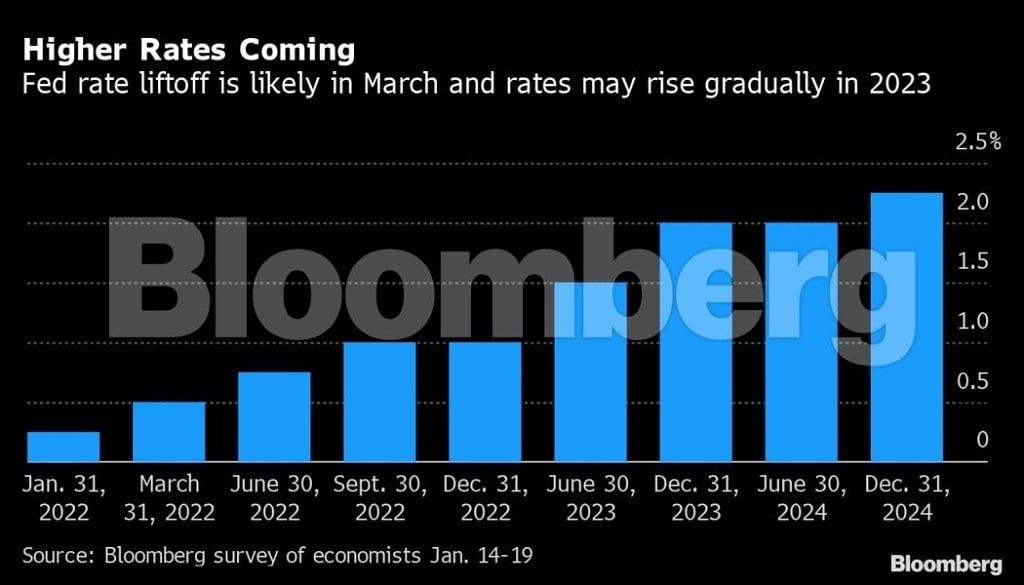

- The US Federal Reserve Bank may hike rates at every policy meeting from March, according to Goldman Sachs economists.

- US rates are near zero but there are inflationary pressures and officials may have to act.

- Closer to home, South Africa in December 2021 recorded it's highest annual inflation rate since March 2017.

Goldman Sachs Group economists said they see a risk the Federal Reserve will tighten monetary policy at every policy meeting from March, a more aggressive approach than the Wall Street bank currently anticipates.

The Goldman Sachs economists led by Jan Hatzius said in a weekend report to clients that they currently expect interest-rate hikes in March, June, September and December and for the central bank to announce the start of a reduction in its balance sheet in July.

But they said inflation pressures mean that the "risks are tilted somewhat to the upside of our baseline," and there is a chance officials will act "at every meeting until the inflation picture changes."

"This raises the possibility of an additional hike or an earlier balance sheet announcement in May, and of more than four hikes this year," the economists said. "We could imagine a number of potential triggers for a shift to rate hikes at consecutive meetings."

Chair Jerome Powell and colleagues meet this week amid expectations they will signal a willingness to lift rates from near zero in March.

Among potential spurs for even tighter policy would be a further increase in long-term inflation expectations or another surprise on inflation, the Goldman Sachs economists said.

They noted they had already been made more concerned about the inflation outlook by the arrival of the omicron variant and continued strength in wage growth.

Recently, South Africa recorded its highest inflation rate since 2017. According to Stats SA, December 2021 annual consumer price inflation hit 5.9%, the highest since March 2017's rate of 6.1%, Fin24 previously reported.

Several economists expect the South African Reserve Bank's Monetary Policy Committee (MPC) to hike the repo rate by 25 basis points to 4%, after its meeting this week. The repo rate is currently at 3.75%, the MPC had raised rates by 25 basis points at its last meeting in November.

Additional reporting by Fin24.

Publications

Publications

Partners

Partners