With its groundbreaking announcement this week of further forays into the financial markets, the Federal Reserve has indicated it will surpass its response to the financial crisis in terms of timing, intensity and, ultimately, monetary value.

The latter part of that matrix will only be a matter of time as the Fed continues its role in the battle against the coronavirus and its stunning impact on the U.S. economy.

The central bank's intention to unload almost all of its remaining firepower seems destined to take it beyond the money-printing initiatives of the previous crisis, and its alphabet-soup array of programs is greater in scope than even all the programs it had launched during the crisis more than a decade ago.

When everything is done, the Fed could have a balance sheet, consisting mainly of the bonds it has purchased to support markets and the economy, approaching $10 trillion, according to Krishna Guha, head of global policy and central bank strategy for Evercore ISI.

"As things stand the Fed is racing very quickly towards a $7 trillion balance sheet and our best guesstimate is that it might peak in the very broad vicinity of $9 or $10 trillion," Guha said in a note to clients. "This is monetized credit policy and fiscal-monetary support on a grand scale."

The central bank's efforts in that regard, taken within a month's time of when the coronavirus began chocking financial markets, easily beats the timeline during the financial crisis.

The race to ease

Indeed, the Fed starting in December 2008 increased its bond holdings by $3.7 trillion, pushing the total balance sheet past $4.5 trillion in operations that spanned six years. In a since-abandoned effort to run off some of those holdings, the total slipped below $3.8 trillion at one point. Since the Fed started purchasing assets again, the total has run past $4.7 trillion, the largest in the central bank's history.

During the crisis — the worst economic meltdown since the Great Depression — the Fed did not start the so-called quantitative easing program until three months after Lehman Brothers collapsed in September 2008. While its launch of the Troubled Asset Relief Program came shortly after Lehman's fall, it took six months for other liquidity programs to come online.

The ambition of the Fed's current efforts will only grow with Monday's announcement that the Fed will purchase Treasurys and mortgage-backed securities "in the amounts needed" to support its goals of stabilizing markets.

For some perspective on just how fast the Fed is moving, it intends to purchase $625 billion this week alone. That's more than the entire $600 billion second leg of quantitative easing that ran for eight months, from November 2010 to June 2011.

Outside of the dollar force of QE, the Fed's amalgam of programs aimed at freeing up frozen credit markets also is more ambitious than anything it did during the Great Recession.

Help still needed from Congress

While programs including the Term Asset-Backed Loan Facility and help for the commercial paper and money markets are familiar to financial crisis historians, the Fed has added to its outreach. It now is buying corporate debt for the first time, added commercial mortgage-backed securities to its targeted purchases to help the credit markets, and it expanded the kinds of securities it is accepting as collateral for its liquidity offerings.

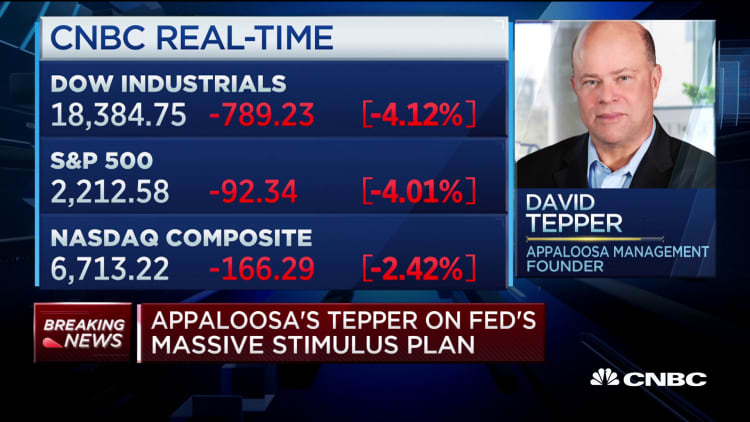

Markets, though, are still distressed over the lack of corresponding fiscal stimulus from Congress, and stocks sold off aggressively Monday.

But that doesn't mean the Fed hasn't done its part — only what it can, at least for now.

"If Congress comes through – which is still our baseline – the combined policy actions should substantially mitigate the risk that the virus shock is amplified by an economy-wide credit shock," Guha said. "What it will not do is have any great bearing on how long the virus shuts down the economy."

To underline the importance of getting fiscal and monetary forces working together, the Fed announced a vague proposal targeted to Main Street small business lending that will need help from whatever Congress passes.

"The Fed package is impressive. It's also necessary, but probably not sufficient," said Lauren Goodwin, economist and multi-asset portfolio strategist at New York Life Investments. "The real challenge faced by the economy is the fact that businesses are closed. That's where the federal government needs to step in."

The Fed, though, might not necessarily be done.

Though it went full-throttle Monday, the central bank has consistently defied critics who say it is running out of ammunition by continuing to come up with new ideas.

The final horizon would be buying stocks and even high-yield corporate bonds, through exchange-traded funds that back big indexes like the S&P 500 and Dow Jones Industrial Average. There's no sign that the Fed is headed in that direction, but it's one final blast it could sound if markets get into too much trouble. The Fed would need permission from Congress first.

"There's a reason why the government has not wanted this perception of the central bank owning risk assets in the past," Goodwin said. "But if a liquidity crisis starts to turn into a solvency crisis and we still don't have that fiscal activity coming in to support the economy, then yes, I think you could continue to see the Fed be creative."

Correction: An earlier version misstated when Lehman Brothers collapsed. It was in 2008.