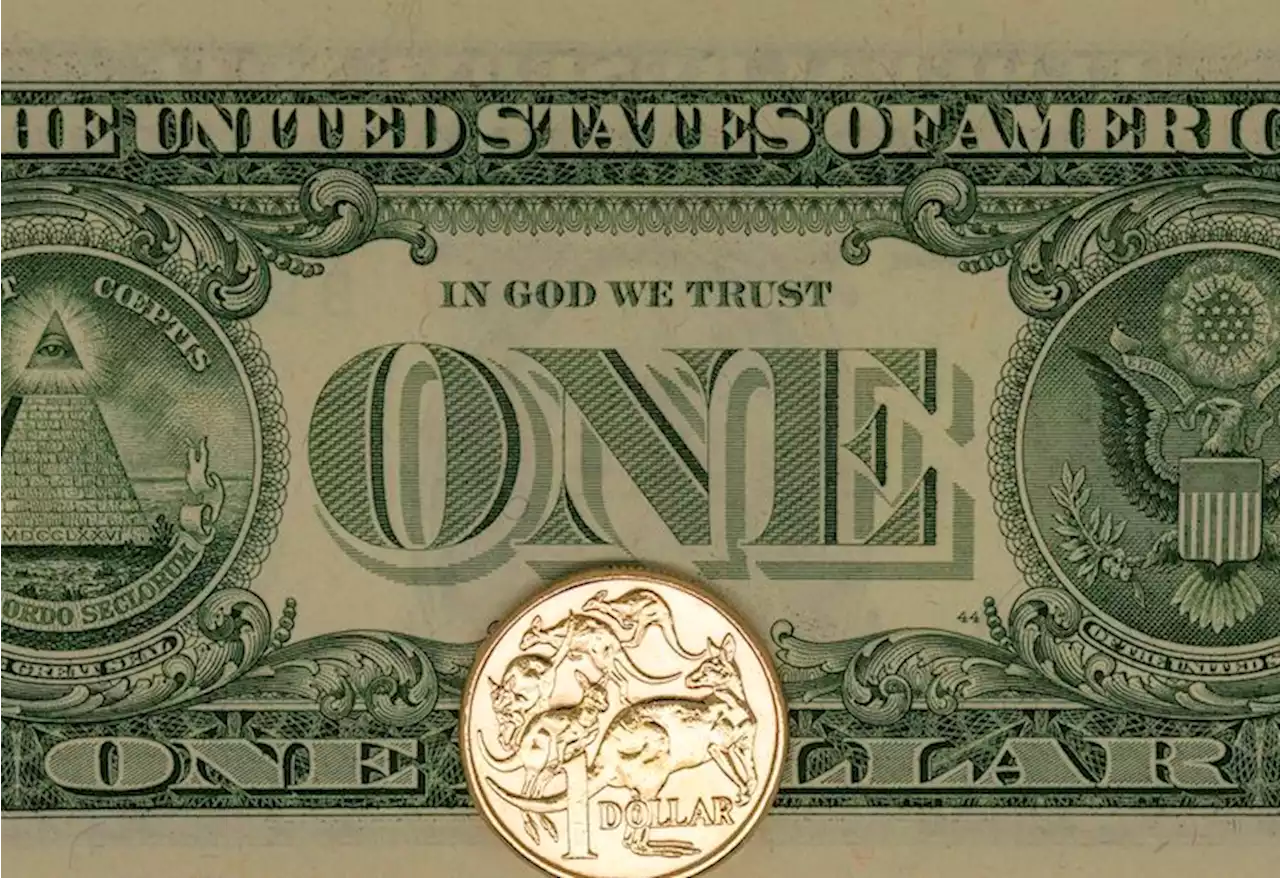

AUD/USD fades corrective bounce near 0.6550 as China inflation flags mixed signals – by anilpanchal7 AUDUSD China Inflation RiskAversion Currencies

China CPI slumps to -0.3% YoY, PPI improves to -4.4% YoY for July.

remains sidelined near the intraday high surrounding 0.6550 as China inflation data flashes mixed signals during early Wednesday. In doing so, the Aussie pair defends the late Tuesday’s corrective bounce off the lowest levels in two months as the market stabilizes after a volatile day.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

AUD/USD corrects to near two-month low around 0.6500 ahead of US/China CPI dataThe AUD/USD pair witnesses a sharp correction amid strength in the US Dollar Index (DXY) and a weakness in China’s business with other nations. The AUD/USD cracks swiftly to near a two-month low around 0.6500 amid strength in the US Dollar and China’s bleak economic growth. US annualized headline inflation is expected to bounce back to 3.3% vs. the former release of 3.0%. The Chinese economy struggles to push inflation higher due to weak domestic demand and vulnerable exports.

AUD/USD corrects to near two-month low around 0.6500 ahead of US/China CPI dataThe AUD/USD pair witnesses a sharp correction amid strength in the US Dollar Index (DXY) and a weakness in China’s business with other nations. The AUD/USD cracks swiftly to near a two-month low around 0.6500 amid strength in the US Dollar and China’s bleak economic growth. US annualized headline inflation is expected to bounce back to 3.3% vs. the former release of 3.0%. The Chinese economy struggles to push inflation higher due to weak domestic demand and vulnerable exports.

Read more »

AUD/USD Snaps Three-Day Winning Streak as Bears Eye 0.6500 on Mixed Australia/China DataThe AUD/USD currency pair experiences its first daily loss in four days, dropping towards 0.6500. The US Dollar remains strong, while China's Trade Balance exceeds expectations. However, Imports and Exports show declines compared to previous readings and market forecasts.

AUD/USD Snaps Three-Day Winning Streak as Bears Eye 0.6500 on Mixed Australia/China DataThe AUD/USD currency pair experiences its first daily loss in four days, dropping towards 0.6500. The US Dollar remains strong, while China's Trade Balance exceeds expectations. However, Imports and Exports show declines compared to previous readings and market forecasts.

Read more »

AUD/USD stays pressured towards 0.6500 as economic woes join fears of China deflationAUD/USD justifies its risk barometer status by being depressed at the lowest level in two months, fading corrective bounce off the multi-day bottom. Mixed Aussie data contrasted with downbeat China trade numbers, Country Garden’s missing payment to lure bears. Moody’s, Fitch and Italy offer challenges for majors from three sides and weigh on sentiment, as well as Aussie price.

AUD/USD stays pressured towards 0.6500 as economic woes join fears of China deflationAUD/USD justifies its risk barometer status by being depressed at the lowest level in two months, fading corrective bounce off the multi-day bottom. Mixed Aussie data contrasted with downbeat China trade numbers, Country Garden’s missing payment to lure bears. Moody’s, Fitch and Italy offer challenges for majors from three sides and weigh on sentiment, as well as Aussie price.

Read more »

AUD/USD posts modest gains around the 0.6570 mark, Australia/US inflation eyedThe AUD/USD pair kicks off the new week on a positive note and gains traction near 0.6575 during the Asian session on Monday. The uptick in the Aussie

AUD/USD posts modest gains around the 0.6570 mark, Australia/US inflation eyedThe AUD/USD pair kicks off the new week on a positive note and gains traction near 0.6575 during the Asian session on Monday. The uptick in the Aussie

Read more »

AUD/USD: Dwindling bets for a deeper pullback – UOBIn the view of Economist Lee Sue Ann and Markets Strategist Quek Ser Leang at UOB Group, the prospects for further decline in AUD/USD seems to be losi

AUD/USD: Dwindling bets for a deeper pullback – UOBIn the view of Economist Lee Sue Ann and Markets Strategist Quek Ser Leang at UOB Group, the prospects for further decline in AUD/USD seems to be losi

Read more »

AUD/USD Forecast: Long Position in Market Less AppealingAs an expert in the financial trading space, I am observing the market for signs of exhaustion that could potentially trigger a bearish move in the AUD

AUD/USD Forecast: Long Position in Market Less AppealingAs an expert in the financial trading space, I am observing the market for signs of exhaustion that could potentially trigger a bearish move in the AUD

Read more »