Analysis-Bond markets face a reckoning after stellar summer run

- Government bond markets, which have enjoyed a summer of solid price gains, now face a reckoning with their bets for speedy central bank rate cuts and slowing inflation, not to mention a tight U.S. presidential election.

Government bonds returned just 4% globally last year after 15% losses across 2021-22, and have returned 1.3% year-to-date."We have many indicators showing that the economy is not falling into a recession. We are just in a soft landing," said Guillaume Rigeade, co-head of fixed income at Carmignac. Economists polled by Reuters also expect roughly one move fewer than traders anticipate from the ECB and the Fed this year.

Bond markets have also been supported by easing inflation. Market gauges of inflation expectations recently fell to their lowest level in more than three years in the U.S. and their lowest in nearly two years in the euro zone. "Whatever the outcome will be, it will result in still high fiscal spending and large bond supply of U.S. Treasuries," said Capital Group investment director Flavio Carpenzano.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

'Ghost' license plates cost NYC $200M a year — fueled by 'James Bond-level' gadgets: new analysisScofflaw drivers with ‘ghost’ license plates are using “James Bond-level” gadgets to whiz through tolls

'Ghost' license plates cost NYC $200M a year — fueled by 'James Bond-level' gadgets: new analysisScofflaw drivers with ‘ghost’ license plates are using “James Bond-level” gadgets to whiz through tolls

Read more »

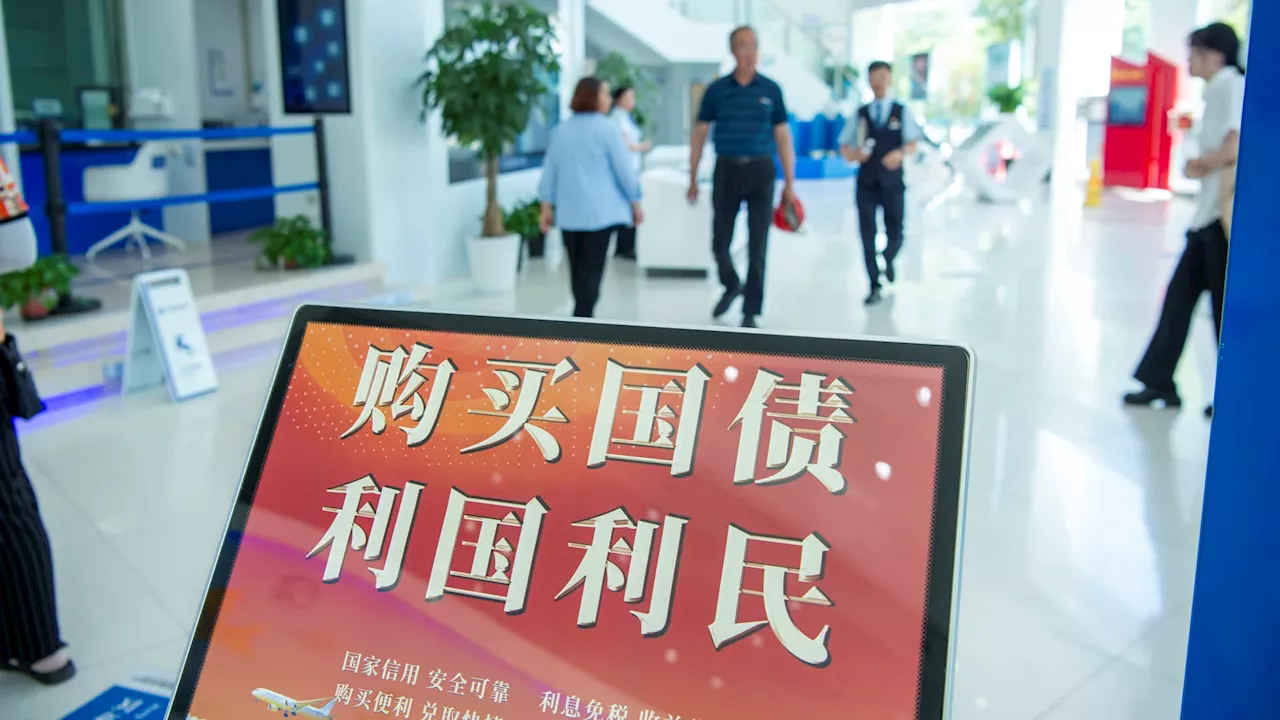

China's bond market rattled as central bank squares off with bond bullsChina's bond market rattled as central bank squares off with bond bulls

China's bond market rattled as central bank squares off with bond bullsChina's bond market rattled as central bank squares off with bond bulls

Read more »

China's bond market is rattled as central bank squares off with bond bullsChina's bond market is on the edge following disruptions as the central bank started intervening heavily to stem a plunge in yields despite a struggling economy.

China's bond market is rattled as central bank squares off with bond bullsChina's bond market is on the edge following disruptions as the central bank started intervening heavily to stem a plunge in yields despite a struggling economy.

Read more »

Bond Market Momentum Firmly Bullish With All Eyes on Powell's Jackson Hole AddressBonds Analysis by James Picerno covering: iShares iBoxx $ Investment Grade Corporate Bond ETF, SPDR® Bloomberg High Yield Bond ETF, Vanguard Total Bond Market Index Fund ETF Shares, iShares 7-10 Year Treasury Bond ETF. Read James Picerno's latest article on Investing.

Bond Market Momentum Firmly Bullish With All Eyes on Powell's Jackson Hole AddressBonds Analysis by James Picerno covering: iShares iBoxx $ Investment Grade Corporate Bond ETF, SPDR® Bloomberg High Yield Bond ETF, Vanguard Total Bond Market Index Fund ETF Shares, iShares 7-10 Year Treasury Bond ETF. Read James Picerno's latest article on Investing.

Read more »

Bonds Continue to Post Gains as September Rate Cuts Get Priced InBonds Analysis by James Picerno covering: iShares 7-10 Year Treasury Bond ETF, SPDR® Bloomberg High Yield Bond ETF, Vanguard Total Bond Market Index Fund ETF Shares. Read James Picerno's latest article on Investing.com

Bonds Continue to Post Gains as September Rate Cuts Get Priced InBonds Analysis by James Picerno covering: iShares 7-10 Year Treasury Bond ETF, SPDR® Bloomberg High Yield Bond ETF, Vanguard Total Bond Market Index Fund ETF Shares. Read James Picerno's latest article on Investing.com

Read more »

Selloff in Junk Bonds Could Signal Trouble Ahead for StocksBonds Analysis by Michele Schneider covering: iShares iBoxx $ High Yield Corporate Bond ETF, iShares 20+ Year Treasury Bond ETF, Quadratic Interest Rate Volatility and Inflation Hedge ETF New. Read Michele Schneider's latest article on Investing.com

Selloff in Junk Bonds Could Signal Trouble Ahead for StocksBonds Analysis by Michele Schneider covering: iShares iBoxx $ High Yield Corporate Bond ETF, iShares 20+ Year Treasury Bond ETF, Quadratic Interest Rate Volatility and Inflation Hedge ETF New. Read Michele Schneider's latest article on Investing.com

Read more »