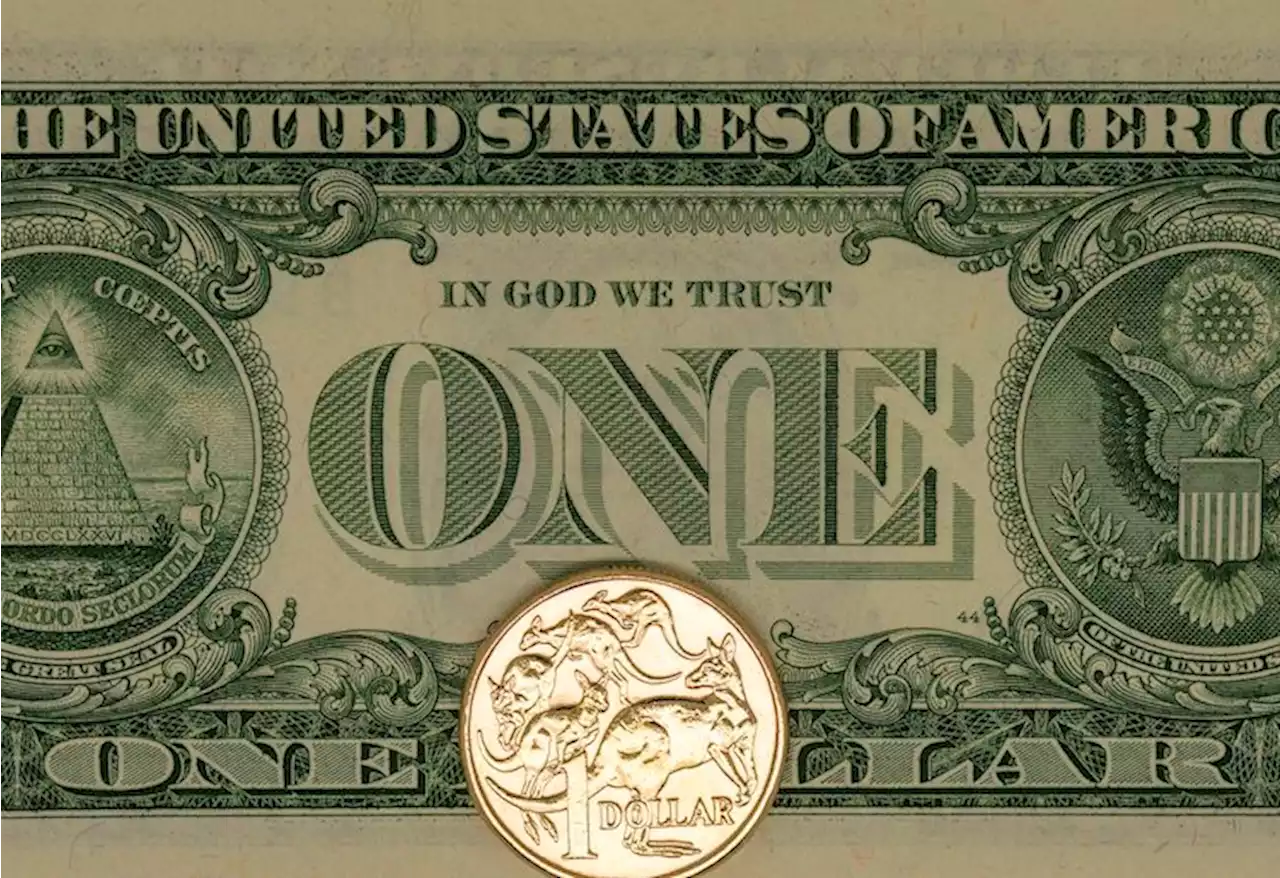

AUD/USD eases from daily high after stronger US PCE Price Index, holds above 0.6500 – by hareshmenghani AUDUSD Inflation Fed Bonds Currencies

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

AUD/USD Price Analysis: Bears keep the reins near 0.6500 ahead of Aussie Retail SalesAUD/USD Price Analysis: Bears keep the reins near 0.6500 ahead of Aussie Retail Sales AUDUSD Technical Analysis RetailSales ChartPatterns SupportResistance

AUD/USD Price Analysis: Bears keep the reins near 0.6500 ahead of Aussie Retail SalesAUD/USD Price Analysis: Bears keep the reins near 0.6500 ahead of Aussie Retail Sales AUDUSD Technical Analysis RetailSales ChartPatterns SupportResistance

Read more »

GBP/USD clings to gains above 1.2350, lacks follow-through ahead of US PCE Price IndexThe GBP/USD pair gains some positive traction on Friday and snaps a three-day losing streak to the 1.2300 neighbourhood, or its lowest level since ear

GBP/USD clings to gains above 1.2350, lacks follow-through ahead of US PCE Price IndexThe GBP/USD pair gains some positive traction on Friday and snaps a three-day losing streak to the 1.2300 neighbourhood, or its lowest level since ear

Read more »

AUD/USD sticks to modest recovery gains around 0.6525-30 area ahead of US PCE Price IndexAUD/USD sticks to modest recovery gains around 0.6525-30 area ahead of US PCE Price Index – by hareshmenghani AUDUSD Fed Inflation Recession Currencies

AUD/USD sticks to modest recovery gains around 0.6525-30 area ahead of US PCE Price IndexAUD/USD sticks to modest recovery gains around 0.6525-30 area ahead of US PCE Price Index – by hareshmenghani AUDUSD Fed Inflation Recession Currencies

Read more »

AUD/USD persists near the lows of the year post-RBNZ hike, dovish US FOMC minutesAUD/USD prolonged its fall after hitting a new year-to-date (YTD) low of 0.6529. It remains under downward pressure as the Federal Reserve Open Market

AUD/USD persists near the lows of the year post-RBNZ hike, dovish US FOMC minutesAUD/USD prolonged its fall after hitting a new year-to-date (YTD) low of 0.6529. It remains under downward pressure as the Federal Reserve Open Market

Read more »

AUD/USD finds a cushion around 0.6500 ahead of Australian Retail Sales and US DurablesThe AUD/USD pair has found an intermediate cushion near the round-level support of 0.6500 in the early Asian session. The Aussie asset has registered

AUD/USD finds a cushion around 0.6500 ahead of Australian Retail Sales and US DurablesThe AUD/USD pair has found an intermediate cushion near the round-level support of 0.6500 in the early Asian session. The Aussie asset has registered

Read more »

When is Australia Retail Sales and how could it affect AUD/USD?Early Friday, around 01:30 AM GMT, the market sees preliminary readings of Australia's seasonally adjusted Retail Sales for April month. Market consen

When is Australia Retail Sales and how could it affect AUD/USD?Early Friday, around 01:30 AM GMT, the market sees preliminary readings of Australia's seasonally adjusted Retail Sales for April month. Market consen

Read more »