using Vyper were exploited on July 30, with losses reaching $24 million at the time of writing.

Curve Finance pools exploited in over $24M due to reentrancy vulnerabilitySeveral stable pools on Curve Finance using Vyper were exploited on July 30, with losses reaching $24 million at the time of writing.

Read more »

Curve Finance factory pools targeted due to reentrancy vulnerabilityFactory pools on Curve Finance faced a reentrancy vulnerability, a security flaw allowing potential funds drain from interrupted contract calls.

Curve Finance factory pools targeted due to reentrancy vulnerabilityFactory pools on Curve Finance faced a reentrancy vulnerability, a security flaw allowing potential funds drain from interrupted contract calls.

Read more »

A key test for EV sales and the adoption curve is comingGM sold about 36,000 EVs in the first half of 2023. With production set to zoom higher, the new Silverado, Blazer and Equinox models better sell.

A key test for EV sales and the adoption curve is comingGM sold about 36,000 EVs in the first half of 2023. With production set to zoom higher, the new Silverado, Blazer and Equinox models better sell.

Read more »

After surprise tweak, what now for BOJ's yield curve control?The Bank of Japan (BOJ) has tweaked its bond yield control policy and will allow interest rates to rise more freely, action that market participants have interpreted as the start of a slow shift away from decades of massive monetary stimulus.

After surprise tweak, what now for BOJ's yield curve control?The Bank of Japan (BOJ) has tweaked its bond yield control policy and will allow interest rates to rise more freely, action that market participants have interpreted as the start of a slow shift away from decades of massive monetary stimulus.

Read more »