From Breakingviews - To bet on China’s shoppers, ditch its companies

struggle with the country’s uneven retail recovery, foreign firms selling popular items like luxury goods and chip equipment to the People’s Republic are rallying. It could be a sign of things to come.

A spending pop in the transport, food and beverage and hospitality sectors helped lift first-quarter GDP to 4.5%. But that data was flattered by comparison to a grim 2022, and April data on imports, inflation and bank loans all. Household time deposits climbed sharply to 92 trillion yuan last month, implying weak consumer confidence.

Quarterly results from China's internet giants paint a gloomy picture. E-commerce company Alibaba and social media and entertainment group Tencent are forecast to report just single-digit percent revenue growth in the three months to March later this week, in no small part because discretionary spending even on relatively affordable categories like apparel, electronics and video games has yet to fully bounce back. Executives at online retailer JD.

recently cautioned that "organic forces driving consumption demand are not yet sufficient." The $57 billion company's New York stock is down a whopping 33% this year; Alibaba and Tencent are trading well below their five-year forward price-to-earnings multiples, per Refinitiv. While Beijing’s crackdowns on domestic technology companies and property developers have eased, other risks are rising. The White House is readying an

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Breakingviews - Newmont’s $19 bln gold deal lacks investor sparkleNewmont boss Tom Palmer has finally dug out a deal with rival Newcrest Mining . After months of discussions the two sides on Sunday agreed to an all-share transaction that values the Australian target’s enterprise at A$28.8 billion ($19.3 bln). Now Palmer has to convince investors the tie-up can really shine.

Breakingviews - Newmont’s $19 bln gold deal lacks investor sparkleNewmont boss Tom Palmer has finally dug out a deal with rival Newcrest Mining . After months of discussions the two sides on Sunday agreed to an all-share transaction that values the Australian target’s enterprise at A$28.8 billion ($19.3 bln). Now Palmer has to convince investors the tie-up can really shine.

Read more »

Breakingviews - Vietnam’s Tesla debuts with wrong kind of powerPham Nhat Vuong is arriving in the United States in so-so 2021 style. Vietnam’s richest man is taking his electric-vehicle company, VinFast, public at a punchy valuation through a merger with casino mogul Lawrence Ho’s special-purpose acquisition company. It values the group at $27 billion and secures it a listing in the U.S. where the money-losing entity wants to sell more vehicles. But it needs funding to grow too, and the inflated deal doesn’t help much.

Breakingviews - Vietnam’s Tesla debuts with wrong kind of powerPham Nhat Vuong is arriving in the United States in so-so 2021 style. Vietnam’s richest man is taking his electric-vehicle company, VinFast, public at a punchy valuation through a merger with casino mogul Lawrence Ho’s special-purpose acquisition company. It values the group at $27 billion and secures it a listing in the U.S. where the money-losing entity wants to sell more vehicles. But it needs funding to grow too, and the inflated deal doesn’t help much.

Read more »

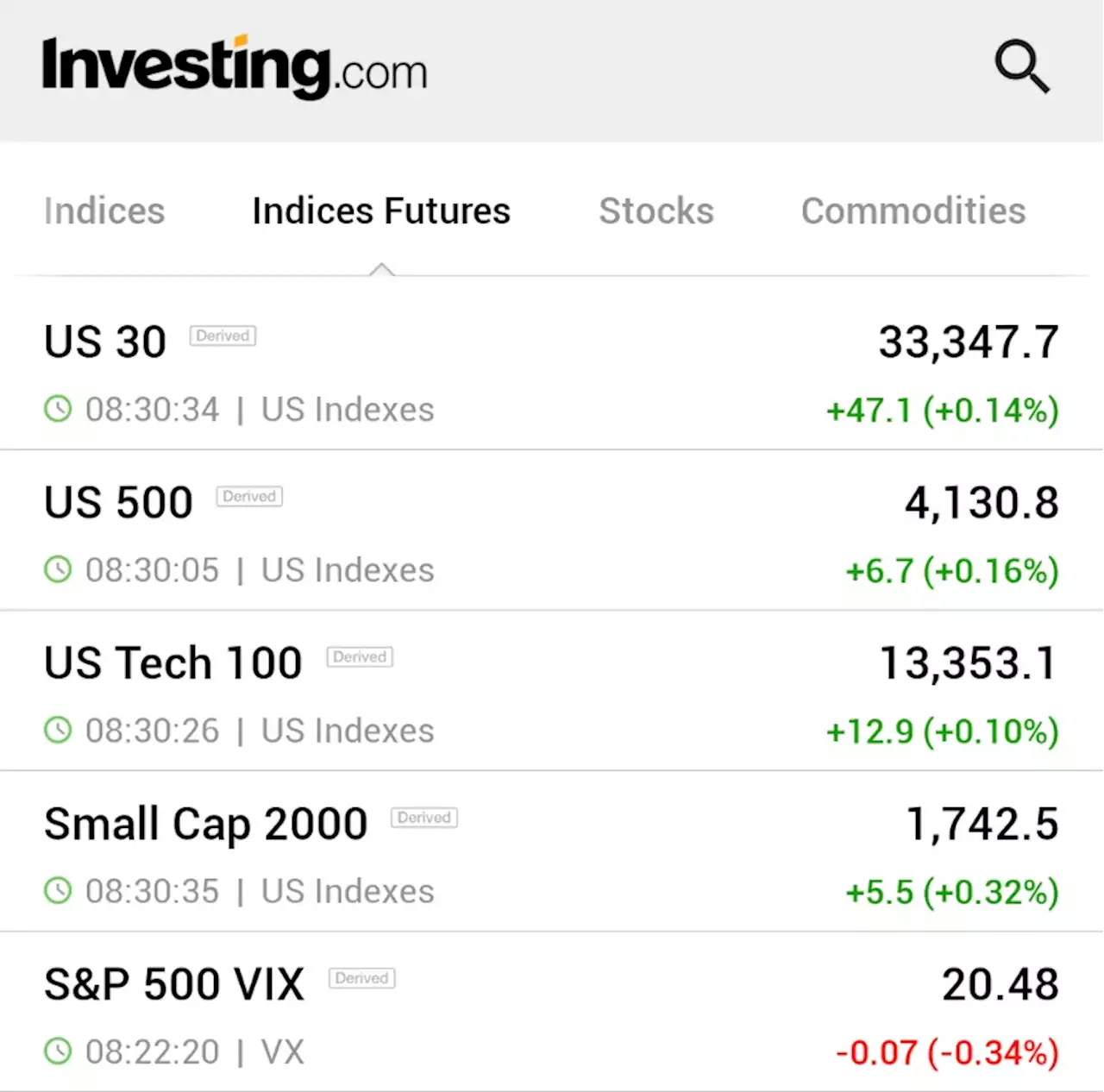

Dow futures trade lower, data heavy week ahead By Investing.com*U.S. STOCK FUTURES INCH HIGHER AS WALL STREET BRACES FOR ANOTHER BUSY WEEK $DIA $SPY $QQQ $IWM $VIX 🇺🇸🇺🇸

Dow futures trade lower, data heavy week ahead By Investing.com*U.S. STOCK FUTURES INCH HIGHER AS WALL STREET BRACES FOR ANOTHER BUSY WEEK $DIA $SPY $QQQ $IWM $VIX 🇺🇸🇺🇸

Read more »

Breakingviews - Rich world has three ways to win over global SouthThe Group of Seven rich countries needs a stronger pitch to non-aligned nations. A strategy based on peace, prosperity and protecting the planet could work. It would certainly be more effective than delivering lectures on democracy.

Breakingviews - Rich world has three ways to win over global SouthThe Group of Seven rich countries needs a stronger pitch to non-aligned nations. A strategy based on peace, prosperity and protecting the planet could work. It would certainly be more effective than delivering lectures on democracy.

Read more »

BIST 100 Index (XU100) - Investing.comGet detailed information on the BIST 100 including charts, technical analysis, components and more.

BIST 100 Index (XU100) - Investing.comGet detailed information on the BIST 100 including charts, technical analysis, components and more.

Read more »

Taylor Swift's financial acumen: avoiding FTX deal, investing in fundsTaylor Swift showed her financial savvy when she avoided a FTX deal. She puts her money in a niche type of fund, an elite investor says.

Read more »