The Monetary Policy Committee (MPC) has decided to hold rates unchanged at 3.5% and the interest rate at 7%, with effect from January 22.

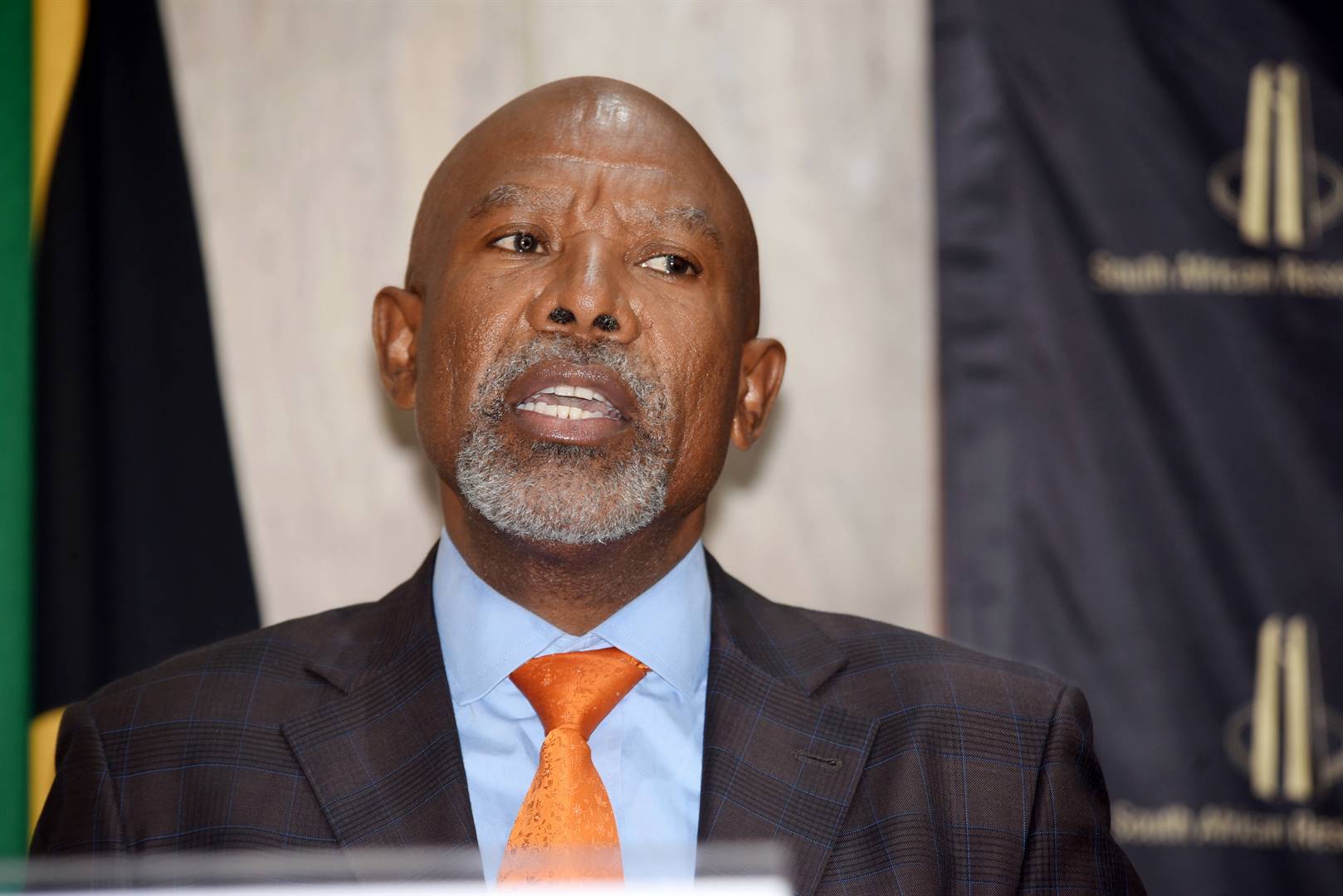

SA Reserve Bank governor Lesetja Kganyago told South Africans that two members of the committee preferred a 25-basis point cut and three preferred to hold rates at the current level.

The Reserve Bank’s decision is in line with market expectations, although some analysts say market conditions were ripe for further loosening.

Kganyago said the overall risks to the inflation outlook appeared to be balanced in the near and medium term.

He said local food price inflation was high but expected to remain broadly contained, adding that the committee also noted the significant but likely temporary reduction in medical insurance price inflation this year.

“Given low passthrough, risks to inflation from currency depreciation are expected to stay muted,” said Kganyago.

However, he warned that additional exchange rate pressures could result from fiscal risks.

He said while there were no demand-side pressures, electricity and other administered prices remained a concern.

The MPC statement shows that headline consumer price inflation averaged 3.3% in 2020, in line with Reserve Bank expectations.

READ: Slowing inflation raises hopes of another rate cut

However, the bank’s forecast is slightly higher for 2021, at 4.0% (up from 3.9%), 4.5% for 2022 (up from 4.4%) and 4.6% for 2023. Core inflation averaged 3.3% in 2020.

Kganyago said despite an upward revision to potential growth, higher growth in 2020 and 2021 implied a small narrowing of the output gap over the forecast period, compared with the November meeting.

Kganyago said global producer price inflation, food price inflation and oil prices have risen. However, a more appreciated nominal exchange rate in recent months is expected to moderate these inflationary pressures.

“This is the backdrop against which the MPC decided to keep rates unchanged at 3.5% per annum,” he said.

The MPC also revised global growth for 2021 higher.

According to the MPC statement, while the virus continues in new waves, the roll-out of vaccines is expected to boost global growth prospects.

However, the global distribution of vaccines is likely to be slow, creating an uneven pace of global economic recovery in 2021, Kganyago warned.

The MPC statement reads that in the third quarter of 2020 the South African economy grew by 66.1% quarter-on-quarter, seasonally adjusted and annualised, compared with the Reserve Bank’s expected 50.3% growth.

It adds that the growth rate for the full year is now expected to be 7.1%, compared with the contraction of 8.0% expected at the time of the November meeting.

However, there are challenges.

Kganyago said the Reserve Bank’s growth projections for the fourth quarter of 2020 were now expected to be lower than previously forecast, adding that the bank expects growth in the first quarter of 2021 to remain muted.

“Global growth, vaccine distribution, a low cost of capital and high commodity prices are supportive of growth. However, new waves of Covid-19 are likely to periodically weigh on economic activity both globally and locally.”

“Also, constraints to the domestic supply of energy, weak investment and uncertainty about vaccine roll-out remain serious downside risks to domestic growth,” said the governor.

READ: World Bank, IMF call for debt suspension

Even with these warnings, some say the Reserve Bank was still in a position to cut rates by 25 basis points.

Mamello Matikinca-Ngwenya, chief economist at FNB, said while the Reserve Bank may have decided to keep the repo rate unchanged, FNB believes there is room for further easing.

“The current economic shock has kept demand in the economy very low and, as a result, inflation has remained firmly anchored below the midpoint of the target band.”

“While expected to tick up in the coming months – mainly pushed up by food, electricity and water prices – inflation should remain well contained over the medium term. We expect inflation to average 3.8% in 2021 on the back of lower insurance and rental inflation,” said Matikinca-Ngwenya.

Last year the Reserve Bank cut the repo rate by 300 basis points, down to its lowest level in four decades. The move was one of several efforts made by the bank to mitigate the effects of Covid-19.

Publications

Publications

Partners

Partners