From Breakingviews - Carlsberg CEO’s big job is to keep glass steady

Aarup-Andersen’s lack of consumer experience may also raise eyebrows at Carlsberg. A veteran from a rival brewer might have been better placed to introduce new products, and adapt to new industry trends.

However, the new boss’s finance pedigree and track record managing businesses suggests that his main job will be to implement the group’s current. It aims to increase revenue by 3% to 5% annually until 2027 and boost operating profit growth above that level.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Breakingviews - Goldman’s new strategy gets baptism of fireThe collapse of Silicon Valley Bank is providing a slightly awkward showcase for Goldman Sachs’ manifold talents. The Wall Street firm’s traders bought bonds from the technology-focused lender as its bankers attempted to help plug the resulting hole the sale left in SVB’s balance sheet. And it is in position to scoop up troubled assets elsewhere. It’s true to the new unified “One Goldman Sachs” strategy expounded by Chief Executive David Solomon, dampened by the client not living to tell the tale.

Breakingviews - Goldman’s new strategy gets baptism of fireThe collapse of Silicon Valley Bank is providing a slightly awkward showcase for Goldman Sachs’ manifold talents. The Wall Street firm’s traders bought bonds from the technology-focused lender as its bankers attempted to help plug the resulting hole the sale left in SVB’s balance sheet. And it is in position to scoop up troubled assets elsewhere. It’s true to the new unified “One Goldman Sachs” strategy expounded by Chief Executive David Solomon, dampened by the client not living to tell the tale.

Read more »

Breakingviews - Larry Fink finds way to dodge ESG crosshairsSeismic events elsewhere are making it easier for BlackRock to inch away from the environmental, social and governance crosshairs. The $8 trillion asset manager’s chair Larry Fink used his annual investor letter to theorise that inflation might stay around 4%, predict stricter bank capital requirements, and namecheck his favourite 80’s band, Talk Talk. Less front and centre than in previous years was a preoccupation with climate change.

Breakingviews - Larry Fink finds way to dodge ESG crosshairsSeismic events elsewhere are making it easier for BlackRock to inch away from the environmental, social and governance crosshairs. The $8 trillion asset manager’s chair Larry Fink used his annual investor letter to theorise that inflation might stay around 4%, predict stricter bank capital requirements, and namecheck his favourite 80’s band, Talk Talk. Less front and centre than in previous years was a preoccupation with climate change.

Read more »

Airline stocks slide despite CEOs' upbeat demand outlookPricy vacations have helped revive airline profits in recent months.

Airline stocks slide despite CEOs' upbeat demand outlookPricy vacations have helped revive airline profits in recent months.

Read more »

Breakingviews - SVB proves even smaller banks are too big to failThe too-big-to-fail problem is proving hard to pin down. On Thursday it will be 15 years since Bear Stearns, an investment bank with assets of $400 billion, was rescued from collapse by JPMorgan . The financial crisis which brought about its downfall triggered a years-long global push by regulators to make sure even the biggest lenders could be safely wound down. Yet last weekend U.S. authorities struggled to contain the fallout from the collapse of SVB Financial , a relatively simple institution about half the size of the defunct Wall Street firm. The threshold for “too big” is smaller than many thought.

Breakingviews - SVB proves even smaller banks are too big to failThe too-big-to-fail problem is proving hard to pin down. On Thursday it will be 15 years since Bear Stearns, an investment bank with assets of $400 billion, was rescued from collapse by JPMorgan . The financial crisis which brought about its downfall triggered a years-long global push by regulators to make sure even the biggest lenders could be safely wound down. Yet last weekend U.S. authorities struggled to contain the fallout from the collapse of SVB Financial , a relatively simple institution about half the size of the defunct Wall Street firm. The threshold for “too big” is smaller than many thought.

Read more »

Breakingviews - Kanye West blunder puts Adidas in playAdidas is a vulnerable underdog among sportswear champions. After a disastrous breakup with the musician formerly known as Kanye West, the $28 billion sneaker maker is slashing dividends and heading for the first loss in decades. Boosting marketing spending could deliver success, but it would be a slog. With no easy win, larger rivals may soon come sniffing.

Breakingviews - Kanye West blunder puts Adidas in playAdidas is a vulnerable underdog among sportswear champions. After a disastrous breakup with the musician formerly known as Kanye West, the $28 billion sneaker maker is slashing dividends and heading for the first loss in decades. Boosting marketing spending could deliver success, but it would be a slog. With no easy win, larger rivals may soon come sniffing.

Read more »

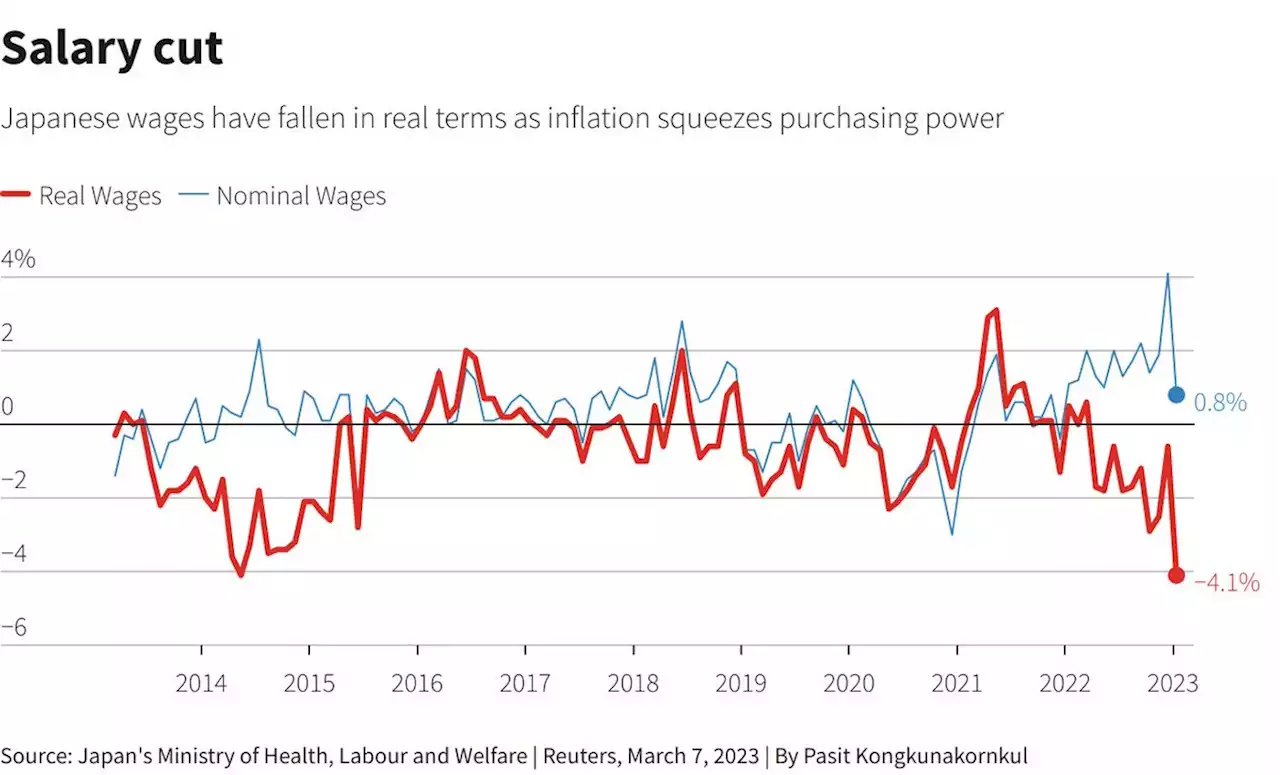

Breakingviews - Bad news salvo gives Bank of Japan some coverIncoming Bank of Japan Governor Kazuo Ueda can breathe a sigh of relief; things aren’t going very well. The conclusion of annual wage negotiations between major industrial unions and employers resulted in average salary rises of around 3%, the highest since 1997 but still slower than consumer prices. Ripples from the collapse of Silicon Valley Bank have shoved down sovereign bond yields, inadvertently driving off an attack by traders who believed global inflation made rate hikes unavoidable. Avoidable is now the precise word.

Breakingviews - Bad news salvo gives Bank of Japan some coverIncoming Bank of Japan Governor Kazuo Ueda can breathe a sigh of relief; things aren’t going very well. The conclusion of annual wage negotiations between major industrial unions and employers resulted in average salary rises of around 3%, the highest since 1997 but still slower than consumer prices. Ripples from the collapse of Silicon Valley Bank have shoved down sovereign bond yields, inadvertently driving off an attack by traders who believed global inflation made rate hikes unavoidable. Avoidable is now the precise word.

Read more »