crudeoil markets continue to recover from recent selloff

market rallied, breaking above the $70 level. However, this uptick may just be a temporary bounce from a bear market oversold condition. It's likely that signs of exhaustion will appear soon, and oil prices may drop even further. After all, there is a ton of previous trading action just above, and typically “market memory” will come into the picture and make this difficult to overcome., which sits just above the $75 level. The market has been consolidating between $80 on the upside and $72.

As energy is a key factor in global growth, this market will be sensitive to any changes in the economic outlook. As the global economy slows down, typically you will see a lot less demand, as traders have been pricing into the market for some time.The $70 level had previously served as a hard floor, but as we approach the $77.50 area, which is the bottom of the overall range, we may encounter some market memory that could act as a barrier.To consider buying, we would need to break above the 50-Day EMA, currently near $81.55. However, that doesn't seem very likely.

Because of this, traders will have to pay close attention to the US Dollar Index, and of course, comments coming out of central banks around the world. Earlier today, the Norwegian central bank hiked rates again, and several other central banks around the world are likely to do so as well. This should slow down economic growth, which of course should keep oil stagnant to negative.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Crude Oil Forecast: Continues to Attempt a RecoveryThe West Texas Intermediate (WTI) Crude Oil market experienced modest gains during Wednesday\u0027s trading session.

Crude Oil Forecast: Continues to Attempt a RecoveryThe West Texas Intermediate (WTI) Crude Oil market experienced modest gains during Wednesday\u0027s trading session.

Read more »

Oil dips after Fed comments, US crude stock buildOil prices fell on Thursday following three sessions of gains, after Federal Reserve Chair Jerome Powell highlighted banking sector credit risks for the world's largest economy, while U.S. crude stocks rose more than expected.

Oil dips after Fed comments, US crude stock buildOil prices fell on Thursday following three sessions of gains, after Federal Reserve Chair Jerome Powell highlighted banking sector credit risks for the world's largest economy, while U.S. crude stocks rose more than expected.

Read more »

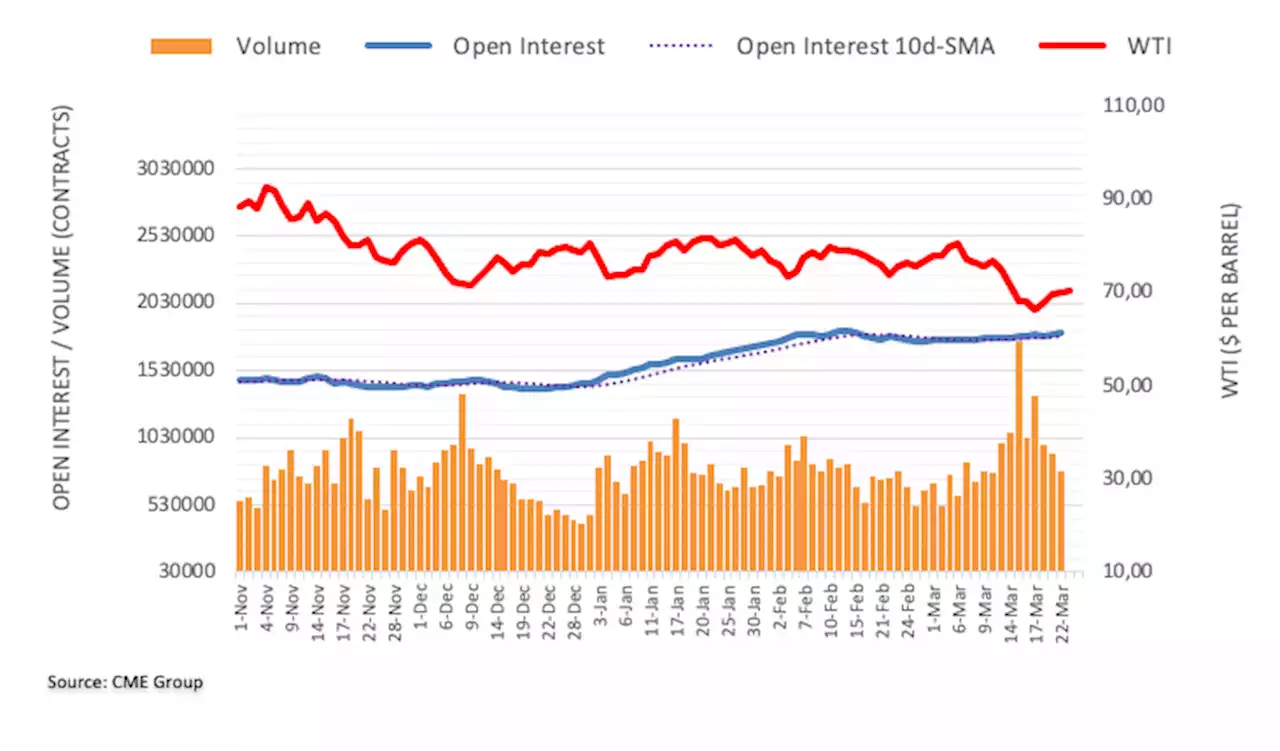

Crude Oil Futures: Scope for extra upsideCME Group’s flash data for crude oil futures markets noted traders increased their open interest positions for the second session in a row on Wednesda

Crude Oil Futures: Scope for extra upsideCME Group’s flash data for crude oil futures markets noted traders increased their open interest positions for the second session in a row on Wednesda

Read more »

Crude Oil Futures: Extra losses appear on the cardsCME Group’s flash data for crude oil futures markets noted traders increased their open interest positions for the third session in a row on Thursday,

Crude Oil Futures: Extra losses appear on the cardsCME Group’s flash data for crude oil futures markets noted traders increased their open interest positions for the third session in a row on Thursday,

Read more »

Gold Price Forecast: XAU/USD back under pressure as markets correct its rate cut expectations – CommerzbankGold price back at $2,000 after Fed meeting. Economists at Commerzbank expect the yellow metal to see renewed downside pressure as the market will be

Gold Price Forecast: XAU/USD back under pressure as markets correct its rate cut expectations – CommerzbankGold price back at $2,000 after Fed meeting. Economists at Commerzbank expect the yellow metal to see renewed downside pressure as the market will be

Read more »

WTI bears in the market on recession fearsWest Texas Intermediate crude oil is lower on Thursday despite risk-on markets that continued to digest the more dovish guidance from the Federal Open

WTI bears in the market on recession fearsWest Texas Intermediate crude oil is lower on Thursday despite risk-on markets that continued to digest the more dovish guidance from the Federal Open

Read more »