The average rate on a 30-year mortgage in the U.S. edged closer to 6% this week and is now at its lowest level since early February 2023. The rate fell to 6.09% from 6.20% last week, mortgage buyer Freddie Mac said Thursday. A year ago, the rate averaged 7.19%. The last time the average rate was this low was on February 2, 2023.

A for sale sign stands outside a home on the market in the Alamo Placita neighborhood Tuesday, Aug. 27, 2024, in central Denver. The average rate on a 30-year mortgage in the U.S. edged closer to 6% this week to its lowest level since early February 2023.

The rate fell to 6.09% from 6.20% last week, mortgage buyer Freddie Mac said Thursday. A year ago, the rate averaged 7.19%.Borrowing costs on 15-year fixed-rate mortgages, popular with homeowners seeking to refinance their home loan to a lower rate, also eased this week. The average rate fell to 5.15% from 5.27% last week. A year ago, it averaged 6.54%, Freddie Mac said.

Mortgage rates are influenced by several factors, including how the bond market reacts to the Fed’s interest rate policy decisions. That can move the trajectory of the 10-year Treasury yield, which lenders use as a guide to pricing home loans.for the first time in more than four years. Fed officials also signaled they expect further cuts this year and in 2025 and 2026. The rate cuts should, over time, lead to lower borrowing costs on mortgages.

The latest pullback in rates should help spur demand for refinancing and home purchase loans, said Sam Khater, Freddie Mac’s chief economist. “While mortgage rates do not directly follow moves by the Federal Reserve, this first cut in over four years will have an impact on the housing market,” Khater said. “Declining mortgage rates over the last several weeks indicate this cut was mostly baked in, but we expect rates to fall further, sparking more housing activity.”

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Average rate on a 30-year mortgage falls to 6.20%, its lowest level since February 2023The average rate on a 30-year mortgage in the U.S. fell this week to its lowest level in 19 months, reflecting a pullback in Treasury yields ahead of an expected interest rate cut from the Federal Reserve next week.

Average rate on a 30-year mortgage falls to 6.20%, its lowest level since February 2023The average rate on a 30-year mortgage in the U.S. fell this week to its lowest level in 19 months, reflecting a pullback in Treasury yields ahead of an expected interest rate cut from the Federal Reserve next week.

Read more »

Average rate on a 30-year mortgage falls to 6.20%, its lowest level since February 2023The average rate on a 30-year mortgage in the U.S. fell this week to its lowest level in 19 months, reflecting a pullback in Treasury yields ahead of an expected interest rate cut from the Federal Reserve next week

Average rate on a 30-year mortgage falls to 6.20%, its lowest level since February 2023The average rate on a 30-year mortgage in the U.S. fell this week to its lowest level in 19 months, reflecting a pullback in Treasury yields ahead of an expected interest rate cut from the Federal Reserve next week

Read more »

Mortgage rates hit lowest level since February 2023Mortgage rates fell for the sixth straight week last week, but mortgage demand still seems to be waiting for something bigger.

Mortgage rates hit lowest level since February 2023Mortgage rates fell for the sixth straight week last week, but mortgage demand still seems to be waiting for something bigger.

Read more »

Mortgage rates hit lowest level since February 2023Mortgage rates fell for the sixth straight week last week, but mortgage demand still seems to be waiting for something bigger.

Mortgage rates hit lowest level since February 2023Mortgage rates fell for the sixth straight week last week, but mortgage demand still seems to be waiting for something bigger.

Read more »

Average rate on a 30-year mortgage falls to 6.20%, its lowest level since February 2023The average rate on a 30-year mortgage in the U.S. fell this week to its lowest level in 19 months, reflecting a pullback in Treasury yields ahead of an expected interest rate cut from the Federal Reserve next week. The rate fell to 6.20% from 6.35% last week, mortgage buyer Freddie Mac said Thursday. A year ago, the rate averaged 7.18%.

Average rate on a 30-year mortgage falls to 6.20%, its lowest level since February 2023The average rate on a 30-year mortgage in the U.S. fell this week to its lowest level in 19 months, reflecting a pullback in Treasury yields ahead of an expected interest rate cut from the Federal Reserve next week. The rate fell to 6.20% from 6.35% last week, mortgage buyer Freddie Mac said Thursday. A year ago, the rate averaged 7.18%.

Read more »

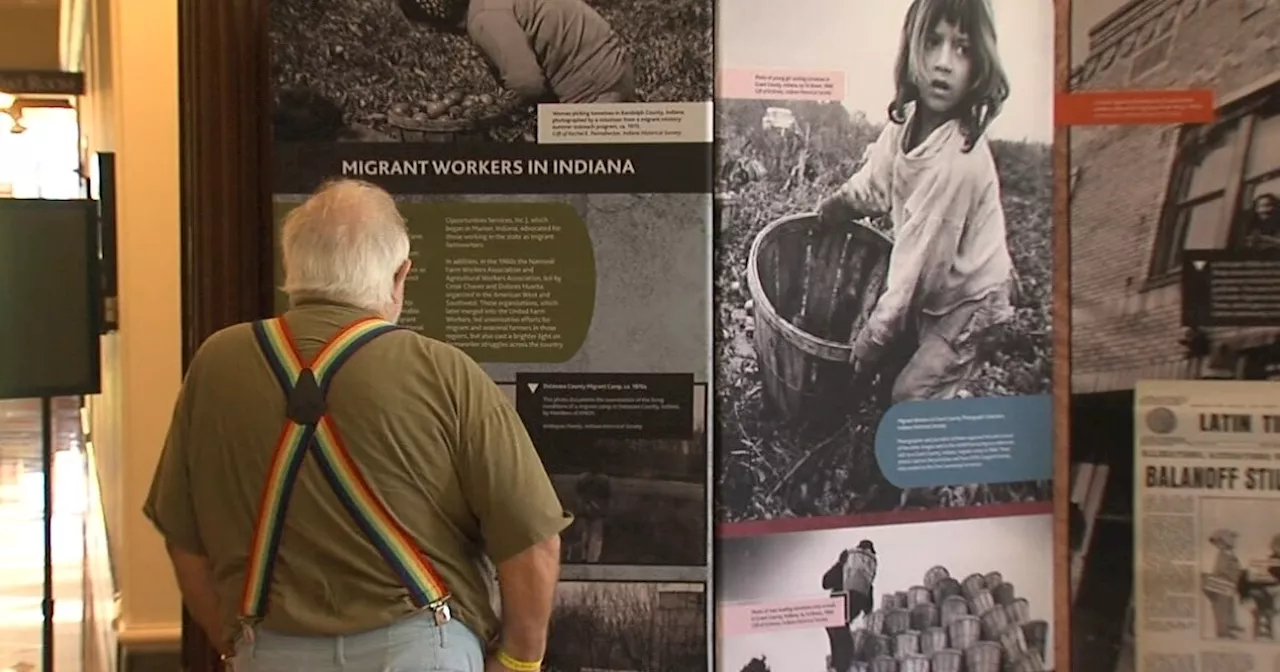

Indiana Historical Society kicks off National Hispanic Heritage MonthAshlyn Wright joined WRTV as a digital content producer in February 2023.

Indiana Historical Society kicks off National Hispanic Heritage MonthAshlyn Wright joined WRTV as a digital content producer in February 2023.

Read more »