We hope you love the services we recommend! All of them were independently selected by our editors. Just so you know, BuzzFeed may collect a share of sales or other compensation from the links on this page if you decide to shop from them.

Saving money can sometimes be a little daunting — especially when there are so many different methods and strategies that all feel overwhelming. But being money-wise doesn't have to be! Even small changes can have a huge impact in the long run.

So we devised a list of tips that'll pretty much make you feel like a whiz at saving money.

Just keep in mind that what might work for one person may not work for another— no financial advice is one-size-fits-all. Be sure to take your personal circumstances and needs into consideration, and do what works for you.

1. Keep your emergency fund in a high-yield savings account so your money can grow a lil faster.

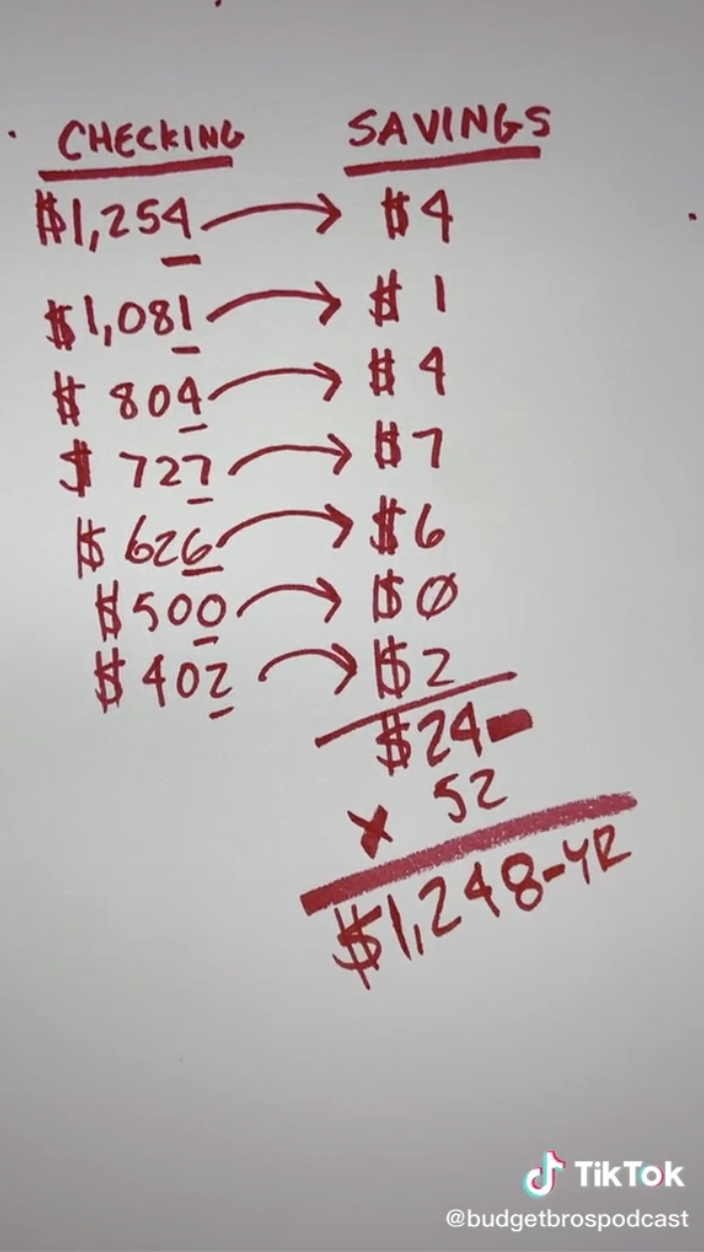

2. Take a look at your checking account balance daily and move the dollar value of the last digit into your savings account. You'll have a nice lump sum of money saved after a year of doing this basically on autopilot.

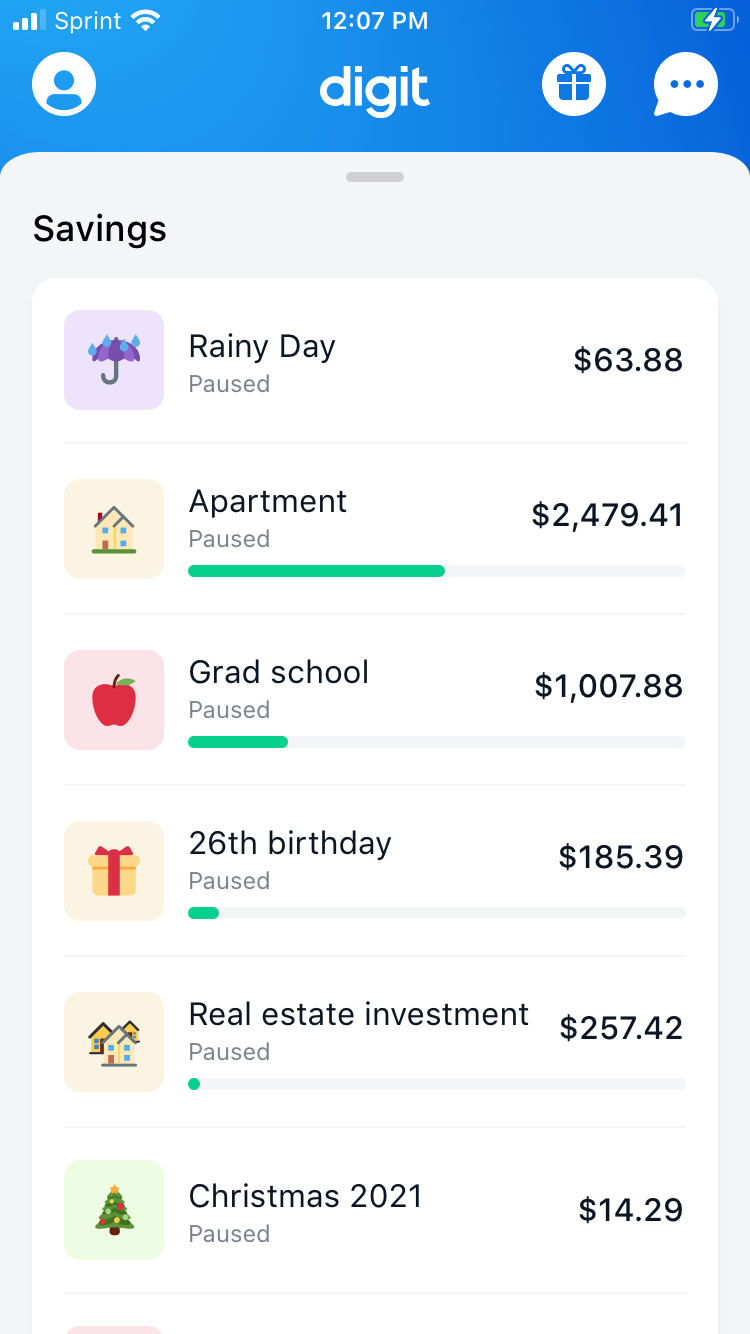

3. Or, use the Digit app to automatically save a little money every day — those small amounts can seriously add up over time!

4. When grocery shopping, take advantage of as many rewards incentives as you can.

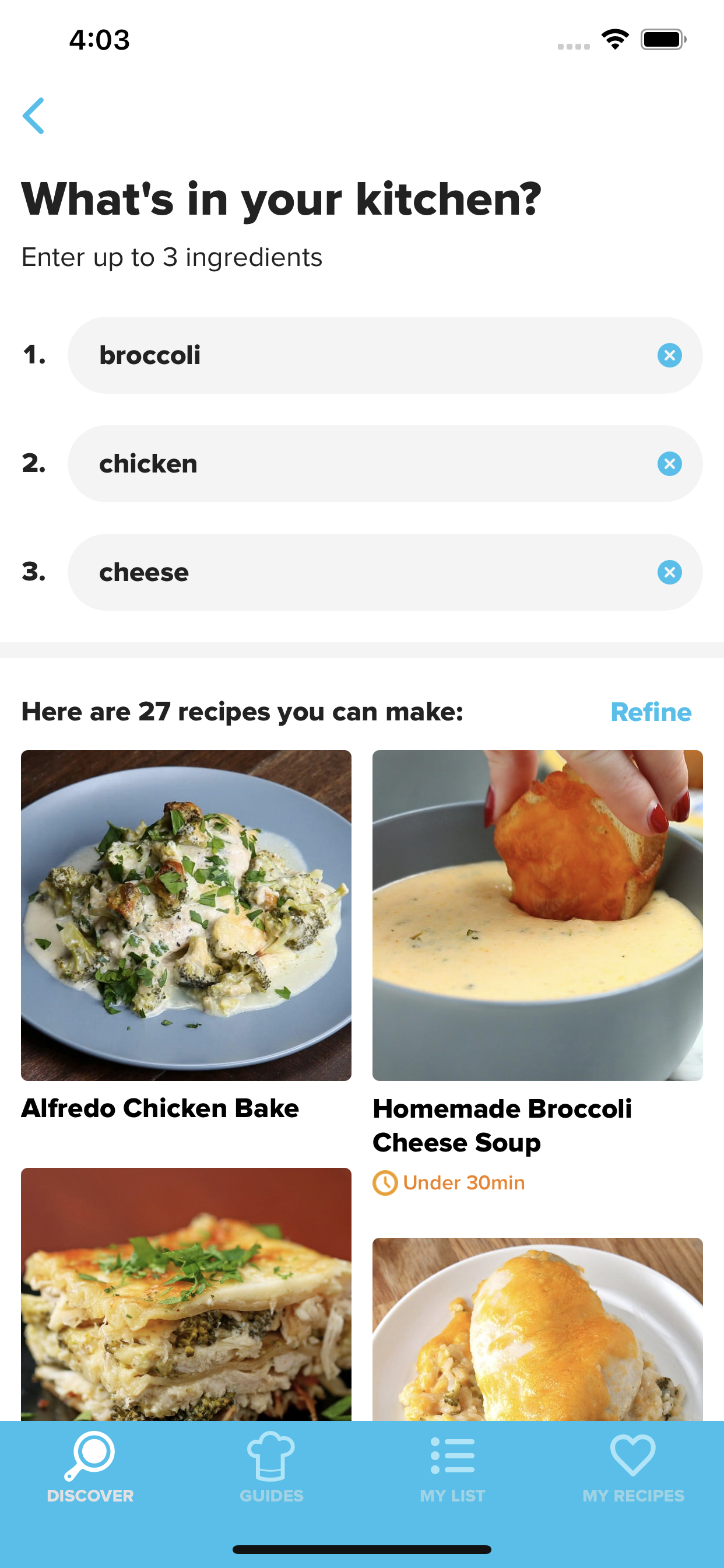

5. And avoid extra trips to the store by using these tools to find recipes you can cook with ingredients you already have at home.

6. If you're in college, you can try to negotiate your tuition.

7. And if you work for a company, see if your employer can help you make student loan payments.

8. Negotiate your rent for a lower monthly payment or perks.

9. Take advantage of streaming service bundles so you can watch more for less.

10. Use Rakuten to get cash back on online purchases — the money adds up quickly!

11. Don't save your payment info on websites — especially not the ones where you tend to overspend.

12. Start saving for holiday gifts at the beginning of the year.

13. When shoe shopping, see if there's a kids size equivalent before moving to the adult section.

14. And remember that you only save money on a sale item if you were going to buy it anyway.

15. Sign up for a gym membership or fitness subscription as a last resort.

16. Book a simple hair appointment at a beauty school for a discount.

17. And finally, make sure you're using all the perks and discounts you can get — whether it's from your job, being a student, or your insurance.

What are some clever money-saving tips you've tried? Let us know in the comments below!

If this sounds like music to your ears (and bank account), check out more of our personal finance posts.